Zeotech Delivers Game-Changing PFS for AusPozz™ Project - A Story about Low - Carbon Concrete Additives.

- Noel Ong

- Jul 18, 2025

- 6 min read

Announcement

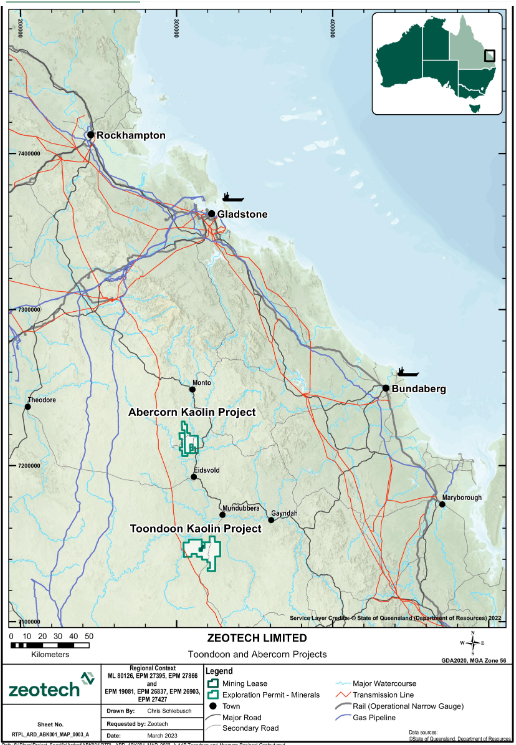

Zeotech Limited (ASX: ZEO) Zeotech Limited (ASX: ZEO) has released a Preliminary Feasibility Study (PFS) for its AusPozz™ Project, underpinned by its Toondoon Kaolin Project in Queensland (Figure 1), confirming the strong technical and economic potential of Australia’s first metakaolin manufacturing facility for the production of low-carbon concrete additives. The study marks a major milestone for Zeotech’s ambition to support Australia’s decarbonisation efforts and transform the construction materials landscape.

Figure 1: Toondoon Kaolin Project map (source: ZEO)

Zeotech, Chief Executive Officer, James Marsh commented:

“We are excited by the positive outcomes of the AusPozz™ Project PFS, which presents a compelling business case for establishing Australia’s first manufacturing facility dedicated to producing a world-class high-reactivity metakaolin. This advanced supplementary cementitious material (“SCM”) product offers both significant environmental and technical benefits, making it a key enabler in accelerating the transition to low-carbon concrete across a broad range of applications.”

“AusPozz™ is well-positioned to become a game changer in Australia’s building and construction materials sector, with the potential to make a substantial contribution to the nation’s net-zero carbon emission targets. We eagerly look forward to advancing the DFS and continue driving sustainable innovation.”

What is AusPozz™ Metakaolin?

AusPozz™ is a high-reactivity metakaolin, a supplementary cementitious material (SCM) that enhances strength, reduces shrinkage, and improves durability in concrete (Figure 2).

It is made by calcining ultra-high purity kaolin from Zeotech’s Toondoon Kaolin Deposit in Queensland.

“AusPozz™ is well-positioned to become a game changer in Australia’s building and construction materials sector, with the potential to make a substantial contribution to the nation’s net-zero carbon emission targets. We eagerly look forward to advancing the DFS and continue driving sustainable innovation.”

Figure 2: Zeotech's AusPozz™ high-reactivity metakaolin. (source: ZEO)

Unlike traditional SCMs such as fly ash (Figure 3) or slag, AusPozz™ is designed to be low-carbon, high-performance, and domestically produced. The proposed facility at the Port of Bundaberg will process 6.23 Mt of kaolin feed over the mine life, supported by nearby infrastructure, utilities, and export routes.

Figure 3: Traditional SCM from coal fly ash. (source: ZEO)

Key Project Highlights

The AusPozz™ PFS outlines a project with robust economics and clear sustainability credentials:

Project Cashflow: $1,014 million (after-tax)

EBITDA: $1,604 million over the 20-year Life of Mine

Net Present Value (NPV8): $406 million after-tax

Internal Rate of Return (IRR): 42%

Payback Period: 2.1 years

Initial Capital Cost: $115 million, with early DSO sales reducing funding needs to ~$95 million

Importantly, early revenue from Kaolin Direct Shipping Ore (DSO) reduces upfront capital needs and accelerates the project’s payback. The PFS also confirms AusPozz™ production capacity of 300,000 tonnes per annum, underpinned by a JORC-compliant Measured and Indicated Resource of 10.87 Mt of high-purity kaolinite and plastic clay.

From a commercial standpoint, Zeotech has secured strong early interest:

65 active sales/specifier leads

MOUs with major industry players:

Holcim Australia (for AusPozz™ trials and potential offtake)

MSI China (for 950,000 tonnes of Kaolin DSO over five years)

Environmentally, AusPozz™ offers a 1-for-1 cement replacement, potentially reducing emissions by 229,800 tonnes CO₂-e per year at nameplate production, equivalent to removing 53,600 petrol-powered cars or powering over 30,860 homes annually.

The Road Ahead: DFS and Beyond to a Low-Carbon Concrete Company.

With the PFS now complete, Zeotech is preparing to launch a Definitive Feasibility Study (DFS) in Q3 2025, to reach Final Investment Decision in Q1 2026 and achieve full-scale production by Q1 2029.

The DFS will advance:

Resource definition and expansion drilling

Binding offtake agreements

Detailed engineering and vendor trials

Environmental approvals and Port infrastructure agreements

Zeotech also unveiled “Horizon 2” downstream opportunities, including:

zeoteCH₄®, a proprietary zeolite targeting landfill methane emissions

Animal feed supplements aimed at preventing milk fever in cows

These initiatives highlight Zeotech’s long-term vision of becoming a diversified green materials technology company.

Next Steps – Summary

✅ Strong Business Case: AusPozz™ offers low-cost, low-risk production with strong market demand and attractive project margins.

✅ High-Quality Resource: The Toondoon Kaolin Deposit contains ultra-high purity kaolinite (>90%), ideal for DSO and metakaolin production.

✅ Scalable Production: The proposed 300,000 tpa AusPozz™ Manufacturing Facility at the Port of Bundaberg is supported by robust infrastructure, with potential for future expansion (Train 2).

✅ Market Readiness: Zeotech has secured 65 active sales leads and MOUs with Holcim (for AusPozz™) and MSI (for Kaolin DSO), signalling strong commercial interest.

✅ Environmental & Social Alignment: The Project supports low-carbon cement alternatives while promoting regional job creation and economic development.

✅ Execution Pathway:

DFS to commence in Q3 2025

Final Investment Decision (FID) targeted for Q1 2026

Full-scale AusPozz™ production expected by Q1 2029

Samso Concluding Comments

Zeotech’s Preliminary Feasibility Study for AusPozz™ should command investor attention. Seasoned investors will always agree that numbers speak volumes—strong margins, a quick payback period, and scalable market applications. I like that there is an alignment with a global shift toward greener infrastructure. At a time when governments and industries are actively seeking alternatives to traditional cement, Zeotech is positioning itself at the forefront of that transition.

The Company’s emphasis on commercial readiness—with active leads and MOUs—reinforces the Project’s viability, not just from a technical perspective but from a real-market demand lens. The backing of Holcim Australia is particularly notable, offering strong third-party validation. In addition, the Project’s location at Bundaberg and its connection to regional development goals enhance its long-term social and economic sustainability.

From the market perspective, a market capitalisation of AUD $127M is not a bad place for investors to consider a position. If Zeotech can make this happen, I would see much bigger valuations and numbers in the 8 numbers will easily be achieved.

I think the narrative is that Zeotech is not a kaolin play. It’s a transformative move into advanced materials with purpose—one that touches everything from housing to infrastructure, and even animal health in the longer term. That’s a rare blend in today’s resource sector.

The Samso Way – Seek the Research

At Samso, we always say the best stories are the ones that show the homework. Zeotech (ASX: ZEO) has done exactly that—through validated testwork, independent resource reviews, and detailed planning for both commercial and environmental success. With a strategic product like AusPozz™ and the groundwork in place, this is a story for those seeking growth with substance.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments