Prodigy Gold NL (ASX:PRX) – A Focused Gold Explorer Building Value in the Tanami. Rich Gold Mining Province.

- Noel Ong

- Jul 8, 2025

- 7 min read

Announcement

In the world of gold exploration, few districts in Australia have remained as persistently prospective yet underexplored as the Tanami region of the Northern Territory. Prodigy Gold NL (ASX:PRX) is one of the companies maintaining a steady presence in this gold-rich district, methodically building its inventory through focused exploration, key partnerships, and well-timed field programs (Figure 1).

Figure 1: Map of Prodigy Gold NL (source: Prodigy Gold)

The Tanami has a rich history of gold discoveries dating back to the late 1800s with the first major development in the early 1980s with the establishment of the Tanami Gold Mine by Normandy Mining (Now Newmont). The Callie Gold deposit was discovered in 1991 and that has been the core of the operations at the Tanami Gold Operations.

At its core, Prodigy Gold continues to maintain a strategic grip on multiple gold systems across its Tanami North and Twin Bonanza project areas, with a total group Mineral Resource now approaching 1 million ounces (989koz Au). The recent AGM presentation (30 October 2024) and the June 2025 NT Government grant announcement offer shareholders an updated window into the company's current position and forward plans.

The PRX Snapshot – Numbers That Matter For a Gold Mining Story.

Total Mineral Resource Inventory: 21.7Mt @ 1.4g/t Au for 989,000 ounces of gold (as of 3 June 2025)

Market Capitalisation (as at 29 Oct 2024): A$4.7 million

Enterprise Value (EV): A$3.0 million

EV per Ounce of Gold: A$3.18/oz — deeply undervalued on a per-ounce basis

Cash Balance (30 Sep 2024): A$1.7 million

Debt: Nil

Capital Structure: 2.33 billion shares on issue & 404 million unlisted options

Four deposits anchor Prodigy Gold’s current Mineral Resource base (Figure 2):

Hyperion – 435Koz Au

Tregony – 80Koz Au

Buccaneer – 359Koz Au

Old Pirate – 115Koz Au

All projects are held 100% by Prodigy Gold.

Figure 2: Map Showing Location of all Prodigy Gold Minerals Resources (source: Prodigy Gold)

Hyperion Gold Deposit – Tanami North Project: Delivering Consistent Results

Hyperion remains the company’s most active and advanced asset (Figure 3). Recent RC drilling results from the 2024 program continue to showcase mineralisation with both grade and scale. Intercepts such as:

10m @ 15.9g/t Au (Tethys Lode)

33m @ 2.6g/t Au (Hyperion Lode)

99m @ 2.7g/t Au

53m @ 2.9g/t Au

These results provide growing support for the deeper potential of the system, especially within the Tethys lode. Notably, Prodigy Gold has secured co-funding from the NT Government under the Resourcing the Territory program for two diamond drill holes aimed at testing these deeper extensions. This marks a strategic validation of the project’s geological upside.

Tregony Gold Deposit: Small, High-Grade, and Upgraded

Tregony, located 25km north of Hyperion, was also subject to a Mineral Resource update in June 2025, now standing at 80Koz Au. Highlights include:

6m @ 12.0g/t Au

3m @ 10.7g/t Au (with visible gold in RC chips)

1m @ 69.1g/t Au confirmed by Chrysos PhotonAssay™

Figure 3: Location of the Tanami North Project area (source: Prodigy Gold)

While smaller in scale than Hyperion, the quality of intercepts indicates strong potential for small-scale, high-grade development.

Co-Funded Diamond Drilling at Tethys – Key Highlights

Prodigy Gold received up to A$112K in co-funding under Round 18 of the NT Government’s Geophysics and Drilling Collaborations (GDC) program, part of the Resourcing the Territory initiative.

Grant supports two deep diamond drill holes at the Tethys lode within the Hyperion Gold Deposit (Figure 4).

The drill holes aim to:

৹ Test down-dip and down-plunge extensions of the mineralisation

৹ Follow up on standout intercept of 10m @ 15.9g/t Au from 177m (hole HYRC24004)

৹ Provide better geological understanding through high-quality core sampling

৹ Investigate the structural controls and continuity of brecciated, high-grade zones

Historical diamond drilling (e.g., 13m @ 5.6g/t Au from 184m in TYRD10003) supports the deeper potential of the Tethys system.

Drill hole plans:

৹ HYDD25001: To intersect Tethys at depth via westward drilling through Suess lodes

৹ HYDD25002: To define orientation of high-grade zone and locate the regional Suess Fault

Diamond drilling to assist in refining:

৹ Structural modelling

৹ Resource expansion

৹ Potential future underground mining scenarios

Figure 4: Cross-section view of Tethys lode showing proposed location of hole HYDD25002 (source: Prodigy Gold)

Prodigy Gold Managing Director, Mark Edwards, commented:

“Prodigy Gold is very pleased to have received the support of the NT Government for our exploration programs through Round 18 of the Geophysics and Drilling Collaborations (GDC) grants program funded by the Resourcing the Territory initiative,” said Managing Director Mark Edwards.

“Without the co-funding support of the NT Government some of these programs would take a lot longer to be initiated, delaying our geological understanding of the regions we work in.”

“These sorts of programs significantly increase our knowledge of the local and regional geology of our projects and could fast track the next major discovery.”

Buccaneer and Old Pirate: The Twin Bonanza Platform

Combined, these deposits total 474 Koz Au and reside on granted Mineral Leases with site infrastructure intact. Historic production from Old Pirate further validates its potential, with:

157kt @ 5.9g/t Au for 29.3koz sold (processed at Coyote)

8.1kt @ 15.4g/t Au for 3.5koz (trial gravity plant run)

Figure 5: Location of the Twin Bonanza Project (source: Prodigy Gold)

Buccaneer has been modelled with updated metallurgy and geotechnical inputs and remains the focus of ongoing mining studies.

Strategic Partnerships: Backed by the Majors

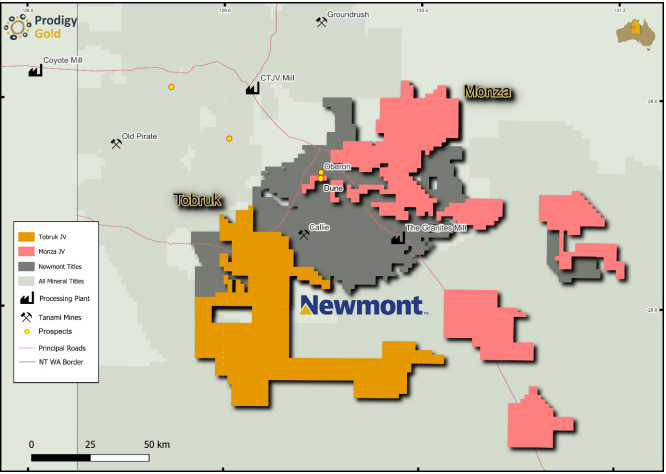

Prodigy Gold maintains active joint ventures with some of the world’s largest players:

Newmont (NYSE:NEM) – Monza and Tobruk JVs surrounding the world-class Callie Mine and the 2.7Moz Oberon Deposit (Figure 6).

IGO Limited (ASX:IGO) – JV partner on the Lake Mackay project covering gold and base metals.

Australasian Metals and Castile Resources – Participating in additional JV programs across the territory.

Figure 6: Newmont Exploration JVs (source: Prodigy Gold)

These partnerships not only bring capital and technical support but offer proximity leverage to some of the most significant mineral systems in the region.

Planned Work and Outlook: What to Expect in 2025

Looking ahead, Prodigy Gold has laid out a structured field season and milestone program:

Q2–Q4 2025 – Follow-up drilling at Hyperion and Tregony

Deep diamond drilling at Hyperion to test extensions of the Tethys lode

Metallurgical testwork to refine processing pathways, including gravity and CIL

Mining lease application process to continue for Hyperion

Assessment of ore sorting to enhance development economics

This ongoing pipeline shows Prodigy Gold’s commitment to de-risking its assets while maintaining optionality for mine development.

Samso Concluding Comments

In reviewing where Prodigy Gold stands today, I think the company has made it clear that it is not about rushing to production but rather getting the fundamentals right—geology, metallurgy, approvals, and partnerships. The value proposition here isn’t just about ounces in the ground; it’s about de-risked growth in a highly prospective and strategically positioned district.

The recent drilling at Hyperion, in particular, is starting to paint a picture of scale, not just width and grade at surface, but emerging depth extensions that may one day support underground development. That kind of optionality is what separates a deposit from a project.

Receiving the NT Government’s support through a co-funding grant is not just a financial win—it’s a recognition that what’s happening at Hyperion might be one of the next significant gold stories in the Tanami.

For investors, especially those with a longer view, I think Prodigy Gold is one to keep on the radar. They are not chasing the headlines. They are building something that could, piece by piece, become a much more significant story.

The Samso Way – Seek the Research

Here at Samso, we pride ourselves on delivering content for investors that is independent and informed by over three decades of experience in the industry. We are always asking the questions that may sound simple and irrelevant, but these are typically the ones that make sense to you, the one seeking the knowledge.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp.

And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and

Comments