Ausgold Limited (ASX: AUC) – Katanning Gold Project DFS Confirms Long-Life, High-Margin Gold Mining Operation.

- Noel Ong

- Jul 27, 2025

- 6 min read

Updated: Jul 28, 2025

Announcement

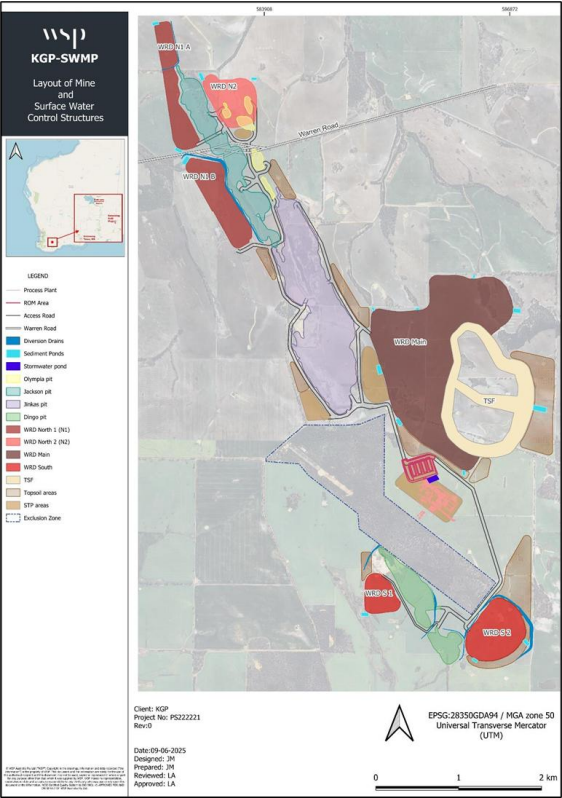

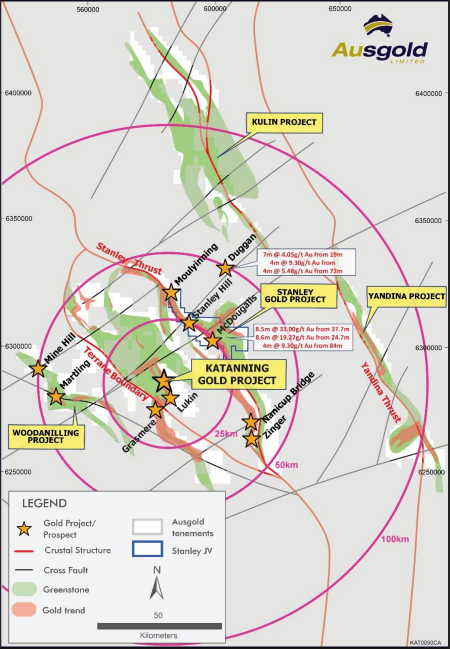

Ausgold Limited (ASX: AUC) has delivered a definitive milestone with the release of its Definitive Feasibility Study (DFS) for the 100%-owned Katanning Gold Project (KGP). The study validates KGP as one of Australia’s most advanced undeveloped open-pit gold projects, combining scale, near-term development potential, and robust economics within a Tier-1 jurisdiction (Figure 1).

Figure 1: KGP Project - Long-life, low-risk operation in a Tier-1 jurisdiction (source: AUC)

Ausgold Executive Chairman John Dorward commented:

“We are delighted with the outcomes of the DFS which clearly demonstrate the robust financial returns that will be generated by the KGP. The onschedule completion of this high-quality study marks a critical milestone in Ausgold’s journey to becoming Australia’s next mid-tier gold producer.

We are now turning our minds to the next phase of project development, including front-end engineering and design and debt financing, while we also progress activities to finalise land access and complete permitting for the Project.”

Key DFS Highlights – A Glance at the Path of the Gold Mining Operation.

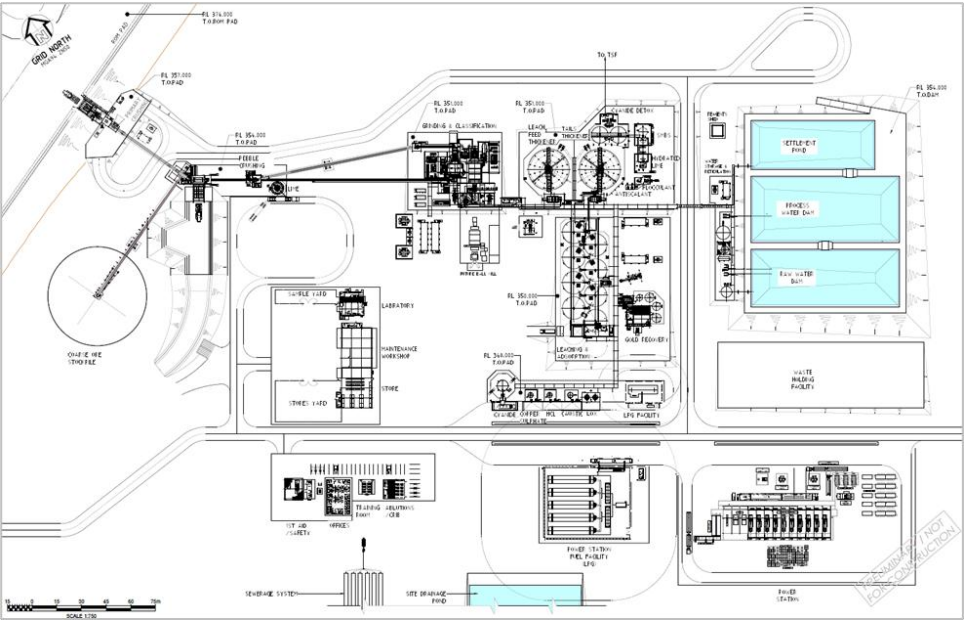

(Figure 2).

Life-of-Mine (10 years):

▸ 1.14Moz gold production

▸ AISC: A$2,265/oz

▸ Post-tax NPV5: A$954 million

▸ IRR: 53%

▸ Post-tax cashflow: A$1.37 billion

▸ Payback: 13 months

First 4 Years (High-Grade Phase):

▸ Avg. production: 140koz/year

▸ AISC: A$2,180/oz

▸ Gold recovery: 91.1%

Ore Reserve: 35.2Mt @ 1.11g/t for 1.25Moz (84% Proved)

Updated Mineral Resource: 69Mt @ 1.11g/t for 2.44Moz (91% Measured & Indicated) (Figure 3)

Pre-Production CapEx: A$355.1 million (incl. contingency)

Figure 2: KGP Project – KGP DFS layout (source: AUC)

Figure 3: Updated MRE of 69Mt @ 1.11g/t Au for 2.44Moz Constrained to A$4,500/oz optimised pit shell (source: AUC)

Mining & Processing Overview

The DFS outlines a conventional open pit operation (Figure 4):

Mining Strategy:

▸ Load-and-haul with a strip ratio of 6.85

▸ Ore mined: 3.5Mtpa

▸ High-grade feed front-loaded to optimise early cashflows

Processing Facility:

▸ 3.6Mtpa CIL plant

▸ Recovery: 90.4% LOM average

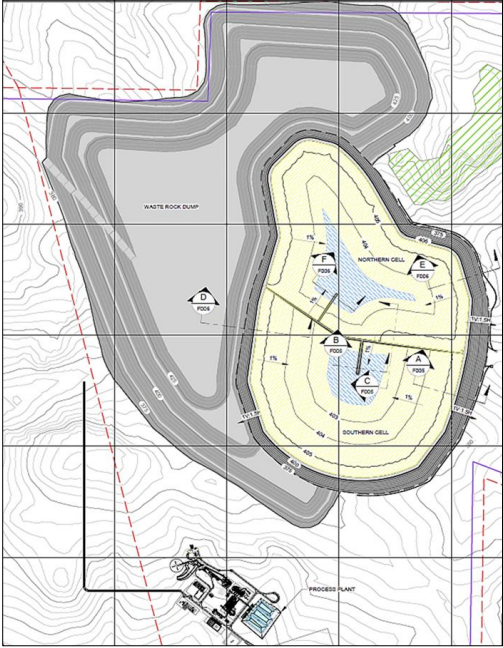

▸ Tailings detoxification and TSF lined with geomembrane for environmental compliance

Power: Hybrid LNG + solar with BESS (42% renewable contribution)

Figure 4: KGP Process Plant Layout (source: AUC)

Figure 5: Integrated Waste Rock and TSF Facility (source: AUC)

Financial Metrics and Sensitivities

Base Case @ A$4,300/oz gold price:

▸ NPV5 (post-tax): A$954M

▸ IRR: 53%

▸ Payback: 13 months

Spot Case @ A$5,000/oz:

▸ NPV5: A$1.35B

▸ IRR: 68%

▸ Payback: 12 months

Cashflow:

▸ Pre-tax: A$1.93B

▸ Post-tax: A$1.37B

▸ WA Royalties: A$122M

▸ Commonwealth Tax: A$565M

Regional & Social Impact

Job Creation:

▸ Construction phase: ~250 FTEs

▸ Operational phase: ~350 FTEs

Community & Indigenous Engagement:

▸ Ongoing collaboration with Traditional Owners and local councils

▸ Regional benefits and procurement programs under discussion

Development Timeline & Next Steps

Permitting & Land Access:

▸ Ongoing; key hearings scheduled from August 2025

Project Milestones:

▸ FID targeted: mid-2026

▸ Construction: ~18 months

▸ First gold pour: late 2027

Regional Exploration

Ausgold holds a dominant +3,500km² land position across the Katanning Greenstone Belt, encompassing all known mineralised trends. The FY26 drilling program will target regional prospects to identify satellite deposits to support a broader production hub at Katanning. Key targets include Nanicup-Zinger (shallow, high-grade hits), Kulin (untested >3km soil anomaly with strong trenching results), and Stanley (28km of gold-in-soil anomalism within the same host rocks as KGP but underexplored at depth) (Figure 6).

Figure 6: Ausgold - Regional Exploration (source: AUC)

Samso Concluding Comments

This DFS from Ausgold does, in my view, give an answer to the doubts of the project. Why has it taken this long to create management confidence to backup the mining game?, I think its just the time taken to collect the data and "maybe" the rising gold price help them push the concept further.

The mining game is all about de-risking as much as possible before committing funds to operations. For those that are new to this side of the resource industry, this is where things get really boring for speculators and really interesting for those that INVEST in solid projects. The market capitalisation of Ausgold is now RUD $255M and this is where serious DYOR and serious risk management for incoming investors starts.

Figure 7: Ausgold share price chart as of 23rd July 2025. (source: commsec)

The Ausgold journey has been a long one, and could the DFS be the start of a mining story for the company, or is it setting itself up for a bigger player to come and take the company out? Shareholders who are in the money will be very happy. The rising fortune since 2024 for shareholders will keep future fundraising roadshows buoyant, as long as the gold price remains at this level or higher.

There is still work to be done, no doubt—land access, permitting, and securing financing. But that’s part of the journey, and the DFS gives them the credibility to have those conversations at the right table. With the first gold targeted for late 2027, there is now a visible runway to development.

For investors who follow Samso, this is where we usually say—it’s time to keep your eyes on the data. The Katanning Gold Project isn’t just a gold story anymore. It’s a project with structure, clarity, and a path forward and most importantly, clarity on potential value on paper

This looks to be a good conservative investment play for gold mining cash flow or an M&A exit for existing shareholders.

The Samso Way – Seek the Research

This DFS reaffirms the discipline of staged de-risking. Ausgold has moved from resource growth to validated economics while preserving the upside of further reserve conversion and exploration-led extensions. With 91% of the MRE in Measured & Indicated, and a lean AISC profile in the lower half of the cost curve, the Katanning story now stands as a practical case study in project buildability and capital efficiency.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments