The Strategic Importance of Bauxite: Powering the Future of Aluminium - How Do ASX Investors Take a Position in the Bauxite Business.

- Noel Ong

- Jul 30

- 24 min read

Updated: Aug 17

The new cold war that is gaining momentum globally is fast creating vast opportunities for jurisdictions hosting commodity projects that have an inelastic demand. Commodities that fall into a real critical supply shortage are all getting a rejuvenation that is now making headlines. Commodities such as bauxite are now starting to get investors' attention.

Bauxite is the main source of Aluminium, and most investors did not even know that it is also the main source of the now very sought-after metal, Gallium. Western Australia has had a dominant and long history with bauxite, with Alcoa and Worsley Alumina (now South 32) being giants in this sector and dominating the bauxite story for decades. Bauxite was first discovered in 1821 by a French geologist by the name of Pierre Berthier near the village of Les Baux in southern France.

Bauxite consists mostly of the aluminium minerals gibbsite (Al(OH)3), boehmite (γ-AlO(OH)), and diaspore (α-AlO(OH)), mixed with the two iron oxides goethite (FeO(OH)) and haematite (Fe2O3), the aluminium clay mineral kaolinite (Al2Si2O5(OH)4) and small amounts of anatase (TiO2) and ilmenite (FeTiO3 or FeO·TiO2). Bauxite appears dull in luster and is reddish-brown, white, or tan.[3] (source: Wikipedia).

The recent nationalisation of projects in Guinea has thrown added pressure on the supply crunch in the business of bauxite, as end users are struggling already with the global "cold war" rhetoric that is creating headaches for all stakeholders in the industry.

According to SMM (Shanghai Metals Market), shortages in 2024 have driven price increases that are now looking to overflow into 2025. Bauxite is not abundant in the biggest consumer, China, and although this may be great for players in the industry, the issue lies in the lack of an economical resource that can sustain a long-term source.

My interest in the bauxite business started in 2020 when I published "The Best Small-Cap Bauxite Companies on the ASX," which really made me gain the understanding that, in some way, the bauxite mining business is a smaller-scale version of the mega iron ore industry that drives the Pilbara region Iron Ore business in Western Australia.

This Samso Insight is all about compiling a story that gives investors a current view of the bauxite business on the ASX. Let's delve into the whole bauxite story and see if we can simplify all the smoke that is currently doing the rounds on mainstream media.

This is an intense Samso Insight, and readers have to have patience as we try and build an extensive context around why I think there are reasons to start taking note of what could be an extensive value-creating sector for ASX investors. To help navigate the Samso Insight, the chapters below will try and help readers stay focused on the review.

The Realisation of the Importance of Bauxite.

Investors in Australia will need to understand that when we talk about bauxite, there is only really one major group that dominates the bauxite industry. They are Rio Tinto, Alcoa or Alcoa Australia and South 32. These three companies and their projects make up what we know as the Australian Bauxite business.

Bauxite mining typically involves a large footprint, and in jurisdictions where this creates a sensitive conversation, it will create unnecessary attention. In Australia, Alcoa is now talking about applying for more ground to expand its operations in the Darling Range. The application is now creating migraines for management as it is creating upheaval among the environmentalists and the Not in My Backyard Crew (NMB Crew).

Alcoa Media Release:

Aluminium: A Metal for the Modern World.

Bauxite is a mineral of immense strategic value, serving as the primary ore of aluminium. In the context of a world steadily shifting toward decarbonisation, electrification, and infrastructure growth, bauxite has become an indispensable commodity.

Aluminium is foundational to countless industries, from aerospace and automotive manufacturing to packaging, consumer electronics, construction, and the renewable energy sector.

What sets aluminium apart is its remarkable versatility. Lightweight yet strong, aluminium offers durability, corrosion resistance, and excellent conductivity. It's also infinitely recyclable without loss of quality, which positions it as a metal of choice in a circular economy.

These properties, combined with the metal's role in building electric vehicles, solar panels, and high-voltage transmission infrastructure, have elevated demand for aluminium—and by extension, bauxite—to unprecedented levels. Global aluminium production now exceeds 70 million tonnes annually, requiring over 300 million tonnes of bauxite each year. This demand is projected to rise steadily, with a compound annual growth rate of approximately 3% to 5% through 2030.

Global Supply and Geopolitical Landscape - Bauxite and Aluminium.

The supply landscape, however, is becoming increasingly complex. While Australia remains the world's leading producer of bauxite, output from Guinea has surged in recent years due to Chinese investment and off-take agreements. China, as the world's largest aluminium producer, has grown heavily reliant on bauxite imports to feed its refining capacity.

However, Guinea's political instability and periodic export disruptions have exposed the fragility of global supply chains. As such, countries and industrial players are seeking alternative, geopolitically stable sources of bauxite, and Australia—particularly Western Australia—is emerging as a preferred jurisdiction.

Figure 1: Historical bauxite mining activity in the Darling Range region of Western Australia, showcasing typical red-oxide terrain and open-cut techniques. (source: WA Today).

As fuel to the scarcity of bauxite and hence the refinement of Aluminium, Guinea’s military government officially announced the return of mining tenements on May 16, 2025. Information Minister Fana Soumah confirmed in a televised address that President Mamady Doumbouya had issued a decree repossessing 51 mining licences covering bauxite, gold, diamond, graphite, and iron concessions, and that these had been “returned free of charge to the state”.

Just over a week later, on May 27, 2025, the government additionally cancelled 129 exploration permits, citing the need to free up unused concessions and tighten resource control. Government measures implemented by Guinea will only fuel the demand and the rush for bauxite for future global needs.

As of 2025, the top five largest bauxite resources globally are located in countries that dominate both production and reserves due to their high-quality deposits and large-scale mining operations.

Top 5 Bauxite Resource Holders Globally.

1. Guinea (source: African News)

Estimated Resources: ~40 billion tonnes

Key Region: Boké, Boffa, Kindia

Notes: Guinea holds the world’s largest bauxite reserves, mostly high-grade, gibbsite-type ore ideal for low-cost refining. The Sangaredi and Boffa mines are among the most significant in the world.

2. Australia (source: Geoscience Australia and FTM Machinery)

Estimated Resources: ~20–24 billion tonnes

Key Regions:

Weipa (Queensland) – operated by Rio Tinto

Gove (Northern Territory)

South-West WA (e.g., Darling Range) – including projects by Alcoa, South32, and Western Yilgarn Limited (ASX: WYX)

Notes: Australia is the world’s largest producer of bauxite. Its deposits are lateritic, shallow, and close to key refining hubs. Australia's operations are also among the most environmentally regulated.

3. Vietnam (source: Yahoo Finance and SMM)

Estimated Resources: ~11 billion tonnes

Key Region: Central Highlands (Dak Nong and Lam Dong provinces)

Notes: Vast reserves, but underdeveloped due to infrastructure and environmental concerns. Long-term potential remains strong.

4. Brazil (source: FTM Machinery)

Estimated Resources: ~10–11 billion tonnes

Key Region: Pará (Porto Trombetas, Juruti, Paragominas)

Notes: Brazil is a major exporter and refiner. Its high-grade bauxite is key for the global alumina market.

5. Indonesia

Estimated Resources: ~3–5 billion tonnes

Key Region: West Kalimantan and Riau Islands

Notes: Resources have grown rapidly with exploration. Indonesia has recently restricted raw ore exports to promote domestic refining.

Highlights of Major Australian Bauxite Resources.

Australia’s major deposits include:

Weipa (Qld): Among the world’s largest, with decades of high-grade production by Rio Tinto.

Darling Range (WA): World-class deposits, host to Alcoa and South32 operations, and Western Yilgarn’s Bauxite Project.

Gove (NT): Managed historically by Rio Tinto, now under rehabilitation.

New players: Smaller companies like Australian Bauxite Ltd and Western Yilgarn Ltd (ASX: WYX) are exploring niche, high-grade, or value-added opportunities (e.g., rare earths in bauxite residue).

Key Bauxite Companies Investors should be looking for on the ASX.

As we look at the small end of the ASX market, there are only a few companies that stand out. In fact, there are only seven companies that cross my mind that are worth discussing. Table 1 below lists the companies and their respective projects and resources. The leader of the pack is Canyon Resources Limited and followed by Metro Mining Limited in terms of resource size and the low SiO2 levels.

Table 1: A list of companies in the ASX small-cap sector that have a notable resource. This is adapted from a table from a presentation by the ABX Group dated 30th April 2025.

Company | ASX Code | Project | Stage | Resource (MT) | AL2O3 | SiO2 |

1.0 - ABx Group Limited | ABX | Binjour | Exploration | 37 | 38.20% | 14.60% |

2.0 - ABx Group Limited | ABX | Taraiga | Exploration | 37.9 | 39.20% | 5.20% |

3.0 - Metro Mining Limited | MMI | Bauxite Hills | Production | 118.7 | 49.20% | 14.10% |

4.0 - Western Yilgarn Limited | WYX | Julimar West | Exploration | 168.3 | 36.10% | 14.70% |

5.0 - VBX Limited | VBX | Wuudagu | Exploration (PFS) | 95.9 | 39.40% | 13.40% |

6.0 - Arrow Minerals Limited | AMD | Niagara | Exploration (MRE) | 185 | 42.3% | 2.7% |

7.0 - Canyon Resources Limited | CAY | Mirim Martap | Exploration (PFS) | 1,027 | 45.30% | 2.70% |

1.0 ABX | ASX - 18th June 2018 - 2.0 ABX | ASX - 31st May 2012 - 3.0 MMI | ASX - 13th May 2024 - 4.0 WYX | ASX - 26th February 2025 - 5.0 VBX | ASX Prospectus - Independent Geological Report - 6.0 AMD | ASX - 7th August 2024 - 7.0 CAY | ASX - 25th May 2021

All projects are in Australia except for Arrow Minerals (Guinea) and Canyon Resources (Cameroon).

Metro Mining – Bauxite Hills Mine (Cape York, QLD).

Metro Mining Limited (ASX: MMI) operates its flagship Bauxite Hills Mine across the Bauxite Hills and Skardon River tenements, located approximately 95 km north of Weipa on Queensland’s Cape York Peninsula.

Figure 2: Metro’s flagship project is the Bauxite Hills Mine (Mine), which is a single operating mine located 95 kilometres (km) north of Weipa in Western Cape York in Far North Queensland, with a total tenement package covering approximately 825km2. (source: Metro Mining)

As of 31 December 2024, the project boasts a JORC-compliant resource of 114.4 million tonnes, with proven and probable reserves totalling 77.7 million tonnes. The deposit is considered high-grade, averaging 49.8% available alumina (Al₂O₃) and 13.3% reactive silica (SiO₂)—well suited for low-temperature refining. The geological model adopts conservative cutoff grades of ≥45% Al₂O₃ and ≤15% SiO₂, supporting a robust classification of the mineable ore.

Mining at Bauxite Hills is conducted via free-dig methods with no requirement for beneficiation, relying instead on simple screening. Production capacity was recently upgraded to 7 million tonnes per annum (Mtpa), with potential for expansion to 8 Mtpa through planned debottlenecking. A notable infrastructure upgrade includes the deployment of the Ikamba floating loading terminal, capable of handling vessel loads exceeding 9 Mtpa, which has enhanced logistics efficiency and reduced freight costs.

As of Q3 2025, shipment pricing remains in line with seasonal benchmarks, and the company anticipates sustained strong Free-On-Board (FOB) revenue through the remainder of the year.

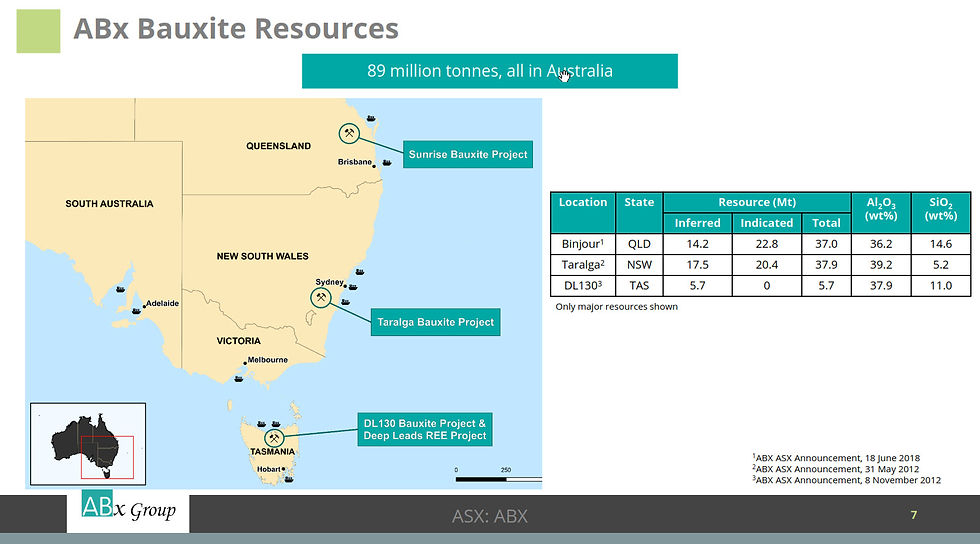

Australian Bauxite Limited (ASX: ABx) - Building a Multi-State Resource Footprint.

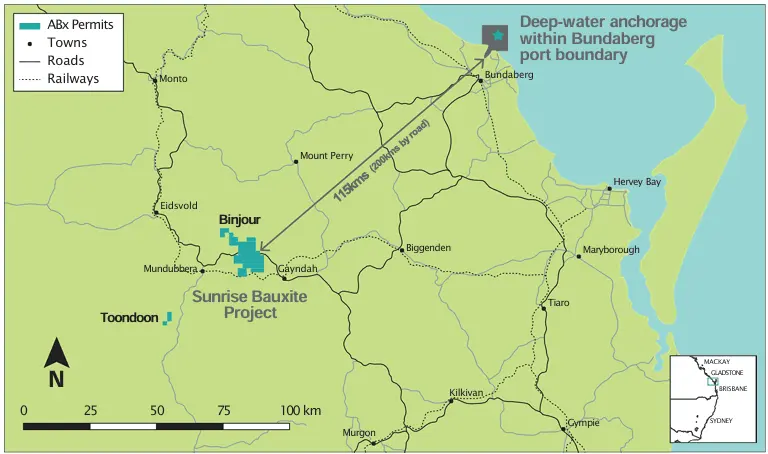

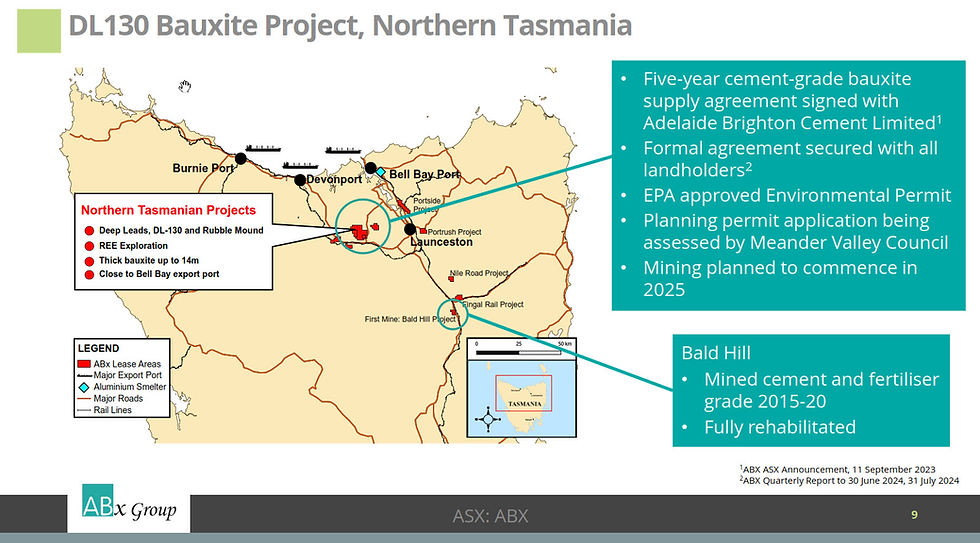

Australian Bauxite Limited (ASX: ABx) maintains a strategic portfolio of approximately 37 tenements spanning across Tasmania, Queensland, and New South Wales (Figure 3). The company’s exploration and development efforts are centred on several promising deposits, including Campbell Town and Bald Hill in Tasmania (Figure 5), Binjour in Queensland (Figure 4), and Inverell, Guyra, and Taralga in New South Wales. This diverse geographic exposure has enabled ABx to gradually define one of the most accessible and flexible bauxite resource bases in Eastern Australia.

Figure 3: Location of ABx Group Bauxite projects. (source Abx Group).

As of 2019, the company’s total JORC-compliant mineral resource stood at approximately 137.1 million tonnes, comprising 72.7 million tonnes of Indicated and 64.4 million tonnes of Inferred resources. Notably, Tasmania’s Campbell Town and Bald Hill deposits collectively account for around 3.5 million tonnes, while the remaining inventory is distributed across Queensland and New South Wales, with Binjour being a key development focus in the north.

Figure 4: Location of Sunrise Bauxite Project at Binjour, QLD. (source: Abx Group)

The company’s bauxite is predominantly composed of high-grade gibbsite trihydrate, characterised by low levels of contaminants and well-suited for low-temperature alumina refining. ABx’s deposits typically exhibit a thickness of 3.5 to 9 metres, with consistent mineralisation across the profile. The alumina-to-silica (A/S) ratio, a critical quality metric in bauxite processing, ranks favourably, placing ABx’s material in the “good to excellent” category based on industry benchmarks.

The Bald Hill project in Tasmania marked ABx’s transition into production, with its first shipment completed in Q3 2015. Since then, the company has maintained a strong focus on infill drilling and regional exploration across the broader Eastern Australian Bauxite Province. Efforts are also underway to optimise product specification across multiple production hubs, including potential processing centres at Campbell Town and Portside, aiming to enhance grade consistency and meet a broader spectrum of end-user requirements.

Figure 5: Location of ABx Group Tasmanian bauxite projects. (source: Abx Group)

Western Yilgarn Limited: A Rising Bauxite Developer?

(source: Western Yilgarn Limited)

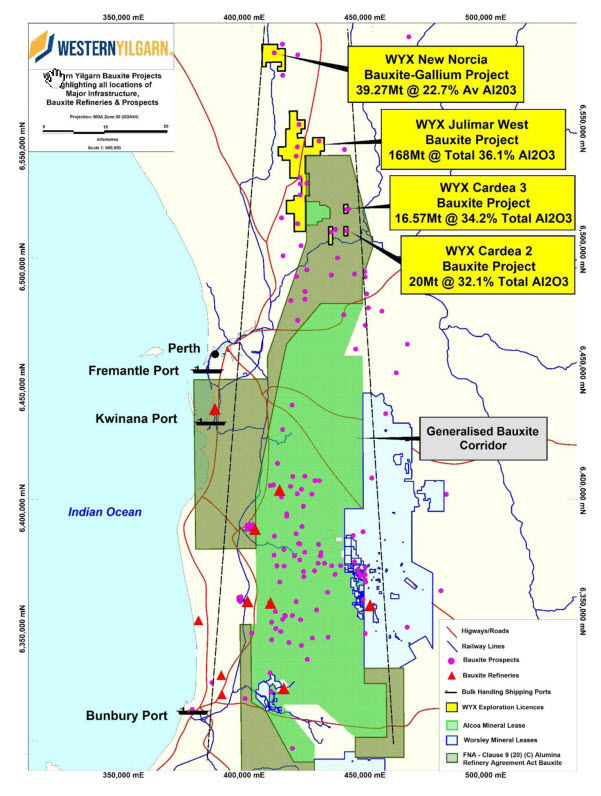

This backdrop provides fertile ground for junior explorers like Western Yilgarn Limited (ASX: WYX), which is positioning itself to become a significant bauxite supplier. Western Yilgarn holds a suite of promising tenements in the Darling Range of Western Australia, one of the most prolific and high-quality bauxite regions globally. The company's flagship Julimar West Bauxite Project hosts an inferred mineral resource estimate of 168.3 million tonnes at 36.1% total alumina, including a high-grade subset of 97.1 million tonnes at 40.5% available alumina. These grades are particularly significant given the low reactive silica content, which is critical for efficient Bayer processing.

Figure 6: Map illustrating mining tenements and surrounding conservation zones in the Darling Range, indicating the spatial context of Western Yilgarn’s projects. (source: walkgps)

Figure 6 is a detailed map showing existing Alcoa/Worsley leases in the Darling Range region, with clear indications of potential expansion zones, helping readers visualise the geographical layout where Western Yilgarn operates.

Julimar West: High-Grade, Shallow, and Strategically Located.

Julimar West's mineralisation is shallow (Figure 7), occurring from surface to approximately eight metres depth across seven distinct zones. The project benefits from its proximity to established transport infrastructure, including rail corridors and ports such as Fremantle, Kwinana, and Bunbury.

This logistical advantage enhances its potential as a Direct Shipping Ore (DSO) operation, allowing quicker market access and reduced capital requirements. Metallurgical testing has confirmed that the ore is gibbsite-dominant, making it particularly amenable to low-temperature refining, which is less energy-intensive and more environmentally sustainable.

Figure 7: Mining operations in Western Australia showing active excavation of bauxite using modern heavy machinery, as it typically mines the shallow nature of bauxite. (source: https://www.alcircle.com/).

Expanding Footprint: Cardea and New Norcia Projects.

Further strengthening Western Yilgarn's position is its Cardea project suite (Figure 8), which includes Cardea 1, 2, and 3. Cardea 2 recently delivered a maiden inferred resource of 20 million tonnes at 32.1% total alumina. Notably, within this figure lies a high-grade component of 2.15 million tonnes grading at 35.7% available alumina. Drilling results have been promising, with shallow intersections returning excellent alumina grades and low reactive silica, indicative of high metallurgical quality. Cardea 3, a more recent acquisition, adds another 16.57 million tonnes at 34.2% alumina to the company’s resource base, further consolidating its footprint in the region.

Together, the Julimar West and Cardea projects now account for an estimated 205 million tonnes of inferred bauxite resources. This scale, when combined with favourable grade characteristics and a low-strip mining profile, positions Western Yilgarn as one of the most advanced and economically viable bauxite developers among Australia’s emerging explorers. The company’s strategic location in the Darling Range—close to world-class alumina refineries—provides a unique advantage in terms of cost competitiveness and ESG performance.

Adding another layer of potential is the New Norcia Bauxite-Gallium Project, which reflects Western Yilgarn’s forward-looking approach. Gallium is a critical metal used in semiconductors, LEDs, and solar panels, and its inclusion as a strategic target aligns the company with broader critical mineral agendas in Australia and globally. While still in early exploration stages, this project hints at the company’s long-term vision to diversify its commodity base and enhance its strategic value.

Figure 8: Location map showing the New Norcia Projects area with nearby major infrastructure.

Strategic Timing and ESG Advantage.

What makes Western Yilgarn’s portfolio particularly compelling is its timing. With global bauxite supply tightening due to Guinea’s export volatility and rising Chinese demand, secure and scalable Australian supply is now in high demand. Western Yilgarn's projects are not only of high quality but also backed by sound infrastructure and regulatory stability, making them prime candidates for development and future offtake agreements. Additionally, the company's transparent reporting, regular resource updates, and systematic exploration campaigns indicate a well-managed and credible operation.

Environmental, Social, and Governance (ESG) performance is another important aspect. Western Australia has a strong track record in regulating sustainable mining practices, and Western Yilgarn’s shallow open-cut mining strategy, combined with its proximity to infrastructure, reduces its environmental footprint. This is particularly attractive to downstream buyers and aluminium producers who are increasingly being held to higher environmental standards.

Check out some recent Samso News on Western Yilgarn Limited:

Canyon Resources Limited.

(source: Edison Group | GlobeNewswire | Reuters | Wikipedia | Canyon Resources Limited)

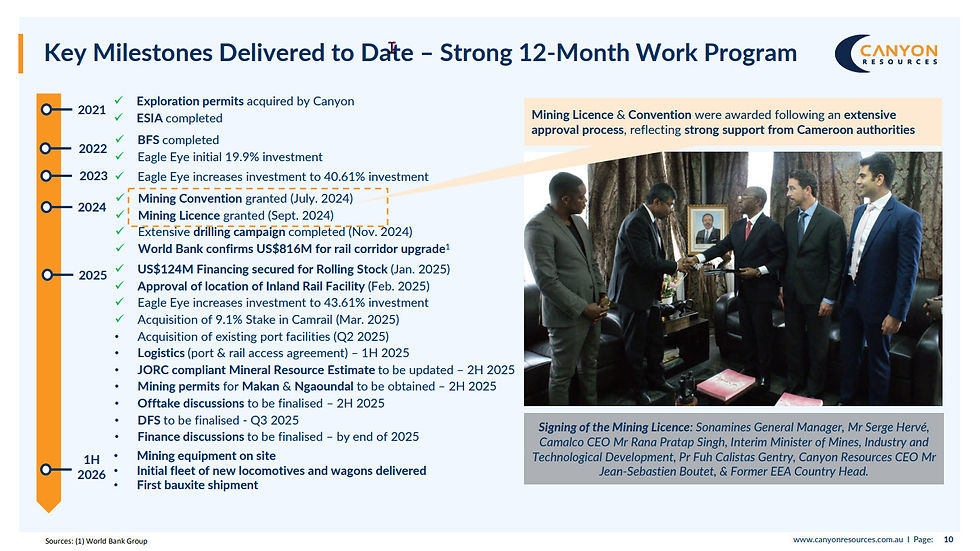

Canyon Resources (ASX: CAY) is steadily advancing its 100%‑owned Minim Martap Bauxite Project, nestled in the Adamawa Region of central Cameroon, near the village of Minim and strategically located adjacent to both rail infrastructure and the Atlantic port of Douala.

Figure 9: Canyon Resources Limited Minum Martap bauxite project in Cameroon. (source: Canyon Resources Limited).

The Project is supported by a Bankable Feasibility Study (BFS), which was completed in 2022 and underpinned by a large and high-grade Mineral Resource Estimate. An initial 20-year Life of Mine (Ore Reserve) was defined in June 2022.

In July 2024, Canyon’s subsidiary, Camalco Cameroun SA, signed a Mining Convention with the Government of Cameroon to mine and export alumina and bauxite at Minim Martap on the grant to the Company of a mining permit (Figure 10).

Figure 10: A timeline for the progress of the Minim Martap bauxite project for Canyon Resources Limited. (source: Canyon Resources Limited).

The signing of the Mining Convention marks the culmination of an extensive approval process, allowing Canyon to proceed with development plans for the Project and is a testament to the strong partnership and collaboration between Canyon and the Government of Cameroon.

Development commenced following the company’s rebranding from Castlemaine Resources in 2010, with exploration permits secured over the Makan, Ngaoundal, and Minim-Martap licences. A pivotal milestone was achieved in August 2020, when the Government of Cameroon granted the project its mining licence, clearing the path for a feasibility study and project financing.

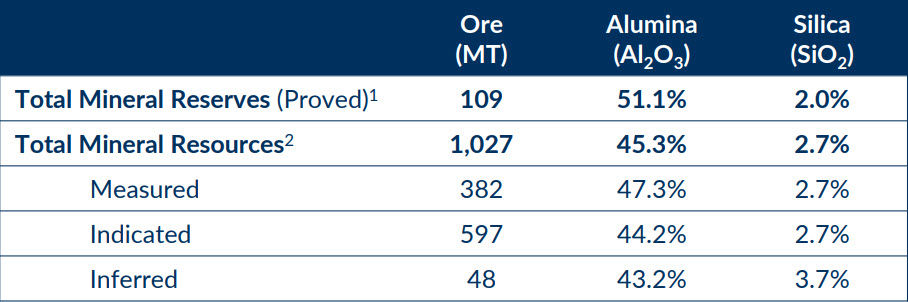

The Minim Martap Resource

The JORC-compliant resource stands at around 1,027 million tonnes, grading 45.3% Al₂O₃ and 2.7% SiO₂, with an Ore Reserve of 109 million tonnes at an upgraded grade of 51.1% Al₂O₃ and 2.0% SiO₂, declared in February 2025. The project has been designed as a 6.4 Mtpa direct-shipping ore operation over a 20-year mine life, underpinned by a robust rail-to-port integration strategy, targeting first shipments in 2026.

Figure 11: The Minim Martap resource as of April 2025. Significant growth potential, as the current mine plan & production target presented in the 2022 Bankable Feasibility Study (BFS) are based on the proved reserves, representing only c. 10.6% of the total resources. (source: Canyon Resources Limited).

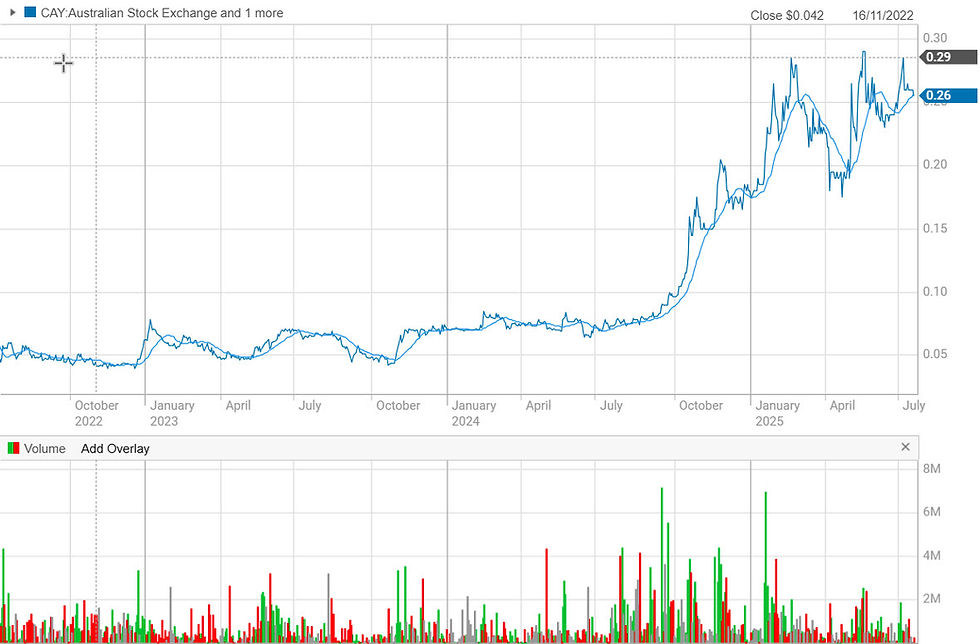

Canyon Market Performance.

Since mining licence approval and the updated Ore Reserve announcement, Canyon has attracted new capital, including a US$140 million credit facility secured in late May 2025.

Figure 12: The share price chart for Canyon Resources as of 18th July 2025. (source: commsec).

The share price has reflected this momentum: trading at just AU$0.07 in mid-2024, the stock surged to a 52-week high of AU$0.30 by May 21 2025, and now sits around AU$0.26, marking a ~249% gain year-over-year—outperforming the ASX All Ordinaries benchmark.

Figure 13: The share price chart for Canyon Resources since October 2022. (source: commsec).

Arrow Minerals Limited.

(source: ABN Newswire)

Arrow Minerals has two projects in Guinea, West Africa. The Niagara Bauxite Project (Niagara, Niagara Project), for which Arrow holds an option to acquire, and the Simandou North Iron Project (Simandou North, SNIP). Both Niagara and Simandou North are located within trucking distance to the Trans Guinean Railway (TGR) that is currently under construction by Winning Consortium Simandou. The location of the Niagara Project relative to the TGR offers substantial advantages for its development, including future access to multi-user rail and port infrastructure (Figure 14).

Figure 14: Project location plan for Arrow Minerals Limited. (source: Arrow Minerals Limited).

Arrow Minerals (ASX: AMD) has reported a maiden JORC Resource of 185 Mt at its Niagara Bauxite Project in Guinea, featuring robust grades of 42.3 % Al₂O₃ and a notably low 2.7 % SiO₂. The resource includes over 75% classified as Indicated, placing it within a 14 km² high‑grade zone, alongside ongoing exploration and the imminent Scoping Study.

Extensive drilling (184 holes to date) confirms shallow, premium‑grade bauxite, and third‑party off‑take and strategic partnership talks are underway.

Niagara Bauxite Project – Progress to Date

An exploration target estimate from August 2024 suggested a potential of 170–340 Mt with ~40–46% Al₂O₃ and 1–4% SiO₂, though still conceptual in nature.

Drilling began in October 2024, focusing on three of nine priority targets. Approximately 2,000 m across ~150 holes and up to 10 bulk samples were planned to support resource estimation and metallurgical work for a scoping study in H1 2025.

By March 2025, a maiden Mineral Resource was declared: 185 million tonnes at 42.3% Al₂O₃ and 2.7% SiO₂, confirming high quality and supporting viability for a starter operation near the soon-to-be‑operational Trans‑Guinean Railway (~100 km away).

ASX Announcement 25th March 2025: Premium DSO Potential in Maiden Mineral Resource

Licence Renewal Uncertainty

On the 19th May 2025, Arrow Minerals went into a trading halt and subsequently a voluntary suspension (May 19) from the ASX as media reports emerged that the Guinean government was reviewing or potentially cancelling a range of exploration tenements, including Arrow’s Niagara Bauxite and Simandou North Iron projects.

The exercise of Arrow’s acquisition option for Niagara remains conditional on a permit renewal of at least two years. They have not yet exercised the option, pending resolution of the permit status.

Meanwhile, the company has continued scoping-level studies (mining, logistics, financial modelling) and engaged with stakeholders to affirm its development credentials and push for rapid resolution.

As of July 2025, the company remains in ASX suspension while seeking confirmation on the status of its exploration permit. Should the government confirm at least a two-year tenure renewal, Arrow will be positioned to advance the acquisition and potentially move toward a starter‑scale bauxite operation.

ASX Announcement 21st July 2025: Amendment to Agreement - Niagara Bauxite Project

Arrow Minerals Market Situation.

Arrow has had had subdue journey over the last 5 years as it progressed the bauxite story. The recent consolidation of the share price, followed by the licence issue, has not been favourable to shareholders. A 20 to 1 consolidation, followed by the recent bad news, is not the best news for shareholders.

Figure 15: The share price chart for Arrow Minerals Limited as of 25th July 2025. (source: commsec).

The recent ASX release on the amendment of the transaction agreement is not adding any joy to the story.

VBX Limited.

(source: VBX Limited)

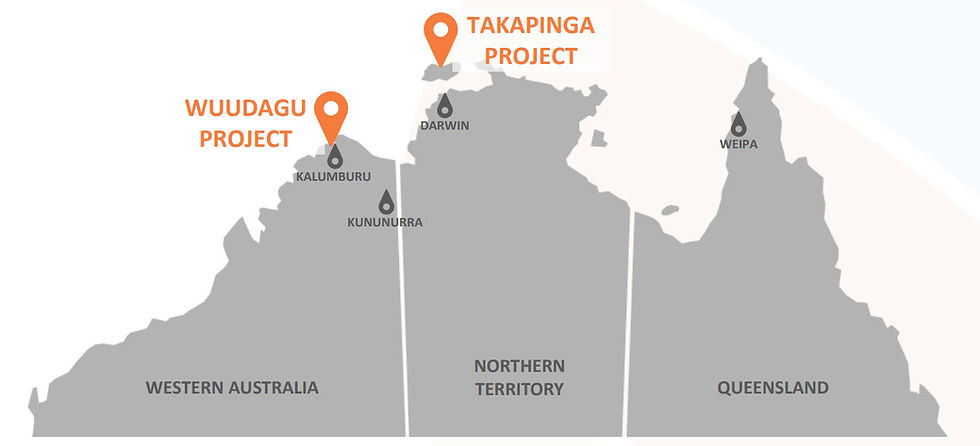

VBX Limited, incorporated in 2013 and headquartered in West Perth, Western Australia, is focused on the exploration and development of high-grade bauxite resources. The company’s flagship asset is the Wuudagu Bauxite Project, located approximately 15 km west of Kalumburu on Wunambal Gaambera country in northern Western Australia (Figure 16). Beyond Wuudagu, VBX also holds the Takapinga Project in the Northern Territory, offering further exploration upside.

Figure 16: Project location plan for VBX Limited. (source: VBX Limited).

This project positions VBX as a promising player in the global bauxite market, particularly due to its proximity to infrastructure and high-quality resource profile. Leading the company is Managing Director Ryan de Franck, supported by a team of directors and executives who collectively hold around 50% of the company’s shares, indicating a strong level of internal alignment and commitment to long-term project development.

VBX listed on the ASX under ticker VBX on 17 June 2025, raising AUD $10 million via an IPO priced at $0.60/share. The IPO was heavily oversubscribed and backed by institutional investors such as Deutsche Balaton, Lowell Resources Fund, and Terra Capital.

Upon listing, the stock surged ~15% intraday as the market welcomed its debut. The share price has since settled down to AUD $0.58 as it begins its ASX journey (Figure 17).

Figure 17: The share price chart for VBX Limited as of 25th July 2025. (source: Market Index).

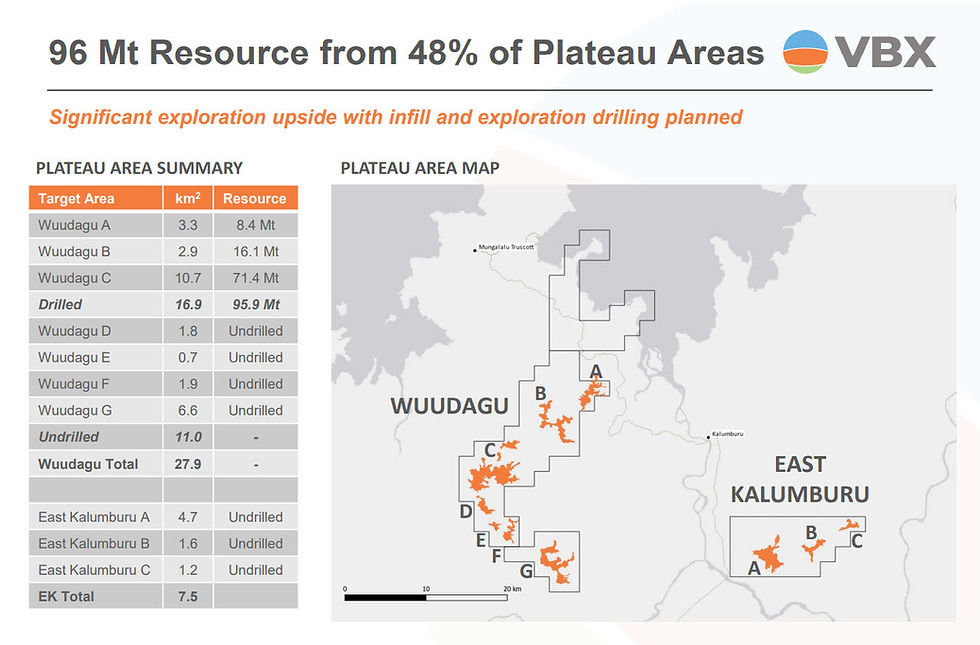

Wuudagu Project

VBX Limited (ASX: VBX) is progressing its Wuudagu Bauxite Project in Western Australia. The company's IPO prospectus and ASX listing materials outline a combined Indicated and Inferred JORC resource of approximately 96 Mt of high‑quality, low‑silica bauxite (Figure 18).

Figure 18: The total resource that is currently in the VBX portfolio at the IPO stage (source: VBX Limited).

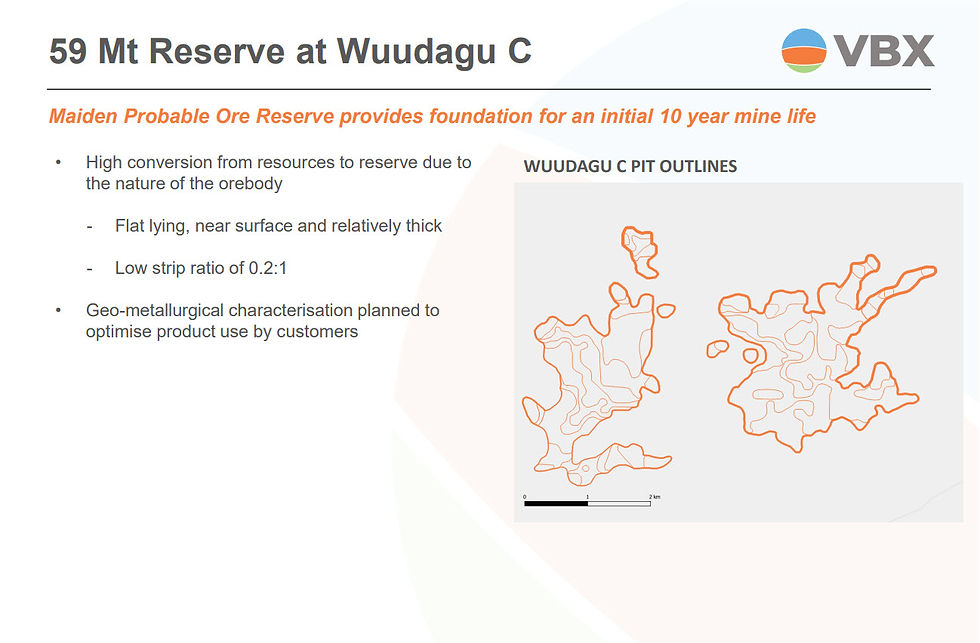

VBX emphasises the ore’s Guinea‑style specifications, including premium grade and favourable logistics, and is targeting a 10+ year mine life underpinned by a 59 Mt Ore Reserve at Wuudagu C. The company aims to enter production by FY 2026, with over half the resource footprint yet to be drill-tested. VBX plans to surface-mine, beneficiate (removing silica), haul via road, and trans‑ship ore from a coastal jetty, aiming for 3.5 Mtpa production over an initial 10‑year mine life (~36 Mt).

ASX Announcement 17th June 2025: Australian Bauxite Developer VBX Lists on ASX

Figure 19: The total resource at Wuudagu C (source: VBX Limited).

According to VBX, the Pre-Feasibility Study (PFS) at the Wuudagu highlights (Completed Early 2025) the following,

Pre-tax NPV (8%): AUD $821 million

IRR: 136%

Payback Period: 16 months

Initial Capex: AUD $125 million

All-in Sustaining Cost (AISC): AUD $54/t CFR China

Average Annual EBITDA: AUD $143 million

Product Grade: ~45.4% Al₂O₃ and ~3.6% SiO₂

As of 30th June, VBX has started its drilling program to support the Wuudagu DFS, as the ASX release dated 30th June 2025 - Drilling program underway to support Wuudagu DFS.

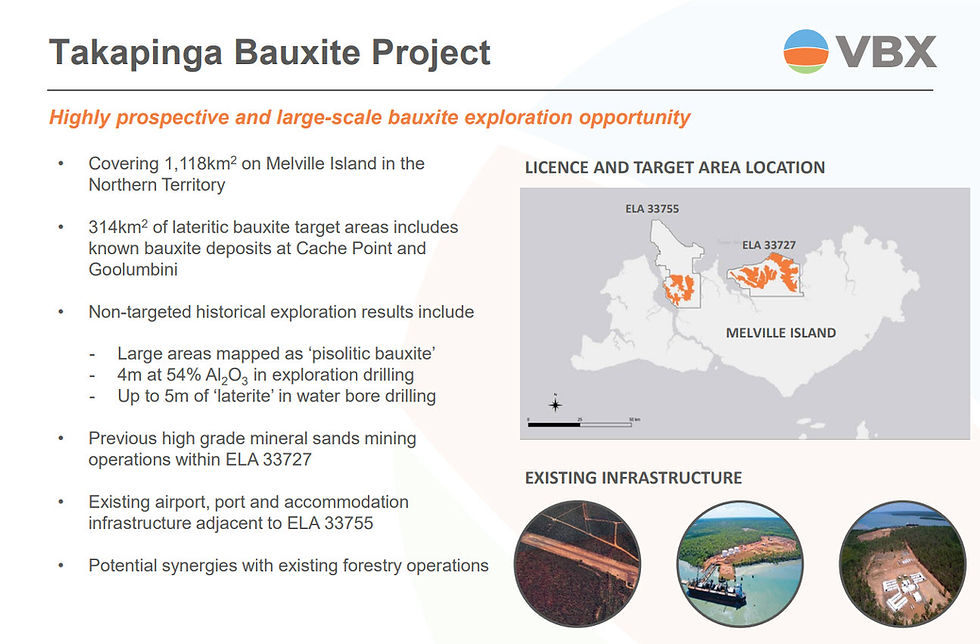

Takapinga Project

The Takapinga bauxite project consists of two exploration licence applications covering approximately 1,118.5 km² on Melville Island in the Northern Territory Figure 20). This exploratory asset is much larger in scale than the company’s flagship Wuudagu site, with roughly 314 km² of mapped lateritic bauxite target areas at known deposits like Cache Point and Goolumbini, along with broader regions identified as pisolitic bauxite potential.

Location: Melville Island, Northern Territory

Size: ~1,118 km² total, with ~314 km² of bauxite targets

Initial Targets: Cache Point, Goolumbini, widespread pisolitic bauxite

Status: Exploration licence applications lodged; early-stage asset

Infrastructure: Near existing airport, port, and accommodation

Potential: High-scale exploration upside and strategic growth opportunity beyond Wuudagu.

Figure 20: The Takapinga Project (source: VBX Limited).

Still in early-stage exploration, Takapinga offers significant upside with its large-scale licence area—around nine times bigger than the Wuudagu Plateau—yet remains underexplored compared to VBX’s well-advanced primary project. VBX is leveraging progress at Wuudagu while building the early groundwork at Takapinga, making it a key longer-term development target if early drilling results prove encouraging.

VBX has flagged the Takapinga Project as a major growth lever, capitalizing on Melville Island’s substantial target area size and its potential for future resource definition. As an early-stage asset, it represents an opportunity to significantly expand VBX’s bauxite footprint beyond its Western Australian operations.

Samso Concluding Comments

For ASX investors in the small end of town, the small capitalisation sector of the ASX, bauxite mining or the business of bauxite, is not well understood. There is little media coverage for this bulk commodity as it has largely been dominated by the major players. Aloca, the Darling Range and bauxite are largely accepted as the bauxite industry, and most investors in the ASX will not be able to mention any other player in the industry. When I wrote about Metro Mining and Canyon Resources back in 2020, there was no other significant company that was in the bauxite space. Till today, I challenge anyone to show that there is any other significant story other than that I have mentioned.

In recent times, Arrow Minerals in Cameroon is probably the only other player that started to sing the bauxite song, but with the government nationalising the country's mineral business, that is now not looking good for the company. If you have had the patience and the sustenance to have gone through this review, the only new players that have some form of significance are VBX Limited and Western Yilgarn Limited. One can add ABx to that list, but there are some important perception that needs to be overcome before I feel a smoother journey is in the coming.

The Real Underlying Value Proposition Investors Need to Consider.

At the time of writing, VBX is sitting at a market capitalisation of AUD $22m, Western Yilgarn is at AUD $4M, and ABX Group Limited is at AUD $9M. These are the hopefuls in the sector, while Metro Mining is in a league of its own with a market capitalisation of AUD $426M. Unfortunately, Metro Mining, in my opinion, does not have the leverage in multiple bags of value, which is more apparent with the other three stories, VBX Limited, Western Yilgarn and ABx Group Limited.

Looking at Table 1, I view that the true value proposition for investors will not be driven by the grades alone. Don't get me wrong, the technical aspect is important, but the business that is happening in Australia is now more than numbers. It's about the ability to deliver an economic solution in the midst of an environmentally sensitive mining jurisdiction.

A Potential Game Playing Out in The Western Australian Bauxite Sector.

The success of a mining business in Australia is now all about appeasing the ESG factor, having the infrastructure and how the mining process can be economised. It is one thing to have a mineral discovery with tonnes and grade, it is entirely different to see the commercialisation of that resource, as the barriers to overcome, the jurisdiction and social barriers are higher in Australia. There is no secret that Alcoa and South32 are looking for more feed, and looking at the players in Table 1, the only one that has the advantage of location is Western Yilgarn.

It has the advantage of being in the dry wheatbelt of Western Australia, trucking distance to existing processing facilities and two major bauxite players wanting and needing feed. It's like a marriage made in heaven. It is a marriage proposition that is still in the early stages of a good idea. As we all know, the devil is in the details, so it is still very early to make any comment that carries weight. It is still just a good thought, and if I am correct, taking a position now after some serious DYOR would be a good idea.

Alcoa and South32 have similar grades and silica content, so optimising the ore from Western Yilgarn will not be a major obstacle. In addition, a company with a market capitalisation of AUD $4M is going to be a lot easier to have a discussion about collaboration, consolidation, Joint Venture or M&A.

The virtues of opportunities in the mining industry are something that is not earned but is bestowed upon by the God of Lady Luck. Western Yilgarn is in a very unique position as it appears to have stumbled onto the good fortune of Lady Luck. How this will proceed with time is never set in concrete, but for the ASX investors, as I have already mentioned, this is definitely one for some serious DYOR.

VBX is steep in the Kimberley region, and working with the traditional owners will be a very important part of their success. The fact that they have an established PFS and appear to have a clear path to establishing a mining business is encouraging. I do like the fact that they have a low silica content, which is on par with Canyon Resources, Arrow Minerals and ABx Group.

Bauxite in Australia is unique in that there are no other real players other than Metro Mining in Queensland. With global demand for both bauxite and aluminium indicating an upside trend (like everything else), the search for the next reliable and sustainable source of bauxite will be the next challenging focus for the likes of Alcoa and South 32.

Like Tungsten, Bauxite is the sleeper at the moment for ASX investors. DYOR and Happy Investing.

The Samso Way – Seek the Research

Here at Samso, we pride ourselves on delivering content for investors that is independent and informed by over three decades of experience in the industry. We are always asking the questions that may sound simple and irrelevant, but these are typically the ones that make sense to you, the one seeking the knowledge.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

References:

"Guinea holds approximately 7.4 billion tonnes of bauxite—about 23–25 % of world reserves" Wikipedia+11Africanews+11PIIE+11Geoscience Australia+1Wikipedia+1DataM Intelligence+3Reuters+3Wikipedia+3.

"Australia contains around 22 % of global bauxite deposits, with reserves between 5.8 and 6 billion tonnes" Wikipedia.

"Vietnam's bauxite reserves are estimated at 5.4–5.8 billion tonnes, with some reports claiming up to 11 billion tonnes".

"Brazil has around 2.63 billion tonnes (~9 %) and Indonesia about 1.17 billion tonnes (~4 %) of global bauxite reserves".

Geological Survey (U.S.) (1986). Geological Survey Professional Paper. U.S. Government Printing Office. p. 2-PA20.

"The Clay Minerals Society Glossary for Clay Science Project". Archived from the original on April 16, 2016.

"Aluminium". Minerals Education Coalition.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and

Comments