Samso News: Vitrafy Life Sciences — IMV Strategic Commercial Agreement Marks a Commercial Validation Step - A Definite #SamsoDYOR and a strong consideration for position play.

- Noel Ong

- 4 minutes ago

- 7 min read

Announcement

IMV Strategic Commercial Agreement Investor Briefing – 15 January 2026 (view the announcement)

IMV Strategic Partnership Investor Presentation – 15 January 2026 (view the announcement)

Vitrafy Enters Strategic Commercial Agreement with IMV – 15 January 2026 (view the announcement)

The Vitrafy Life Sciences story was last on our radar when we reviewed their progress after their IPO on the 25th of June 2025 - Vitrafy Life Sciences Limited (ASX: VFY) — Turning Cryopreservation Innovation into Market Reality - Animal and Human Health Solutions.

This was a first for Samso as we started to increase our coverage on the ASX. From a Samso perspective, this announcement gives us additional interest to feature on the Samso platform because it demonstrates partner-led commercial validation rather than speculative market positioning. Aligning with a global incumbent like IMV Technologies materially reduces execution risk and confirms that Vitrafy’s technology is being tested in real-world, scaled operating environments.

Vitrafy Life Sciences Limited – Strategic Partnership Update (15 January 2026).

Vitrafy Life Sciences Limited (ASX: VFY) released a market update on 15 January 2026 outlining a strategic commercial agreement with global animal reproduction leader IMV Technologies. The agreement positions Vitrafy’s cryopreservation technology within IMV’s global product and distribution platform, marking a material step in Vitrafy’s commercial execution strategy following Samso’s earlier IPO coverage of the Company.

About IMV Technologies (IMV)

IMV Technologies is a global leader in reproductive biotechnologies and animal reproduction technologies, with a legacy of innovation dating back to 1963 when founder Robert Cassou developed the revolutionary “French Straw” for semen storage and artificial insemination.

The company operates worldwide, designing, manufacturing, and distributing equipment, consumables, software, and solutions that support the entire reproductive process for farm animals, including semen collection, analysis, preservation, storage, insemination, and pregnancy diagnosis.

The “French Straw” — What It Is and Why It Was Revolutionary

The “French Straw” is a small, sealed plastic tube developed in the early 1960s by Robert Cassou, founder of IMV Technologies, to store, freeze, transport, and use animal semen for artificial insemination (AI).

At the time, semen was stored in glass ampoules or bulky containers, which were fragile, inconsistent in volume, difficult to label, and unreliable during freezing and thawing.

The French Straw changed all of that.

Core Focus & Innovation

Innovation “For Life”: Research and development are central to IMV’s mission, with a dedicated R&D team of veterinarians, biologists, engineers, cryobiologists, and others driving new technologies and improvements. They invest a significant portion of their revenues into innovation and hold hundreds of patents.

Broad Expertise: Their technological developments cover equipment for collecting, analyzing, preserving, and packaging reproductive cells—as well as advanced data processing software that helps partners make informed decisions every day.

Customer Collaboration: IMV works closely with customers—breeders, veterinarians, insemination centers, and researchers—to develop solutions that meet real-world needs and continuously improve outcomes.

The Business of Vitrafy Life Sciences Limited: Cryopreservation Technology Platforms

Vitrafy Life Sciences is a cryopreservation technology company delivering nitrogen-free freezing and thawing solutions across regulated and unregulated life sciences markets.

The Company’s platform integrates proprietary hardware, software, and managed services, designed to improve post-thaw cell viability and operational consistency.

Core applications span animal reproduction, aquaculture, blood platelets, and cell and gene therapies, providing multiple commercial pathways.

Vitrafy’s strategy focuses on partner-led scale in animal reproduction while advancing human health market expansion in North America.

Highlights – IMV Strategic Commercial Agreement (15 January 2026)

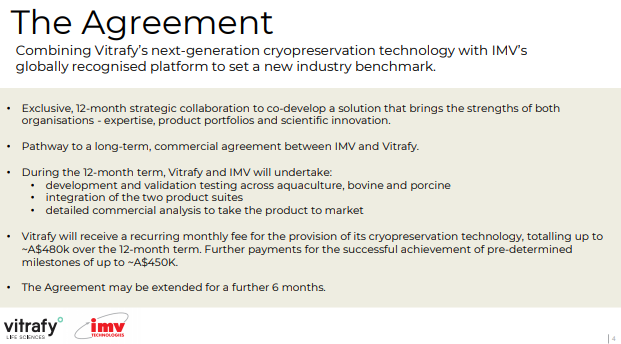

Exclusive 12-month strategic commercial agreement with IMV Technologies, the global leader in animal reproduction (Figure 1).

Figure 1: IMV Strategic Partnership overview (source: VFY)

IMV (Figure 2) supports over 500 million animal inseminations annually across operations in 128 countries, providing immediate access to scale.

Figure 2: IMV Technologies: Global Leader in Animal Reproduction (source: VFY)

Agreement designed to integrate Vitrafy’s next-generation cryopreservation technology into IMV’s globally recognised product suite (Figure 3).

Figure 3: Agreement scope and validation pathway (source: VFY)

Vitrafy to receive up to approximately A$480,000 in recurring monthly fees over the initial term.

Additional milestone payments of up to approximately A$450,000, linked to successful technical and commercial outcomes.

Structured pathway toward a long-term commercial agreement, subject to validation and integration milestones.

Leadership Commentary

Upon execution of the Agreement, Managing Director and CEO, Brent Owens, commented:

“This agreement with IMV Technologies represents a significant step in Vitrafy’s commercialisation strategy. By partnering with the global leader in animal reproduction, we accelerate the validation and adoption of our cryopreservation technology at scale.

This Agreement creates immediate revenue opportunities but also positions Vitrafy for longterm growth through global market access, while we continue to advance our human health strategy in North America.”

CEO of IMV Technologies, Oliver Kohlhaas, commented:

“Vitrafy’s unique nitrogen-free cryopreservation technology has the potential to improve post-thaw cell viability. We are excited to collaborate with Vitrafy to offer even better solutions for our customers.”

Near-term Milestones to Watch

Completion of species-specific validation testing across aquaculture and livestock segments.

Integration outcomes between Vitrafy’s technology and IMV’s existing product platforms.

Achievement of commercial and technical milestones linked to additional payments.

Progression toward a long-term commercial agreement beyond the initial term.

Samso Concluding Comments

When Samso first reviewed Vitrafy during its IPO, the core idea was simple. The company needed to show that its lab-based cryopreservation results could work the same way in everyday commercial use.

The partnership with IMV supports this aim by placing Vitrafy’s technology into a large, established animal reproduction platform. This provides a practical setting to test performance, reliability, and integration.

The commercial terms are also structured in a controlled way. Regular fees provide income while milestone payments depend on results being achieved.

From a Samso view, this release acts as a progress check rather than a change in direction. Vitrafy is continuing to follow the path set out at IPO, making this a clear #SamsoDYOR reminder focused on delivery.

Market Implication - The Investor Lens

Vitrafy is an interesting company for the Samso platform as it has a decent market cap of AUD $121M and its share price is looking steady. For me, this means that the value has not really been unlocked. For me, the market cap makes me feel that there is value in the business and not just a prospective ground that may have potential to become mineralised or later an economical business.

Figure 4: Vitrafy share price chart as of 23rd January 2025. (source: CommSec)

A business like Vitrafy is for the population of the globe, and the market is projected to be in the USD $17-18 billion by 2034-2035 and at a GAR of 8% over the decade. A fraction of that will be sufficient, and I am sure the market capitalisation of Vitrafy will be more than the current AUD $121M.

The most important thing is that the business works and there is market capture, which is still unknown at this stage. With positive news such as that release on the ASX update, one can only hope that the wheels are turning and shareholders will be hoping that it is going to turn faster soon.

The Samso Way – Seek the Research

Here at Samso, we pride ourselves on delivering content for investors that is independent and informed by over three decades of experience in the industry. Our content is well-researched and is only created if I see merit in discussing the company's story.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Never bite off more than you can chew is my parting comment.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer, or solicitation to subscribe for, purchase, or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try to write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation sees the benefit of what Samso is trying to achieve and has a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments