RareX (ASX: REE) Continues to Confirm Cummins Range as Australia’s Standout Gallium Discovery.

- Noel Ong

- Jul 21, 2025

- 7 min read

Announcement

RareX Limited (ASX: REE) has delivered another round of eye-catching assay results that significantly strengthen its position as the developer of one of Australia's most advanced and highest-grade gallium deposits at the Cummins Range Project (Figure 1). The latest update, announced on 24 June 2025, showcases high-grade gallium re-assays from Cummins Range and builds upon an already compelling narrative that began with RareX’s March 2025 discovery announcement.

Figure 1: Cummins Range Project (source: REE)

Key Highlights – Cummins Range Gallium Re-assay Results

💠Significant Intercepts Include (Figure 2):

60m @ 99 g/t Ga₂O₃, 3% TREO, 195 g/t Sc₂O₃ from 29m, including 33m @ 115 g/t Ga₂O₃ and 258 g/t Sc₂O₃.

50m @ 68 g/t Ga₂O₃, 2% TREO, 227 g/t Sc₂O₃ from 47m, including 5m @ 113 g/t Ga₂O₃, 10.2% TREO and 420 g/t Sc₂O₃.

Results are derived from re-assaying of 2020 infill drilling pulps – the first 15 of a 58-hole re-assay program.

These numbers confirm and expand upon the March 2025 discovery, where RareX reported values up to 6,826 g/t Ga₂O₃ in historical drilling data.

Cummins Range is now shaping up as not just Australia’s most advanced gallium project, but potentially one of the world’s most strategic due to its co-location with rare earths, scandium and phosphate—a powerful multi-commodity suite.

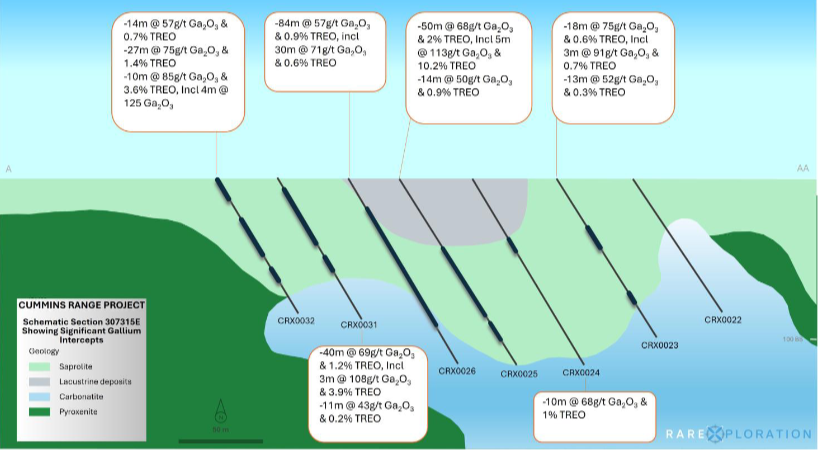

Figure 2: Section 307315E with gallium grades across 250m of the Rare Carbonatite Dyke. (source: REE ASX 24 June 2025)

The gallium-rich mineralisation is hosted within the weathered saprolite horizon, with its geometry and distribution clearly illustrated in Figure 3.

Figure 3: Collar location plan showing carbonatite dykes 100m below surface. Also showing Section (Figure 1) location. (source: REE ASX 24 June 2025).

CEO and Managing Director, James Durrant, commented:

“This latest round of assays confirms what our early analysis suggested; the gallium at Cummins Range is not only real, but significant. With consistent grades now returned from infill drilling, we can probably say Cummins Range is one of Australia’s most advanced and highest- grade gallium projects.

“What makes this particularly strategic is that the gallium sits within a broader rare earth-phosphate-scandium system, making Cummins Range one of the most geopolitically relevant critical mineral deposits in the country. With Chinese supply effectively off the table, and no meaningful Western production, we’re now prioritising pathways to unlock gallium as a core value stream alongside rare earths and phosphate, including working in our strategic partnership with Gega Elements to assess novel refining technology that could enable low-cost gallium extraction.”

Historical High-Grade Gallium Intercepts

The latest assays build upon the significant results first announced in March 2025, which brought Cummins Range into the spotlight as one of Australia’s most prospective gallium-hosting deposits. Key historical intercepts (Figure 4 & Figure 5) included:

99m @ 106 g/t Ga₂O₃, 0.77% TREO, 160 g/t Sc₂O₃ from 1m

60m @ 124 g/t Ga₂O₃, 3% TREO, 372 g/t Sc₂O₃ from 36m, including 12m @ 242 g/t Ga₂O₃, 6.7% TREO, 638 g/t Sc₂O₃

74m @ 123 g/t Ga₂O₃, 2.4% TREO, 186 g/t Sc₂O₃ from surface, including 30m @ 206 g/t Ga₂O₃, 4.6% TREO, 310 g/t Sc₂O₃

Figure 4: Section 307340E with gallium intercepts at Cummins Range deposit. Section location is shown in Figure 5. (source: REE ASX 25 March 2025)

These results, derived from historical drilling campaigns between 2007 and 2012, were only recently reassessed for gallium, revealing grades that place Cummins Range among the highest in Australia. The fact that only 25% of historical holes were originally assayed for gallium suggests considerable upside remains untapped across the broader resource footprint.

Figure 5: Collar location plan showing carbonatite dykes 100m below surface. Also showing Section (Figure 4) location. (source: REE ASX 25 March 2025)

Why Gallium Matters – Market Relevance

Gallium is a critical mineral with essential roles in:

Semiconductors (gallium arsenide, gallium nitride).

5G networks, defence systems, AI chips.

Optoelectronics and solar energy technologies.

The global market for gallium is forecast to explode from US$2.45B in 2024 to US$21.53B by 2034, driven by structural supply risks (98% of production controlled by China) and surging demand across semiconductors, EVs, defence and renewables.

Strategic Positioning – RareX’s Gallium Advantage

These latest assays underscore that gallium is not an incidental by-product at Cummins Range. It is present in thick, high-grade zones, often overlapping with rare earth and scandium zones in the weathered saprolite profile of the carbonatite pipe.

Importantly, RareX is:

Already re-assaying past drilling with excellent success.

Pursuing refining collaboration with Gega Elements Pty Ltd (Gega), as announced on 30 May 2025.

Actively integrating gallium into broader project economics and planning.

This places RareX ahead of the curve in Australia’s race to develop sovereign gallium production.

Other Notable Developments from RareX

This gallium news follows several important company milestones:

Strategic Collaboration with Gega Elements: RareX is working with Gega to develop Australia’s first integrated gallium refining capability, aiming to transform laboratory success into an operational refining flow sheet.

Environmental & Social Commitment at Mrima Hill: RareX has appointed WSP to lead early-stage ESG planning at its Kenyan critical minerals project, underlining its disciplined, long-term strategy.

Ausenco Appointed for Early Infrastructure Studies: Ausenco’s local Kenyan experience (notably Kwale) strengthens RareX’s operational readiness at Mrima Hill.

Together, these moves reinforce RareX’s “develop it right” approach, targeting not just geological potential but supply chain depth and ESG alignment.

Samso Concluding Comments

RareX’s evolving gallium story at Cummins Range is an interesting story that is aligning with the compelling critical mineral narratives on the ASX right now. The recent resampling does tell a good story, and it does seem to demonstrate that it occurs in broad zones. In a market where gallium is almost entirely controlled by China, RareX is positioning itself as a participant to meet a rapidly emerging supply chain gap.

As I have mentioned in a previous Samso News, I am not overly versed in what the grades mean. As you can see from the release, the numbers seem to be significant—some of which exceed 200 g/t Ga₂O₃—but also in the scale and consistency of mineralisation.

The grades do speak for themselves, with intercepts such as 60m @ 99 g/t Ga₂O₃ and 50m @ 68 g/t Ga₂O₃ placing Cummins Range firmly in the high-grade category.

The company’s decision to re-assay historical pulps and integrate gallium into its development strategy shows a maturity that’s often lacking in early-stage critical mineral stories.

The strategic collaboration with Gega Elements for refining technology and the appointment of WSP and Ausenco for ESG and infrastructure planning, respectively, show a clear path forward. These appear to be not token partnerships—the credible and long-term moves do reflect RareX’s intent to advance Cummins Range from resource to production.

For investors, the key will be watching how gallium is integrated into the broader feasibility and economic models. If RareX can demonstrate that gallium can be economically recovered alongside its rare earth-phosphate base, the implications are significant. This could transform Cummins Range from a strong rare earths project into a globally strategic, multi-commodity development. Samso has followed many early-stage stories, but this one may offer a unique blend of technical merit, strategic timing, and execution capability.

What concerns me, or rather, I am pondering why this is still an AUD 16M market capitalised company. I understand that this was a much lower valued comp[any prior to the ASX releases on this topic, but with all the hype of Gallium, I am not sure why it is still "cheap".

Figure 6: RareX Limited share price chart as of 11th July 2025. (source: commsec)

The Samso Way – Seek the Research

Is this a real gallium story? The re-assay results from the Cummins Range show consistently high-grade gallium intersecting with rare earths and scandium, which is promising, but promising alone isn’t enough. The real shift comes with RareX’s appointment of heavyweight contractors like WSP and Ausenco to lay the groundwork for ESG compliance, infrastructure readiness, and eventual production. That move gives the story some real-world credibility.

Still, the core investor question remains: are the grades sufficient, and is there enough resource to build an economic case? The early signs are strong, but as always, seek the Research.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments