Exploration with Purpose – Axel REE's Caladão & Caldas Programs Keep Delivering - Gallium or Rare Earths?

- Noel Ong

- Jul 4, 2025

- 6 min read

Announcement

From Prospectus to Progress: 🆕 IPO Review

Since debuting on the ASX in May 2024, Axel REE Limited (ASX: AXL) has maintained its strategic exploration push across two key Brazilian projects—the Caldas Rare Earths Project and the Caladão Gallium-REE Project (Figure 1). The company has taken significant steps forward in its goal to define high-value clay-hosted rare earth and gallium mineralisation, both critical to the future of electrification and green technologies.

Figure 1: Location Map of the Caldas project tenements inside and outside the Caldera (source: AXL)

🔷 ASX Snapshot – Axel REE Limited (ASX: AXL)

ASX Code: AXL

Listing Date: 23 July 2024

IPO Offer Price: $0.25

Current Share Price (as at June 2025): $0.078

Market Capitalisation: $12.21 million

Industry Group: Materials

🔷 What Has Axel Done Since Listing - Rare Earths or Gallium story?

In May 2025, Axel reported significant high-grade REE results from its Caldas Project in the Poços de Caldas Alkaline Complex, with highlights including:

CAL-AUG-022: 8.8m @ 5,309ppm TREO (26% MREO) from surface

CAL-AUG-024: 10.8m @ 3,683ppm TREO (32% MREO)

CAL-AUG-025: 11.4m @ 3,608ppm TREO (21% MREO)

All drill holes returned intercepts above 1,000ppm TREO, confirming thick, clay-hosted mineralisation across the Caldera. Notably, mineralisation remains open at depth, suggesting room for resource growth through deeper drilling (Figure 2).

Figure 2: Cross-section of auger drill prospects inside the Caldera, showing REE mineralisation remains open at depth.

The Axel Board commented:

“The consistent flow of high-grade TREO results continue from our shallow augerdrilling program inside the Poços de Caldas Alkaline Complex. The grades reported are consistent with major discoveries made by neighbours including Meteoric Resources NL (MEI) and Viridis Mining and Minerals Limited (VMM).

Importantly, the high grade TREO mineralisation is increasing at the end of auger holes, demonstrating the mineralisation is open at depth and amenable to deeperdrilling.”

Following this, in June 2025, the Company expanded its footprint at the Caladão Project in Brazil’s Lithium Valley, reporting:

Gallium grades up to 128g/t Ga₂O₃ from surface in Area B (Figure 3)

Significant lateral continuity across Areas A and B, with intercepts like:

⚬ 16m @ 75g/t Ga₂O₃ (CLD-AUG-351)

⚬ 8m @ 88g/t Ga₂O₃ (CLD-AUG-393)

Figure 3: Geological map of Caladão Area B, highlighting the distribution of Gallium intersections, using a 50 g/t Ga2O3 cutoff. (source: AXL)

Continued strong REE intercepts (Figure 4):

⚬ 11m @ 2,718ppm TREO (CLD-AUD-310)

⚬ 9m @ 1,618ppm TREO (CLD-AUG-332)

Non-Executive Chairman, Paul Dickson, commented:

“The latest Gallium assay results from Caladão continue to demonstrate both high grades and remarkable lateral and vertical continuity across both Area A and now Area B. This consistently mineralised profile supports our strategy to rapidly define a significant maiden gallium and REE resource in area B in addition to the Mineral Resource Estimation for gallium and REE in area A, which is in the MRE calculation phase with SRK. These results highlight both the continuity and scalability of gallium mineralisation, supporting our strategy for rapid resource development for REE and gallium in the Caladão Project.”

Figure 4: Distribution of TREO intercepts at Area B over Geological map. (source: AXL)

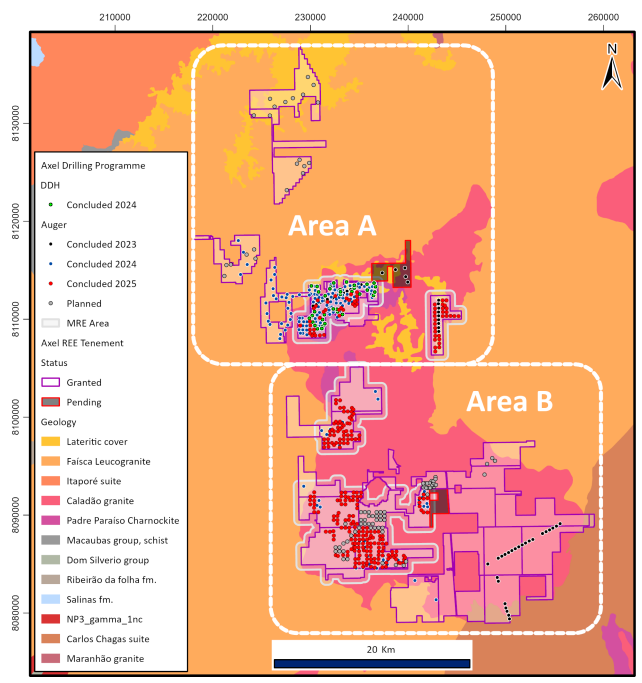

Both projects are progressing toward maiden Mineral Resource Estimates (MRE), with SRK Consulting engaged. The initial MRE for Caladão Area A is due mid-2025 (Figure 5).

Figure 5: Caladão Project with Area A and B over Geology. (source: AXL)

🔷 Use of IPO Funds – Summary (Actual vs Budget)

As at 31 March 2025, Axel REE Limited reported a total expenditure of $3.97 million, compared to the $13.82 million projected in its Prospectus for the 24 months following listing. The most significant variance relates to exploration, where only $1.43 million has been spent out of the forecasted $9.85 million, largely due to the early stage of the Company’s post-listing timeline.

Having listed on the ASX on 19 July 2024, Axel is still within the first 8 months of its 24-month planned expenditure period. The Company confirmed it remains on track to meet its overall budgeted use of funds, with a substantial portion of exploration activity—including drilling and the delivery of a maiden Mineral Resource Estimate at the Caladão REE-Gallium Project—scheduled for the months ahead. This measured rollout reflects a strategic pacing of capital deployment while prioritising technical milestones.

🔷 Share Price Performance Since Listing

Since its ASX debut on 23 July 2024 at an IPO offer price of $0.25, Axel REE Limited (ASX: AXL) has experienced a measured evolution in its share price. Following an initial period of subdued trading, the share price began to build momentum in April 2025 on the back of consistent drilling success across its Brazilian rare earths and gallium assets. A pronounced rally in May saw the stock surge past $0.09, driven by strong exploration updates and growing recognition of the Company’s clay-hosted REE potential.

While still trading below IPO levels, Axel’s share price trend suggests the market is starting to respond to the underlying technical progress—a pattern not uncommon in the early chapters of emerging exploration stories.

Figure 6: AXL’s Share price as of 23 June 2025 (source: ASX)

Samso Concluding Comments

Axel REE Limited has results emerging from both the Caladão and Caldas projects, and it looks like the Company is positioning to play a serious role in telling the story in the rare earth and gallium supply chain—two commodities poised to benefit from the ongoing energy transition.

As the maiden MREs near completion and deeper drilling programs commence, investors may find themselves at a turning point. While the current market capitalisation sits below its listing valuation, the fundamentals being built are arguably stronger than they were at IPO.

Axel is a company that sits in that limbo market space where it has what would have been a decent REE project, but that market has fallen out of favour with ASX investors. The Gallium story is one that is yet to be played out, but I think the market has some serious flaws for participants in the Gallium space. I am no expert in that space, but I think this is a very small market, and with China being the man behind the screen playing the puppets, I think this will not end well for ASX small-cap players.

As always, seek the research — because that’s where the real story unfolds.

The Samso Way – Seek the Research (Summary)

Axel REE’s story is a reminder that real value lies beneath the surface. While the market response may lag, the company’s consistent technical results across Caldas and Caladão highlight a strong foundation in critical minerals. With high-value MREO grades and Tier-1 geology, Axel is positioning itself as a serious long-term player in the REE and gallium space.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments