Cyclone Metals Limited (ASX: CLE) – Iron Bear Project Scoping Study Positions Company for Large-Scale, Low-Carbon Magnetite Production - A Green Iron Ore and Green Steel Story Unfolding.

- Noel Ong

- Aug 13, 2025

- 9 min read

Updated: Aug 14, 2025

Announcement

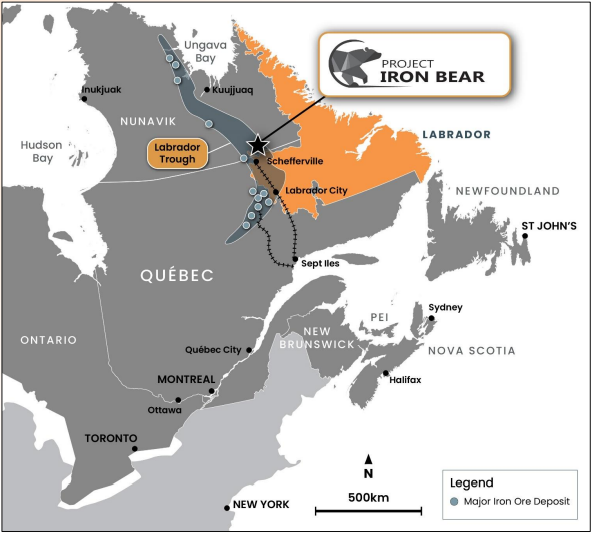

Cyclone Metals Limited (ASX: CLE) has released the results of its Scoping Study for the flagship Iron Bear Project, located in the Labrador Trough, Canada — a region that has been a cornerstone of North America’s iron ore industry for over 70 years. The study outlines the potential for a world-class, long-life magnetite operation, producing premium iron ore products that are aligned with the growing demand for low-carbon “green steel”.

Figure 1: Iron Bear Regional Location (source: CLE)

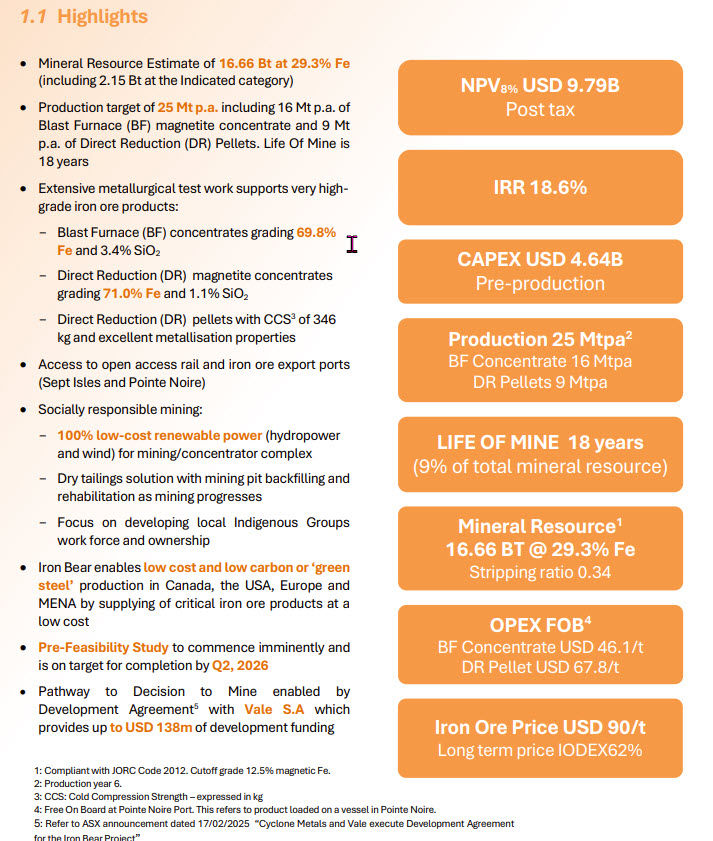

The Scoping Study evaluates three production scenarios — Low Case (12.5Mt p.a.), Base Case (25Mt p.a.), and High Case (50Mt p.a.) — underpinned by a JORC 2012-compliant Mineral Resource of 16.66 billion tonnes at 29.3% Fe, including 2.15 billion tonnes in the Indicated category.

With a conservative iron ore price assumption of USD 90/t (62% Fe benchmark, 2035 real terms) and staged development, the project demonstrates strong economics, robust margins, and sustainable development credentials. This is the beginning of what could be a world-class Green Iron Ore and Green Steel story that is setting the tone for the Green Energy, Low-Emission stage.

Project Highlights – The Development of a Green Iron Ore and Green Steel Story - Base Case Scenario A1

The Base Case targets 25Mt p.a. of high-grade products over an 18-year Life of Mine (LOM):

The operation is planned to produce 16 million tonnes per annum of Blast Furnace (BF) magnetite concentrate, with a grade of 69.8% Fe and a silica content of 3.4% SiO₂, aligning with premium specifications sought by global steelmakers.

In addition, it is designed to deliver 9 million tonnes per annum of Direct Reduction (DR) pellets, grading 71.0% Fe with a low silica content of 1.1% SiO₂ and high metallisation properties, demonstrated by a Cold Compression Strength (CCS) of 346kg, making them highly suitable for low-carbon steel production routes.

Key Metrics:

Post-tax NPV8%: USD 9.79 billion

IRR: 18.6%

Pre-production CAPEX: USD 4.426 billion

OPEX FOB Pointe Noire: USD 46.1/t (BF), USD 67.8/t (DR)

Payback Period: 6 years 9 months

Stripping Ratio: 0.34:1 (Figure 2)

Mineral Resource Utilisation: 71% Indicated, 29% Inferred over LOM

The production ramp-up is phased:

Year 2 – 12.5Mt p.a. concentrate capacity

Year 5 – 17.5Mt p.a. with pellet production added

Year 6 – Full 25Mt p.a. capacity achieved

Figure 2: Material Moved and Strip Ratio - 25Mt p.a. / Base Case - Scenario A1, B5, C9 (source: CLE)

Premium Product Advantage

Metallurgical testwork confirms that Iron Bear can produce tier-one magnetite concentrates suitable for both blast furnace and direct reduction steelmaking routes. These high-grade, low-silica products command pricing premiums due to their ability to:

High-grade magnetite products from the Iron Bear Project are designed to enhance furnace productivity, reduce carbon emissions per tonne of steel produced, and provide flexibility for blending with lower-grade ores to optimise overall steelmaking efficiency.

This positions Iron Bear to supply key markets in Canada, USA, Europe, and MENA, where low-carbon steel initiatives are driving demand for premium feedstocks.

Sustainability and ESG Focus

Cyclone Metals has embedded sustainability into the project design:

100% renewable energy for the concentrator and associated facilities — sourced from the proposed 60MW Menihek hydro plant and 280MW wind farm, with a 315kV transmission link to Churchill Falls in later phases.

Dry tailings and progressive pit backfilling to minimise environmental footprint.

Employment and ownership opportunities for local Indigenous groups.

This ESG-driven approach supports not only social licence but also access to funding streams increasingly tied to environmental performance.

Infrastructure and Logistics

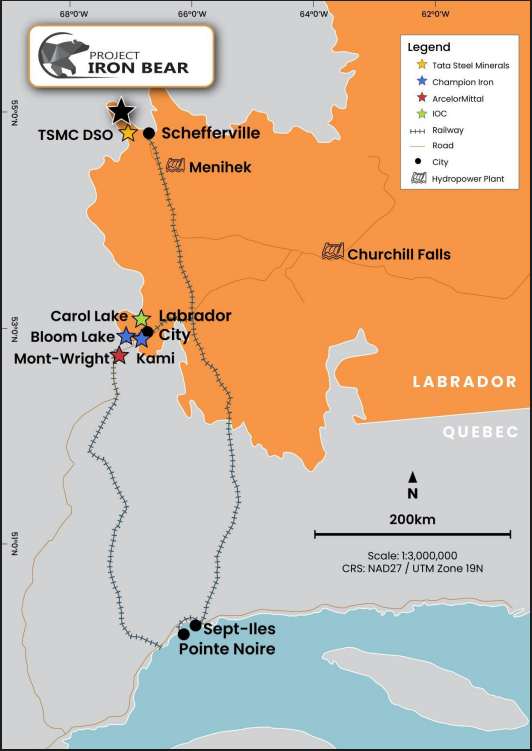

The study proposes transporting 25Mt p.a. of blast furnace concentrate by rail from the Iron Bear site near Schefferville to the Sept-Îles/Pointe-Noire ports in Quebec, using and upgrading existing networks operated by Tshiuetin Rail Transportation (TSH), Quebec North Shore and Labrador Railway (QNS&L), and Société ferroviaire et portuaire de Pointe-Noire (SFPPN). This plan leverages proven rail corridors, requiring targeted upgrades to deliver a technically feasible and economically viable transport solution.

Figure 3: Iron Bear Renewable Assets Location (source: CLE)

The logistics model allows for efficient movement of high-grade concentrate and DR pellets to market.

Capital and Operating Costs

CAPEX (Base Case): USD 4.426B pre-production, including:

Mining – USD 252M (pre-production)

Concentrator – USD 830M

Pelletising – USD 1.05B

Power – USD 1.137B

Rail – USD 588M

Port – USD 127M

Contingency – USD 975M

OPEX (FOB Pointe Noire, Year 6 steady-state):

BF Concentrate – USD 46.19/t

DR Pellets – USD 67.77/t

The capital cost estimate follows AACE Class 5 guidelines, with an accuracy range of -25% to +50%. Costs are in USD (April 2025 base date) and include direct, indirect, contingency, and future escalation provisions for project planning and investment decisions.

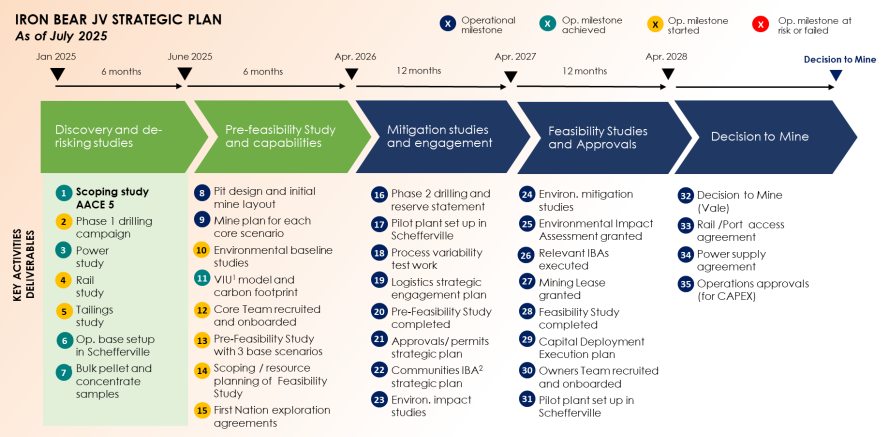

Development Pathway and Vale Partnership

The Pre-Feasibility Study (PFS) will commence shortly, targeting completion by Q2 2026. The project’s de-risking and funding pathway is underpinned by a Development Agreement with Vale S.A., one of the world’s largest iron ore producers:

Phase 1 – USD 18M (funded by Vale) for PFS, drilling, and environmental baseline work.

Phase 2 – Up to USD 120M (funded by Vale) for bankable feasibility, environmental impact assessments, and Impact Benefit Agreements with First Nations.

Upon completing Phase 2, Vale can earn 75% equity in the Iron Bear Project. The agreement is designed to leverage Vale’s technical, operational, and financial capacity to secure the estimated USD 4.426B pre-production funding at Decision to Mine.

Figure 4: Iron Bear JV Strategic Plan (source: CLE)

Risk Management

The Scoping Study identifies environmental, operational, and financial risks, including:

Water management, tailings stability, biodiversity, and greenhouse gas emissions – The project must address comprehensive environmental management requirements, including controlling and treating water used in processing, ensuring the long-term stability and safety of tailings storage facilities, protecting sensitive biodiversity in the project area, and implementing strategies to minimise and offset greenhouse gas emissions throughout operations.

Infrastructure and geotechnical challenges in sub-Arctic conditions – Operating in the Labrador Trough’s sub-Arctic climate brings engineering and construction challenges such as permafrost, deep frost penetration, heavy snow loads, and extended winter conditions, which impact infrastructure design, mine development, and year-round logistics. These factors demand specialised geotechnical solutions and robust construction standards to ensure operational resilience.

Market volatility in iron ore pricing – The project’s financial performance is sensitive to fluctuations in global iron ore prices, which are influenced by factors such as steel production trends, demand shifts in key markets, supply disruptions, and broader macroeconomic conditions. Managing this volatility will require prudent market strategies, flexible offtake arrangements, and potential hedging measures.

The partnership with Vale mitigates several risks by providing technical expertise, funding for studies, and potential capital support at development decision points.

Strategic Positioning in the Magnetite Market

Iron Bear’s combination of scale, grade, infrastructure access, and ESG credentials places it in a favourable position relative to global magnetite peers. Comparable projects in the Labrador Trough and globally have been successfully funded at Decision to Mine stage, particularly where premium-grade magnetite products are produced.

The timing is also notable, as the steel industry transitions towards direct reduction and low-carbon pathways, demand for high-grade magnetite concentrates and DR pellets is expected to strengthen, especially in Europe, North America, and MENA.

Paul Berend, Cyclone’s CEO and Managing Director, commented,

“The Iron Bear Scoping Study highlights an extraordinary opportunity to develop a sustainable and low-cost iron ore mining and processing operation, in a first world mining jurisdiction. With the support of our partner Vale, Iron Bear is poised to become strategic large-scale producer of highquality magnetite products, which are critical to unlock low carbon steel production.

The Scoping Study supports our ambition to generate outstanding financial returns for our shareholders and create long term economic and social benefits for the indigenous and local communities adjacent to the project area. We are actively de-risking the project and developing sustainable mining scenarios, including systematic rehabilitation of mined areas, dry tailings and using 100% renewable energy for the concentrator complex.

I would like to thank our project team which has developed such an exceptional study. The team continues to deliver outstanding results, and we are looking forward to advancing to the next engineering milestone, the Pre-Feasibility Study, which will be awarded in the coming weeks and completed by Q2 next year.”

Samso Concluding Comments

This latest ASX release is effectively showcasing the Iron Bear Project as a global green iron ore and green steel project. Almost 12 months ago, Cyclone Metals unveiled to the ASX the potential value proposition of such a project, and this scoping study, in my opinion, sets the stage for what is to come in the coming months. The scoping study is identifying that the process to production is achievable.

The study highlights (Figure 5) that the scale, quality, and infrastructure are all present, and the economics remain strong even under conservative pricing assumptions. The premium product profile is its real differentiator, giving it a seat at the table in the emerging low-carbon steel supply chain. Don't forget that the price used is not the price for the premium products; there is a lot of room for error.

Figure 5: Highlights from the Cyclone Metals Iron Bear Scoping Study. (source: Cyclone Metals Limited).

From a development perspective, the Vale partnership is a major de-risking factor, both technically and financially. It creates a clear funding pathway through PFS, BFS, and into Decision to Mine — a stage where large-scale magnetite projects traditionally secure capital through a blend of equity, debt, and offtake agreements.

The partnership is what makes the Cyclone story very different from your traditional mineral resource exploration (Cyclone is not an exploration story) to a production story. The fact that Vale is playing big brother with one hand on the prize cannot be underestimated. Cyclone Metals is currently at AUD $0.075 and has a market capitalisation of just under AUD $83M is still destined for growth.

The next 12–18 months will be critical. Delivery of the PFS by mid-2026, continued technical validation of product quality, and Vale’s Phase 2 decision will be the milestones to watch. Should all align, Iron Bear could well become one of the next generation’s cornerstone magnetite projects — and a strategic supplier in the decarbonisation of steel.

Figure 6: The share price chart for Champion Iron Limited (ASX: CIA) as of 12th August 2025. (source: commsec).

The competitor or a similar narrative to the whole Iron Bear story is that of Champion Iron Limited, which is currently sitting on a valuation of AUD 2.27B with a share price of AUD $4.31 as of the 12th August 2025 (Figure 6). In terms of a guide to what Cyclone could become, this is a good barometer. Take a pick where you think the share price for Cyclone could be valued at in time, but I think it is safe to say that it will be north of where it is now.

For those who have been following Samso, I have always made this comparison, and I think positioning at a market capitalisation in the sub-AUD $100M range is not a silly idea. As always, DYOR. I am a shareholder, and I am a happy one.

The Samso Way – Seek the Research

Strong projects are built on detailed studies, solid partnerships, and clear market alignment. The key is to look beyond headlines, understand the assumptions, and see how each milestone reduces risk, turning potential into a bankable opportunity.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments