Cyclone Metals (ASX: CLE) Powers Ahead – Iron Bear Gathers Pace with Renewables, Vale Support, and Premium Iron Outputs - The Business of Green Iron Ore approaches Monetisation.

- Noel Ong

- Jul 31, 2025

- 7 min read

Announcement

Cyclone Metals Limited (ASX: CLE) has released its Quarterly Activities Report for the period ending 30 June 2025, and the Iron Bear Project is steadily ticking boxes. As readers will remember from our previous Samso News, the Iron Bear project is backed by a strategic partnership with Vale S.A. The quarter saw the completion of critical technical studies, advancement in metallurgical testing, progress across engineering and environmental baselines, and tangible steps toward the upcoming Scoping Study and PFS.

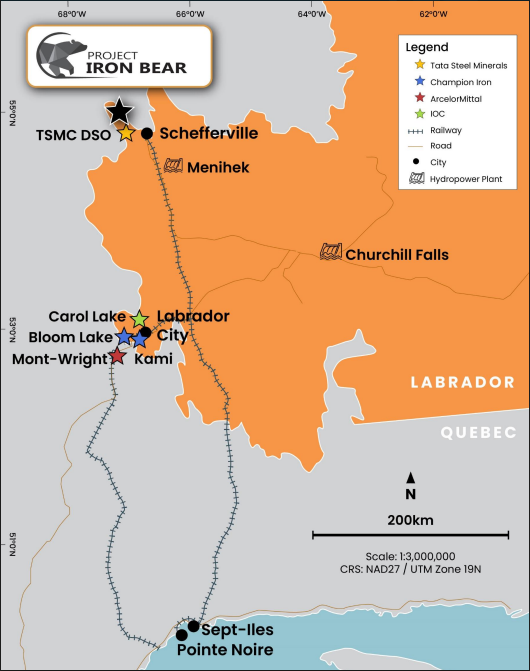

For shareholders, Cyclone Metals is focusing on de-risking its flagship 16.6Bt Iron Bear Project in the Labrador Trough (Figure 1).

Figure 1: Iron Bear Project (source: CLE)

Cyclone’s CEO and Executive Director, Mr Paul Berend, highlighted the benefits of the collaboration with Vale in advancing the project:

“It is encouraging to see the Project developing at a rapid pace with key de-risking milestones being achieved. He added, “We are confident that the Iron Bear Project will deliver substantial benefits for all the key stakeholders, including our shareholders and local communities, as we work closely with our partner Vale, to develop a sustainable mining operation powered by cutting edge technologies and renewable energy”.

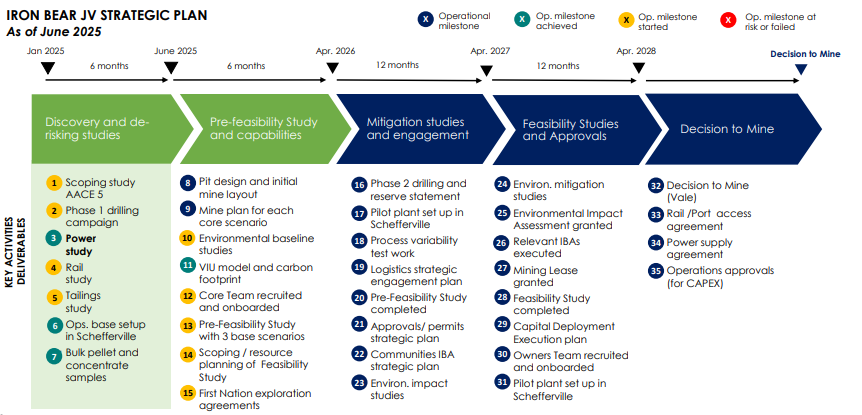

Cyclone has met all key Iron Bear milestones and is now preparing 2025 drilling to expand resources, while advancing dry tailings work to support in-pit rehabilitation and enhance project sustainability (Figure 2).

Figure 2: Strategic Development Plan Iron Bear Project (source: CLE)

Highlights – Iron Key Bear Project - The Green Iron Ore Story.

1.0 Power Supply Study: Green and Economically Robust

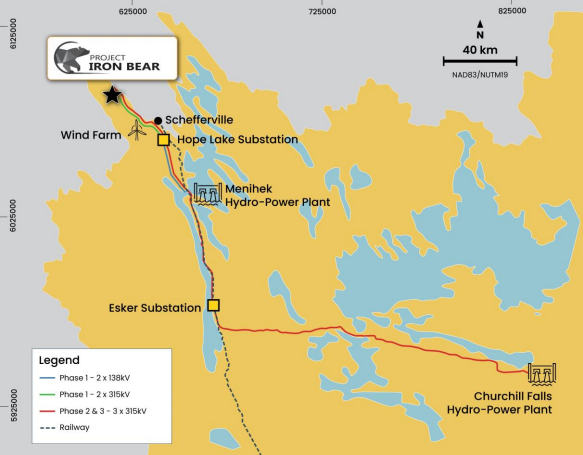

Hatch Ltd completed a conceptual power study to AACE Class 5 standards, outlining staged renewable energy solutions for the Iron Bear mine and concentrator complex.

Three-phase power supply scenarios (10 Mtpa to 50 Mtpa) were modelled using blended hydro (Menihek, Churchill Falls) and wind energy.

Phase 1 power unit cost estimated at just CAD 0.023/kWh, confirming cost-effective energy underpinned by green infrastructure (Figure 3).

Total power CAPEX estimates range from CAD 1.6B (Phase 1) to CAD 4.4B (Phase 3).

Figure 3: Iron Bear could operate with 100% renewable power (source: CLE)

2.0 Phase 4 Metallurgical Test Work Completed

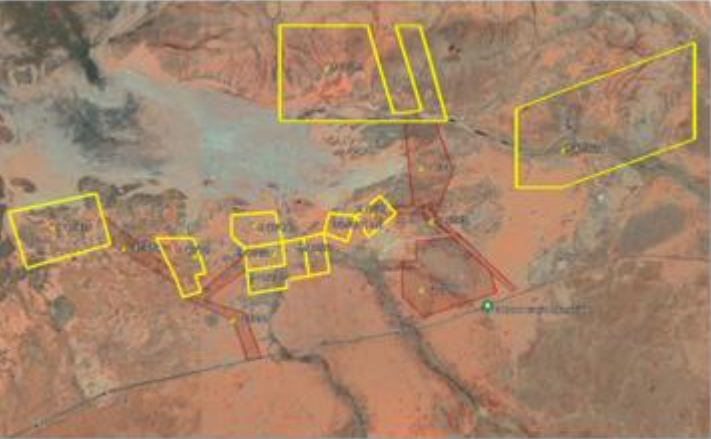

17.7 tonnes of core sediment processed at the Quebec-based pilot plant (Figure 4).

Outputs included:

2.3t DR concentrate @ 71% Fe, 1.2% SiO₂

3.5t BF concentrate @ 69.1% Fe, 3.5% SiO₂

260kg DR pellets @ 68.4% Fe with excellent metallisation and physical attributes.

Recovery improvement: flotation yields lifted to 87–89%, well above the prior 80%.

Figure 4: Selected drillhole collars for sampling campaign. (source: CLE)

3.0 Rail and Slurry Pipeline Studies Advance

Simulation modeling completed to identify potential bottlenecks on existing rail infrastructure.

Preliminary design and hydraulic modeling completed for the slurry and return water pipelines.

Both rail and slurry studies feed into a broader internal trade-off study ahead of the PFS.

4.0 PFS Contracts and Additional Engineering Work

Tenders issued and near award for:

Main PFS

Pelletising Study

Marketing Study (Phases 1 & 2)

Dewatering, drying, and dry tailings stacking testwork underway.

Conceptual mine planning initiated using latest resource model.

5.0 Environment & Community Engagement

Environmental and social work packages awarded to Sikumiut Environmental Management Ltd. (physical environment & permitting) and Transfert Environnement et Société (social integration).

In-field surveys completed in June 2025:

Focused on species at risk and biodiversity

Surface water quality and flow regime monitoring installed, with two more survey visits planned in Q3–Q4 2025.

6.0 Financial Overview

Cyclone had $1.3M in cash at 30 June 2025.

Reimbursement of $1.2M from Vale for Q1 operational costs.

Iron Block 103 Corporation (CLE’s Canadian subsidiary) held $5.2M in cash, with an additional US$5M received 3 July 2025 from Vale per the development agreement.

CLE also holds ASX-listed equity investments totalling ~$6.7M.

7.0 Update on Other Assets

Before Cyclone took on Iron Bear, the company portfolio had a mix of Australian and projects in New Zealand projects. The projects are primarily exploration in nature, and in light of the value of Iron Bear, these projects have taken a back seat to exploration activities.

7.1 New Zealand – Grand Port Projects (Figure 5)

Sampling completed at Drybread (797 samples) and Waikerikeri (662 samples).

Passive seismic (Tromino) geophysical surveys completed to support structural interpretations.

Progress continues at Muirs and Mareburn tenements; geological modelling commenced at Muirs.

Figure 5: Location of Grand Port Projects, situated in premier gold production districts. (source: CLE)

7.2 Australia – Wee Macgregor and Lady Ethleen (QLD), Nickol River (WA)

Cyclone retains 20% interest in Wee Macgregor (Cohiba earning 80%).

The Lady Ethleen tenement continues to be evaluated following prior GlyLeach™ trials.

CLE continues to assess options for Nickol River, including JV or divestment strategies (Figure 6).

Figure 6: Nickol River Project tenements, located 10km east of Karratha in the West Pilbara of Western Australia (source: CLE)

8.0 Corporate Updates

Shareholder Meeting held 5 June 2025: all resolutions passed.

Multiple share and performance rights transactions completed, including:

Issuance of ~14.1M shares and 2M performance rights (converted to shares).

Options (CLEO) began trading on ASX in May 2025.

Quarterly spend:

$198K exploration (mainly NZ)

$390K admin and corporate cost

$1.2M reimbursed by Vale

Samso Concluding Comments

Cyclone Metals is quietly shaping the Iron Bear Project into a credible green-aligned iron ore story on the ASX. Cyclone is showing the market that it is ticking the boxes that the company said it would do, in the process giving the market confidence that this is more than just talk. As an early shareholder, whenever I explained this story, I was consistently being rebuffed on its significance and ability to have market acceptance.

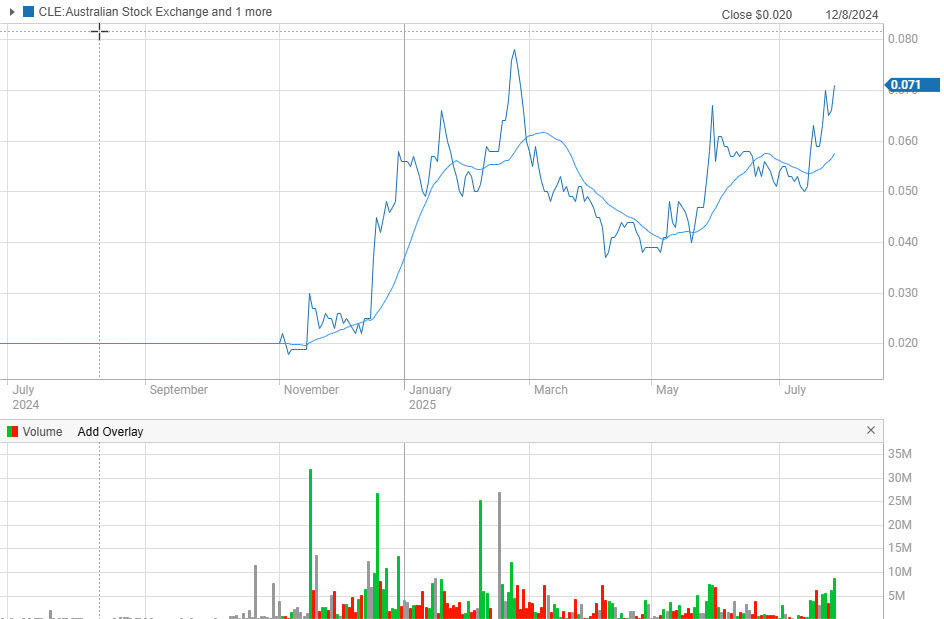

Figure 7: Cyclone Metals Limited share price chart as at 28th July 2025. (source: commsec)

The cost metrics revealed in the power study are compelling. A CAD 0.023/kWh energy input for Phase 1 puts Iron Bear firmly into the lower quartile for energy costs, critical for high-margin DR pellet production. From a metallurgical standpoint, the test results validate Iron Bear’s feed quality and processing potential and further support its low-carbon credentials.

In addition, the standout power study is not just the numbers, although sub-CAD 0.025/kWh is impressive—it’s the execution. Partnering with Hatch, designing around Menihek and Churchill Falls, and mapping out three scalable phases signals a strategic, long-game mindset. It’s clear Cyclone is building a project that aligns with where the global steel industry is heading.

For investors, this report reinforces CLE’s transition into a technically and financially supported iron ore development company. The next major catalysts will be the release of the Scoping Study, finalisation of the rail and slurry studies, and the kickoff of the Pre-Feasibility Study. This level of momentum, especially when paired with ESG-aligned infrastructure and community engagement, is not common for a junior iron ore developer.

Vale’s presence in the background should not be overlooked or forgotten. Their funding and technical support de-risk the path to production considerably. This level of validation, along with the progressive test work and near-term Scoping Study, means the pieces are coming together with a high degree of intentionality.

For investors, this is a time to consider how early de-risking—in metallurgy, infrastructure, and ESG—can be a value unlocker in this cycle. Iron Bear may not be front-page news just yet, but if the current momentum holds, that won’t be the case for long.

For me, the Cyclone story has always been about execution, and at this stage, Cyclone appears to be aligning the right pieces on that front.

The Samso Way – Seek the Research

At Samso, we believe this is the phase where real value begins to crystallise. The iron ore market is changing, and companies that position themselves early in the low-carbon supply chain, supported by strong partnerships and rigorous planning, could be tomorrow’s strategic winners. Keep your eye on the detail—and always seek the research.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments