CRR – Cap Burn Gold Project Acquisition Completed, Delivering a Drill-Ready Target in New Zealand’s Otago Gold Belt

- Noel Ong

- Dec 26, 2025

- 6 min read

Announcement

Completion of Cap Burn Gold Project Acquisition 4 December 2025 (click here to view the announcement)

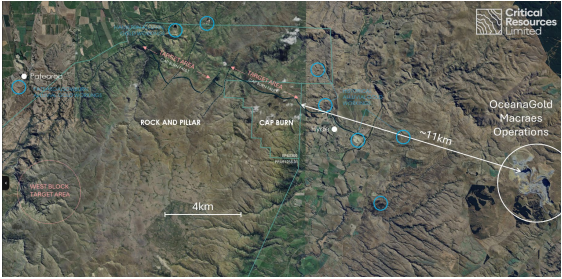

Critical Resources Limited (ASX: CRR) has completed the acquisition of the Cap Burn Gold Project in the Otago region of New Zealand’s South Island (Figure 1), securing Ministerial approval for the transfer of exploration permit EP60300. The Company has also finalised the transfer of the land access agreement with the local landowner, clearing the way for an inaugural drilling program to commence in the coming weeks.

Figure 1: Location of acquired New Zealand projects (Green) with major gold mining projects. (source: CRR)

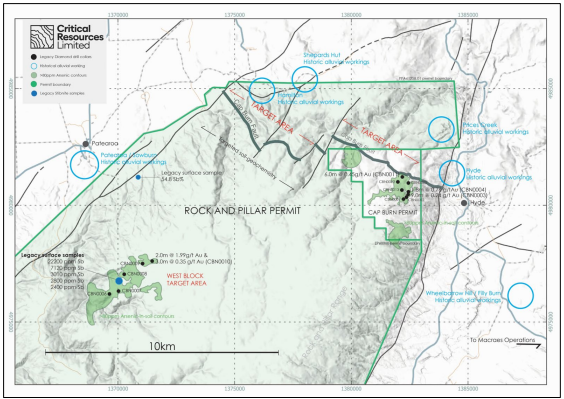

Cap Burn sits ~11 km along the same structural corridor that hosts OceanaGold’s +10Moz Macraes Gold Mine and shares geological similarities with Santana Minerals’ Rise and Shine (RAS) deposit (Figure 2). This acquisition strengthens CRR’s emerging New Zealand gold portfolio and provides immediate exposure to one of the Southern Hemisphere’s most prospective orogenic gold belts.

Figure 2: Cap Burn Project location ~11km from OceanaGold Macraes Gold Operations with major and minor interpreted structures. (source: CRR)

The Business of the Company: Focus – The Otago Gold Belt

Critical Resources continues to build a diversified portfolio of metals and minerals across high-grade, geologically fertile regions. The Company’s assets span lithium (Canada), base metals (NSW), and an expanding gold footprint in New Zealand. The Cap Burn acquisition complements CRR’s existing Otago and Reefton regional tenements, creating a multi-asset pipeline with low holding costs and near-term exploration catalysts.

Highlights – Acquisition Completion & Drill-Ready Target Beneath a 1 km² Arsenic Halo

Key Highlights from the Announcement:

Acquisition Complete: Permit transfer approved by New Zealand Petroleum & Minerals (NZP&M), granting CRR 100% ownership of Cap Burn through its subsidiary Goldfire Resources.

Land Access Secured: Transfer of the station land access agreement allows immediate commencement of drilling within the predefined exploration area.

Drill-Ready Status: Contractor Ecodrilling NZ has been secured, with mobilisation scheduled in the coming weeks.

High-Potential Geological Setting: Cap Burn is located along the same structural trend as Macraes (+10Moz) and Bendigo–Ophir (+2.3Moz), targeting high-grade orogenic gold below a >1 km² arsenic-in-soil anomaly (20–150 ppm As) (Figure 3).

Figure 3: Cap Burn and Rock and Pillar Projects – legacy drilling targeting arsenic-in-soil anomaly. (source: CRR)

Geophysical and Structural Alignment: The Cap Burn Fault aligns with the Footwall Fault at Macraes and the Thompsons Gorge Fault at Rise and Shine discovery (RAS), both key conduits for gold-bearing fluids.

Compelling Down-Plunge Target: Revised geological interpretation highlights potential for high-grade shoots beneath the TZ4–TZ3 schist units, mirroring the RAS discovery path (Figure 4).

Figure 4: Cap Burn Project cross-section (top) – Conceptual cross-section & RAS comparison (source: CRR)

These highlights reinforce Cap Burn as an advanced, low-cost, structurally controlled gold target with proven analogues along the Otago Schist Belt.

Leadership Commentary

Critical Resources’ Managing Director, Mr. Tim Wither, commented:

‘We are very pleased to announce the completion of the Cap Burn Gold Project acquisition, marking a significant step forward for Critical Resources in New Zealand. With Ministerial consent secured and land access agreement transfer finalised, we are now ready to commence our inaugural drilling program at Cap Burn. Our drill contractor Ecodrilling NZ is scheduled to mobilise to site in the coming weeks, ensuring rapid progress on exploration activities. We appreciate and acknowledge the support from all stakeholders for the permit transfer to be completed.

‘The geologically robust Cap Burn Project further strengthens Critical Resources gold portfolio, providing shareholders with exposure to a highly prospective, underexplored region adjacent to world-class deposits. Critical Resources is committed to responsible development and close engagement with local stakeholders, ensuring that exploration activities are coordinated seamlessly with ongoing farming operations. We look forward to updating shareholders as drilling begins and to advancing our strategy to deliver multi-cycle value across our global assets.’

About the Project

The Cap Burn Project lies on the northern margin of the Otago Schist Belt—one of New Zealand’s most productive yet underexplored gold terrains (Figure 5).

Key geological attributes include:

A >1 km² arsenic anomaly coincident with a strong EM boundary marking the Cap Burn Fault.

Previous drilling results, including:

9 m @ 0.24 g/t Au from 54 m (CBN0003)

1.8 m @ 0.76 g/t Au from 14.2 m (CBN0004)

6 m @ 0.45 g/t Au from 173 m incl. 1 m @ 1.22 g/t Au (CBN0011)

Structural and lithological similarities to Santana Minerals’ Rise and Shine deposit, where high-grade mineralisation occurs beneath arsenic-in-soil halos at TZ4/TZ3 boundaries.

A revised geological model now targets down-plunge extensions analogous to RAS, where grades up to 3.4 g/t Au over wide intervals have been intersected.

Figure 5: Cap Burn Project – looking west along the Cap Burn fault. (source: CRR)

Near-term Milestones to Watch

CRR has outlined a clear exploration roadmap for Cap Burn and its broader New Zealand portfolio (Table 1):

Inaugural RC Drilling at Cap Burn – Dec 2025 to Jan 2026

Follow-up drilling contingent on results

Permit transfers underway for Tokomairiro, Lammerlaw, Croesus, Silver Peaks, and Rock & Pillar

Geochemistry & field mapping programs scheduled across all new tenements (2026)

Table 1 – Proposed work program for New Zealand exploration/prospecting permits.

The above timeframes are indicative and subject to change without notice.

CRR’s portfolio now spans 1,794 km² of prospective ground across Otago and Reefton, positioning the Company as a significant early-mover in a region witnessing renewed exploration interest.

Samso Concluding Comments

Like the strategy of CRR in taking a big punt on the mineral prospectivity of New Zealand. The addition of Cap Burn to CRR’s portfolio, for me, simply adds potential to the story within what is a prospective orogenic gold belt. While the broader Otago region has delivered multi-million-ounce deposits such as Macraes and Bendigo–Ophir, large areas remain strikingly underexplored. CRR has effectively positioned itself at the forefront of the next exploration cycle in New Zealand.

The geological comparability to Rise and Shine—particularly the TZ4/TZ3 boundary relationship and arsenic halo footprint—provides a robust model for exploration. These kinds of structural repetitions are uncommon, and when they occur, they often create predictable vectors toward higher-grade mineralisation at depth.

Investors should also appreciate the timing. CRR is entering the region during a period of renewed discovery momentum, low competition for ground, and strong governmental support for exploration. The holding costs are low, yet the upside remains significant due to the scale of untested structures and the improving understanding of Otago’s orogenic system.

As the inaugural drilling program begins, Cap Burn will be a defining test case for CRR’s New Zealand strategy. If drilling validates the down-plunge conceptual target, CRR may unlock a new gold system capable of delivering multi-cycle value over the coming years.

The Samso Way – Seek the Research

Always follow the data, understand the geology, and let the evidence guide your investment journey.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer, or solicitation to subscribe for, purchase, or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try to write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation sees the benefit of what Samso is trying to achieve and has a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments