Ballard Mining Limited (ASX: BM1) – A Samso DYOR Priority – A Gold Mining Story

- Noel Ong

- Aug 20, 2025

- 6 min read

Announcement

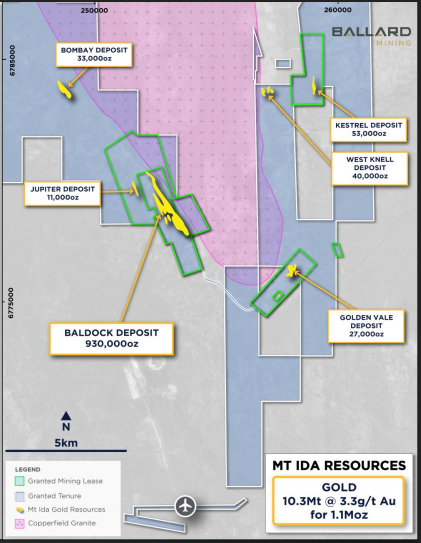

Ballard Mining Limited (ASX: BM1) is not entering the gold space quietly. Born from the demerger of Delta Lithium’s gold assets, Ballard arrives on the ASX with a focused strategy, a $30M IPO war chest, and the high-grade Mt. Ida Gold Project (Figure 1) in hand. Its foundation? A 1.1Moz at 3.3g/t Au JORC Resource, led by the fully permitted Baldock deposit (930koz @ 4.1g/t Au).

Figure 1: Location of Mt Ida Gold Project (source: BM1)

This is not a typical early-stage explorer. Ballard’s focus is on drilling, converting resources, and building toward a Reserve while targeting high-grade discoveries across a 26km stretch of underexplored gold-bearing shear zones.

Ballard is drilling aggressively — 130,000 metres across four rigs — and is well-funded to do so.

🔹 Key Highlights - The Gold Mining Journey.

Ballard offers strong growth potential, with high-grade resources and a funded drill program targeting expansion and Reserve conversion across 26km of underexplored ground (Figure 2).

Baldock Deposit: 930koz @ 4.1g/t Au, fully permitted, and core to near-term development.

JORC MRE: Total 1.1Moz @ 3.3g/t across six gold deposits.

Location Advantage: Within ~100km of four processing plants in WA’s prolific goldfields.

Exploration Upside: 26km of untested strike (Baldock Thrust and Ballard Fault).

Enterprise Value / Resource Ounce: Just $95/oz, well below +2g/t gold developer average of $328/oz.

Major Shareholders:

Delta Lithium – 46% (escrowed)

Hancock Prospecting – 6.2%

Mineral Resources – 5.6%

Figure 2: Resource Growth and Development Opportunity of Mt Ida Gold Project (source: BM1)

🔹 Development Pipeline: From Resource to Reserve

Ballard is running parallel growth and development programs:

Stream | Activity |

Infill Drilling | At Baldock to underpin a Maiden Reserve by mid-CY2026 |

Extensional Drilling | Targeting resource growth along strike and at depth |

Exploration Drilling | 50,000m regional targeting new discoveries |

Studies | Mining, metallurgy, geotech, and plant engineering underway |

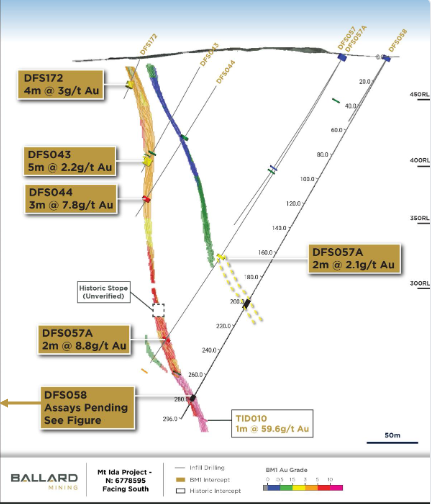

Recent infill drilling results include (Figure 3):

3m @ 17.7g/t Au (DFS062)

4m @ 12g/t Au (DFS063)

4m @ 7.3g/t Au (DFS146)

Figure 3: BALDOCK – First Infill Results (source: BM1)

These support high confidence in the resource and reinforce the project’s potential for early cashflow through high-grade starter pits.

🔹 Exploration Catalysts: Untapped Terrain

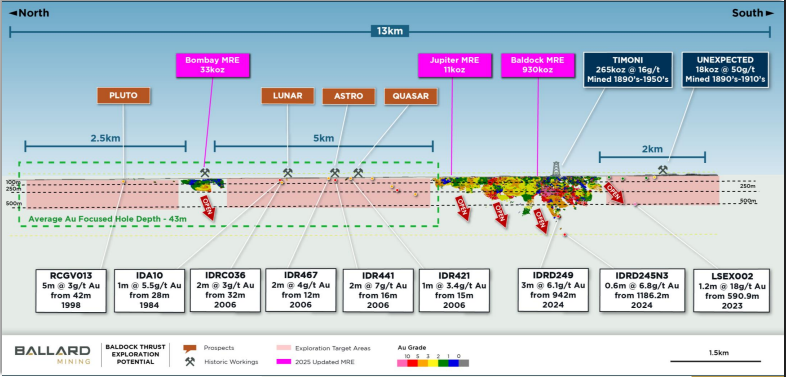

A 35,000m drill program is planned across the Baldock deposit, targeting extensions and increasing resource confidence as part of Ballard’s aggressive growth strategy (Figure 4).

Beyond Baldock, the broader Mt Ida Project holds substantial upside, with 26km of largely underexplored greenstone shear zones. Key targets include:

Baldock Thrust Zone: Over 7km of under-drilled terrain with average historic drill depth of just 43m.

Ballard Fault: Structurally identical to Baldock, but with minimal historical drilling.

High-Resolution Drone Magnetics: Completed in July 2025 — results to guide next wave of exploration.

Figure 4: Baldock Thrust Exploration (source: BM1)

This area has seen over 671 historic holes, mostly shallow RAB, leaving significant untested potential. Ballard is now deploying modern targeting techniques across this camp-scale system.

🔹 Mineral Rights Structure: Aligned for Success

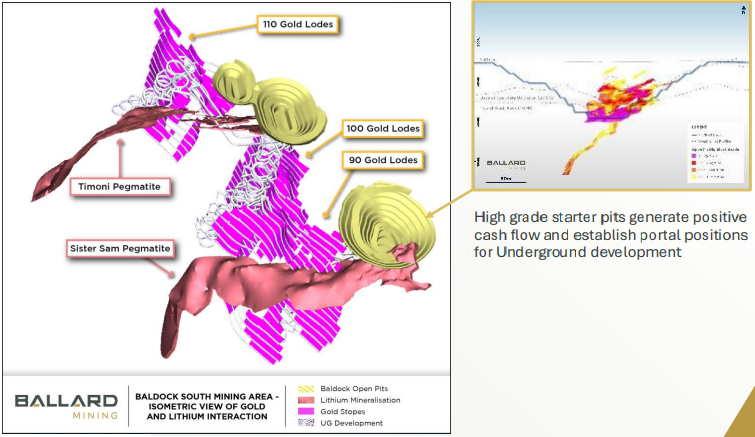

Ballard holds exclusive rights to gold across the tenure via a Mineral Rights Deed with Delta Lithium. As part of the agreement, Ballard will issue 220 million shares to Delta (or its nominee) in consideration for the gold asset (Figure 5).

The deed establishes a clear and cooperative framework:

Enables independent mining of gold and lithium.

Allows shared infrastructure and cost efficiencies.

Provides step-in rights, pre-emptive rights, and call options — a commercially robust arrangement.

Figure 5: Conceptual Designs only to show interaction of gold and lithium (source: BM1)

This structure ensures both parties can advance their respective commodities without conflict, while unlocking value from shared development.

🔹 Peer Comparison: Value and Grade

Ballard’s ASX-listed gold peers average $198/oz EV per resource, while higher-grade (+2g/t) peers command around $328/oz — highlighting Ballard’s value at just $95/oz.

Metric | Ballard | Peer Group Avg |

Grade | 3.3g/t Au | 1.8g/t Au |

EV/Resource | $95/oz | $198/oz |

EV/Resource (+2g/t peers) | — | $328/oz |

Ballard’s combination of high grade and low EV/oz is rare. The Company trades below sector averages despite superior resource quality, giving it strong re-rating potential as reserves build.

🔹 Board Composition: Built for Execution

Ballard is led by a proven team with a track record of delivering major outcomes in the Australian gold sector.

Simon Lill, Non-Executive Chair, previously guided De Grey Mining from a sub-$1M explorer to a $5 billion takeover by Northern Star (ASX: NST), overseeing the discovery of the Hemi gold deposit — one of Australia’s largest in recent history.

Paul Brennan, Managing Director, is a mining engineer with over 20 years of underground operational experience, including senior leadership roles at Saracen Minerals and Calidus Resources, where he oversaw the construction of a 2.4Mtpa gold processing plant.

With leadership shaped by real-world execution, Ballard is positioned to convert its gold potential into long-term value.

Samso Concluding Comments

Ballard Mining Limited ticks all the boxes for a Samso DYOR Priority: grade, scale, strategy, and execution. The Mt. Ida Gold Project offers high-grade production potential in a jurisdiction that understands mining. But more importantly, Ballard isn’t selling a dream— they’re drilling into reality.

Their IPO funds are already hard at work, with four rigs pushing to expand the resource base and build toward a reserve. The depth of geological opportunity across the 26km greenstone belt hasn’t been fully priced in. The Baldock deposit, with ounces per vertical metre among the best in its class, serves as a platform, not a peak.

This is a story about unlocking potential with discipline and funding, and Ballard appears to be one of the few junior gold developers doing both in parallel. When the project was part of the greater lithium story, the value proposition of the gold side of the project was lost. Spinning it out into Ballard was ultimately the only future, and with the demise of the lithium story, this is a good way of creating more value.

I don't think that the project is a 100% no-brainer in terms of success because if it were, this would have been done sooner. Like all projects, there are issues, and similarly, there are solutions. It will take time to show all the bad parts, so take your time to DYOR.

For the research-focused investor looking for high-grade gold, competent execution, and a project that’s moving, Ballard Mining deserves your attention.

The Samso Way – Seek the Research

At Samso, we follow the evidence, not the hype. Ballard’s data-rich, grade-driven approach gives investors real milestones to track and genuine upside to consider. If you’re building a watchlist for WA gold developers, start here.

Let’s tell your story. Let’s make it matter.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position or particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and has a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments