Ark Mines Limited (ASX: AHK) - Is the Rare Earths Wagon Moving Again?

- Noel Ong

- Sep 9, 2025

- 6 min read

Announcement

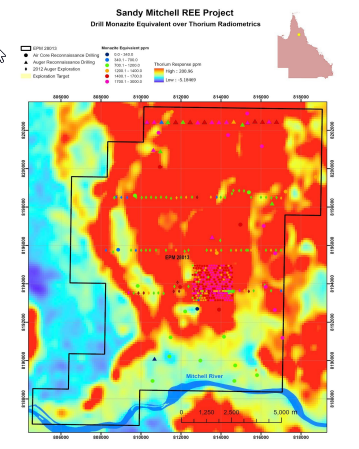

Ark Mines (ASX: AHK) has secured a $4.5 million investment from the QIC Critical Minerals and Battery Technology Fund (QCMBTF) to advance development of its flagship Sandy Mitchell Rare Earth and Heavy Mineral Project, located northwest of Cairns (Figure 1). The funding package—$4m in upfront royalty-linked financing and $500,000 in equity (subject to shareholder approval)—follows a collaborative due diligence process and underscores the Queensland Government’s commitment to strengthening domestic critical minerals supply chains.

Figure 1: Sandy Mitchell Project Location (source: AHK)

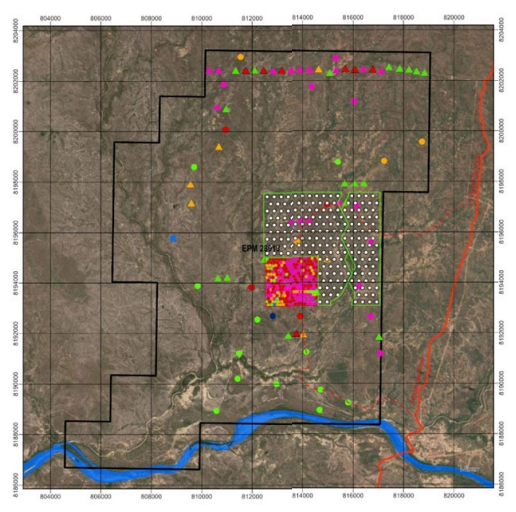

This investment provides Ark Mines with a non-dilutive funding pathway, positioning the company to accelerate its development program. Stage-3 infill drilling is underway, and results will feed into a Pre-Feasibility Study (PFS) scheduled for early 2026. Production is targeted for late 2027, with ~80 jobs expected to be created locally. The Sandy Mitchell resource currently stands at 71.8 Mt @ 1,732.7 ppm Monazite Equivalent (MzEq), with Ark aiming to significantly expand this figure in the near term (Figure 2).

Figure 2: Exploration Target and Drilling Results (source: AHK)

Project Highlights - Moving the Rare Earth Narrative.

Strategic Investment: QCMBTF’s backing aligns Ark Mines with the Queensland Government’s strategy to build sovereign capability in critical minerals.

Resource Expansion: Current Measured MRE covers only ~4.5% of the anomaly area. Exploration targets outline 1.3–1.5 Bt @ 1,286–1,903 ppm MzEq, suggesting substantial growth potential.

Metallurgical Advantage: Early test work returned a concentrate grading ~52% TREO, with gravity separation confirming simple, low-cost beneficiation pathways (Figure 3).

Figure 3: Metallurgy Results (Slide 7: Gravity Beneficiation 52% TREO) (source: AHK)

Low Environmental Impact: Mining is shallow (10–15m), chemical-free, and designed for continuous rehabilitation — offering an environmentally sustainable profile compared to hard rock alternatives (Figure 4).

Figure 4: Low-Impact Mining Method (source: AHK)

Pathway to Production

Ark Mines has locked in drilling and metallurgical programs that will underpin the upcoming PFS in early 2026 (Figure 5). The company expects the resource base to grow substantially, with management guidance pointing toward an upgrade well beyond the current 71.8 Mt. Offtake discussions with processors and customers are also underway, highlighting market interest in Sandy Mitchell’s high-value rare earth and heavy mineral basket.

Figure 5: Resource Growth Potential (source: AHK)

CEO & Managing Director Benjamin Emery commented:

“We are pleased to announce this funding agreement with the QCMBTF, which follows an extensive period of engagement with the Fund and marks a significant step forward in our strategy to develop Sandy Mitchell through to production. With a busy works program scheduled for the second half of 2025, this investment provides Ark with an effective non-dilutive source of funding to accelerate development.”

“Strategically, it also delivers long-term alignment with the state government’s policy objective to position the North Queensland region as a key supplier of the critical minerals used in global clean energy supply chains. Our goal now is to establish Ark Mines as a leading Australian rare earths supplier, serving end users in domestic and international markets.”

“We look forward to updating our investors on more key developments in the coming months, led in the near-term by a comprehensive infill drill program which we expect will deliver a significant increase to the current Measured resource of MzEq at Sandy Mitchell.”

Samso Concluding Comments

The Rare Earth sector seems to be lighting some renewed interest back into the ASX. I have to admit that the positive vibes seem to be creating momentum back into what was a very beaten sector. I have not followed Ark Mines, but this ASX release sure does make me think twice about whether there could be a resurgence of interest in the REE story.

The $4.5M commitment from the QIC Critical Minerals Fund provides Ark Mines with capital and an endorsement of both the scale of Sandy Mitchell and the strategic importance of rare earths to Queensland’s future economy. The structure is a mix a mix of royalties and equity that reduces dilution while tying government-backed funding to long-term project success.

Investors should note the dual momentum — drilling to grow a resource already defined at 71.8 Mt @ 1,732.7 ppm MzEq, and metallurgy that has already proven up a 52% TREO concentrate via simple gravity separation. This dual pathway of resource expansion and process validation places Ark Mines in a strong position ahead of its 2026 PFS.

Equally important, Sandy Mitchell’s low-impact, shallow mining model may prove to be one of its greatest differentiators. With no chemicals, no blasting, and continuous rehabilitation, it provides an ESG profile that could attract end-users and financiers focused on supply chain sustainability.

This is similar to the recent release by OD6 Metals Limited (Ion Exchange and Nanofiltration Redefine Rare Earth Processing Flowsheet - First Mover Advantage for OD6 Limited? Is It Time for Investors?), in defining a new process to treat its ore and hence giving a more economical process for extracting its products.

In short, the Ark Mines story is moving into a phase where execution is now paramount and growing the resource, refining the flowsheet, and laying the groundwork for offtake is awaiting shareholders. If these elements align, Sandy Mitchell has every chance of becoming a significant Australian rare earth supplier. #SamsoNews is where investors can look for valuable insights to guide their DYOR.

The Samso Way – Seek the Research

At #SamsoNews, the focus is always on cutting through the noise and grounding every analysis in facts and context. Real insights come when investors do their own research and look beyond the headlines.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments