OD6 Metals Limited - Rare Earths or Copper?

- Noel Ong

- Nov 27, 2024

- 9 min read

Updated: Jul 13, 2025

The OD6 Metals Limited (ASX: OD6) story was all about the Rare Earths sector, and now we are looking at the Gulf Creek Copper project. Is this OD6 Metals' view of its future?

The OD6 story has been frequented on the Samso platform over the last few years, and this new approach suggests that the company is taking a different approach to giving shareholders value. To say that the ASX equity market has been tough for Rare Earth explorers would be the understatement of the century, so it is no surprise that management has created something worth shouting about on the ASX.

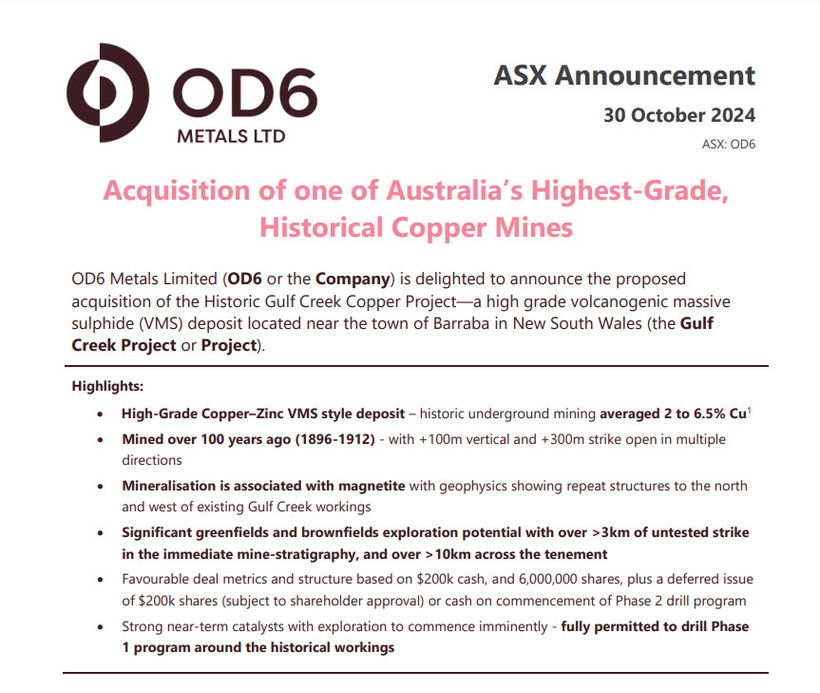

The Gulf Creek Copper VMS project looks very "interesting" at face value. I was impressed with the new approach when I saw the announcement on October 30th (2024). The historical information released by OD6 definitely made me think this could be an excellent replacement for the company's future.

The Gulf Creek project is located approximately 15 kilometers northeast of the town of Baraba and north-northwest of Tamworth in the New England district of New South Wales (Figure 1). The tenement is situated on the Cobbadah 1:100,000 map sheet within the 1:250,000 Manilla map sheet.

Figure 1: Location of the Gulf Creek Copper project. (Source: OD6 Metals Limited)

Access is readily gained off the Gulf Creek road and then along approximately 1 kilometer of dirt road. The land owner has granted permission to inspect the workings and conduct field work, and a formal minerals exploration access deed is now in place.

Figure 2: The OD6 Metals announcement highlights. (Source: OD6Metals Ltd)

As an exploration geologist and someone who is also on the corporate side, I like the idea of a VMS (Volcanogenic Massive Sulphide). The brief information shown in Figure 2 does indicate that there is something worthy of a closer look.

A good VMS deposit is not easy to find these days, and the Samso platform has featured a few stories, the best of which has been New World Resources Limited (ASX: NWC).

Coffee with Samso with New World Resources Limited:

Some other companies like Venture Minerals Limited (now Critica Limited) and Warriedar Resources Limited. Typically, in the minerals exploration sector, Venture/Critica did not find it (I assume), and Warriedar is still working in the area.

The Rare Earth OD6 Story.

It is no secret in the market that the recent Rare Earths journey has not ended well. The fall from the heights of popularity in the Rare Earth story almost had it written in the script, but to many, me included, I thought this could end differently.

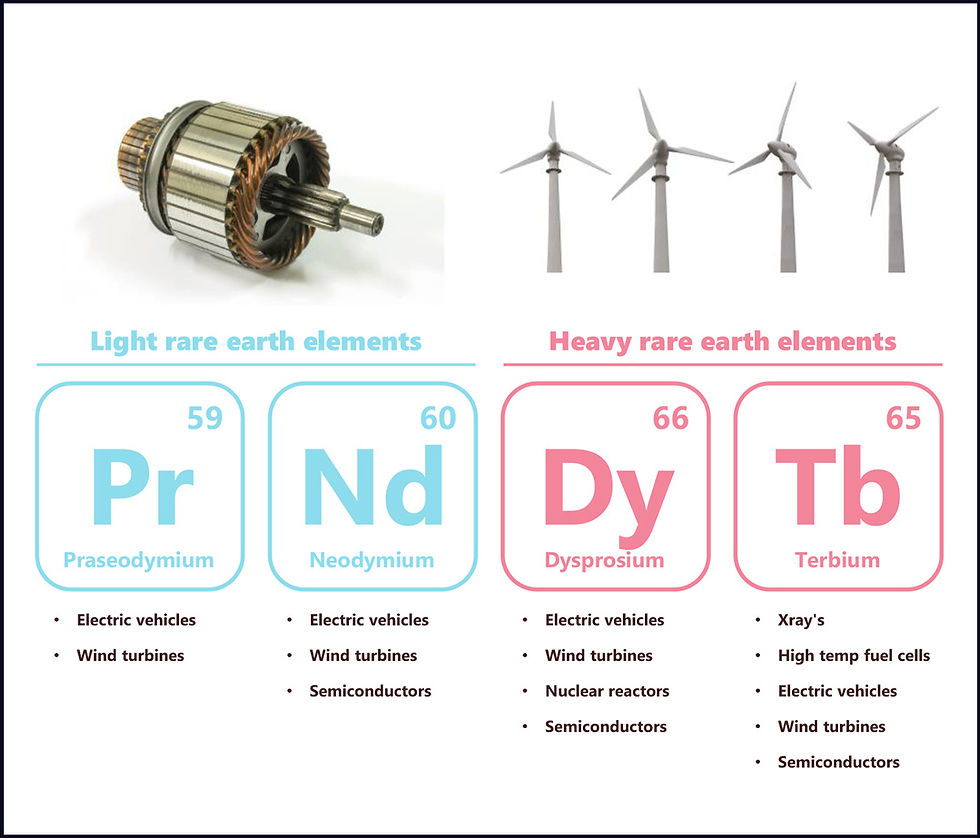

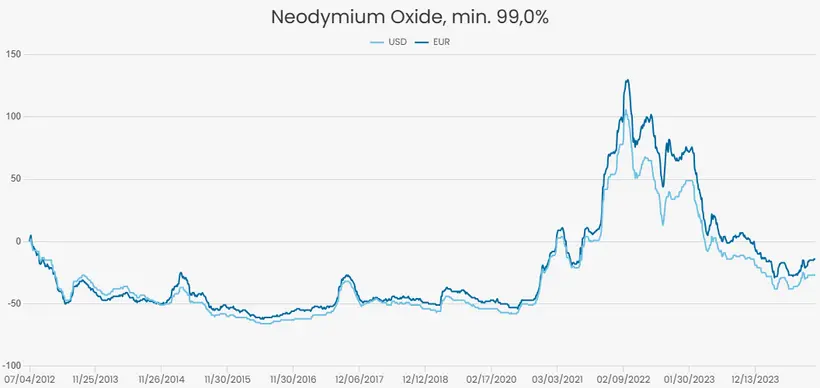

The pricing for the three main participants, Dysprosium (Figure 3), Neodymium (Figure 4), and Praseodymium (Figure 5), is the same as it was in 2020, and I must say that climbing that mountain will be a tough task. It is not impossible, but I think it will be a long, hard journey.

Figure 3: The Dysprosium price is currently $403.92 per kg (18/11/2024), dysprosium changed –31.24% since 1st Jan 2024 and –38.18% since the start of last year. It lost slightly in value last year and –1.75% compared to its price of $411.10 per kg on Jan 1st 2021. The price increased +17.00% since Jan 1st 2020. If we go back further than 5 years to Jan 1st 2018, when the cost of one kg dysprosium was $238.14, then the increase is +69.61%. (Source: Strategic Metals Invest)

The market sentiment is that the Rare Earth Story is no longer on investors' watchlists, but one wonders if the REE story can connect itself to the market insistence on the resurgence of the lithium story. The fall from the peaks of the lithium ride is greater than that of the REE path, as we are now looking at producers getting the rough end of the falling lithium price.

Companies that were the darlings of the lithium industry, such as Pilbara Minerals Limited (ASX: PLS) and Mineral Resources Limited (ASX: MIN) , are now 50% less than their peaks. There are no prizes for those who think the share price of MIN may be due to something other than the lithium price, but jokes aside, they are undoubtedly one of the market leaders in Australia for lithium.

Figure 4: At today’s price of $109.78 per kg (18/11/2024), neodymium changed –3.02% since the start of 2024. It has lost –47.55% since January last year. Compared to its price of $109.70 per kg on Jan 1st 2021 it has changed +0.07% in value. If we go back further to Jan 1st 2018, when the cost of neodymium was $70.04 per kg, then this rare earth metal has gained +56.74%. (Source: Strategic Metals Invest)

When I attended the Rare Earth Conference in Canberra last year, I was impressed at what the US was trying to do to capture market share with its incentives for the industry. I had read a lot of commentary in the past that wrestling the market from the Chinese would take a lot of work. At the beginning of the Rare Earth movement with the Clay deposits, I had to be a fast learner as things were moving fast. My understanding at that time was next to zero.

Figure 5: At today’s price of $109.23 per kg (18/11/2024), praseodymium has changed –3.16% since Jan 1st 2024. It changed –49.73% since Jan 2022 and has gained +30.97% compared to its price of $83.40 per kg on Jan 1st 2021 and is up +50.10% since Jan 1st 2020. If we go back to Jan 1st 2018, when the cost of a kilogram of praseodymium was $85.68, then the price has increased +27.49%.(Source: Strategic Metals Invest).

As the downturn in bucket pricing of Rare Earths started to show weakness, there was the fear of it going back to the low levels, but there was optimism that it would not do that as there is a new sheriff in town, so to speak. The talk of the US wanting an alternative to the Chinese Permanent Magnets could potentially save the day. Only time will start to tell if this is going to happen.

I think the investment highs coming from the "new market" must slow down before hopefully taking a second wind and strengthening. Its like technical traders saying that the first run to break new highs will be followed by other attempts as the bull retreats to rest for the next run.

If what I learnt from the trip to the Conference in Canberra last year is the amount of investment that has already happened cannot just stop. The Trump administration aims to "Make America Great Again", so one would probably bet things may or will get significantly better.

The OD6 Copper Story

Now, the new Gulf Creek Copper project has all the bells and whistles. OD6 is now a copper and Rare Earths story. The best copper project that a small-cap company like OD6 Metals can play with is a VMS (Volcanic massive Sulphide). I encourage readers to check the link out and immerse themselves to understand why a discovery of a VMS is a good thing for someone like OD6 Metals Limited.

Like all these old Australian projects, in the state of New South Wales, questions are always asked about the prospectivity and jurisdiction. The Gulf Creek copper project has been around for a long time and according to R.Thom 2007,

"The Gulf Creek Copper represents the largest copper mine of its type in the New England region of New South Wales and was primarily mined between 1889 and 1912. Over 35,000 tonnes of Cu ore was mined, delivering an average grade of 5% Cu over the mine life. Higher grades were recovered from some areas such as Fishers Mine, with head grades exceeding 15% Cu. Mine records estimate probable ore reserves up to 50,000 tonnes of ore grading 2.7% copper (Cu) and 4.65% zinc (Zn) remain in the known ore lenses.

The deposit is considered to be a Cyprus pyrite style and has not been properly explored since mining ceased almost 100 years ago, creating an exceptional modern exploration opportunity. The mine extended to a depth of 150 metres, a strike length of 400 metres and the ore channel was 30 metres in width.

The ore channel hosts 3 parallel lodes known as the Cornish Lode (2m wide @ 6-6.5% Cu, Middle Lode (1.5-2m wide @ 3-3.5% Cu) and the Big Lode (7m wide @ 2-2.5% Cu). Records also indicate strong Zn credits (~ 2 times Cu in the estimated ore reserves) were of little value to historic miners and may become a valuable credit to modern mine assessment.

The extensive strike, width and multiple lode nature of the project warrants an immediate drilling program to determine the strike and open pit potential of the mineralisation as well as drilling below the workings to determine the potential for modern underground mining."

Identity Crises for OD6 Metals.

Introducing a copper project to the OD6 platform has undoubtedly created mixed reactions among shareholders and potential investors in the ASX (Australian Stock Exchange). In my mind, OD6 is synonymous with the Rare Earth journey, but the lack of market interest is a big problem. This problem needs to take a back seat now, as the immediate need for management to create interest in the stock is paramount to the company's survival.

This is not something that needs to be spelt out at this stage, but the introduction of the Gulf Creek project is not wrong, as it does show promise as a project. Shareholders have a history of quickly forgetting the reality of an identity crisis as the value of their investments increases, so I am sure time will undoubtedly heal shareholders' worries.

Patience

OD6 shareholders need to be patient and supportive of management. The ministerial approval required in New South Wales will take months, and the land access will add to that timeline. If the locals are friendly and cooperative, you could add up to three months to the timeline.

I read that there was an issue with the permit area regarding being within an area of potential impact on a critically endangered bird species and a threatened species of gum tree. As a result, both the NSW Government and the Commonwealth Government required the previous operator of the area (Comet Resources, 11 January 2024) to undertake several assessments to determine the significance of its proposed activities on the bird and gum tree species. A contractor was engaged, but I don't know the result of that discussion.

Some historical readings highlighted a Native Title factor within the project, which was cleared, however, what that means for present owners in the area is unclear to me.

Readers will want to consider how the present ruling on Native Tile plays out. Unfortunately, the latest issue with Regis Resources in New South Wales is high on the concerns for mineral explorers and this will be an ongoing issues for potential investors and present shareholders of OD6 Metals.

Samso Concluding Comments

OD6's strategic move to acquire the copper project is good. In the present ASX market, there is not too much choice for OD6 Metals. The timing required to overcome the points mentioned previously will need to be managed. As always, I assume that management has already looked at all these factors and that all the concerns raised are under control.

The Gulf Creek copper project is worth shouting about from a technical point of view. The presentation released by OD6 Metals is worth a detailed read, and as I always say, contact the OD6 management and talk to them. I cannot stress this point enough: spend the time talking to the management, as they are more than happy to discuss these aspects with anyone who genuinely needs to know.

Reference:

R.Thom, 2007. EL 6492 Gulf Creek, Annual Report for 26th may 2005 to 25 May 2006. Graynic Metals Limited.

The Samso Way – Seek the Research

At Samso, we encourage investors to look beyond the headlines and focus on the foundations of value—geology, strategy, and execution. Pivotal Metals (ASX: PVT) is a clear example of why this matters. The Company’s systematic approach at the early-stage Lorraine project—highlighted by bonanza-grade gold, emerging gabbro-hosted sulphide targets, and newly defined magnetic corridors—signals a much larger mineral system at play. For those who value method over hype, PVT is one to research now and follow closely as the exploration story builds.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints. Read full Disclaimer.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me on noel.ong@samso.com.au.

Comments