Western Queen Advances with High-Grade Tungsten Assays and Maiden Resource Estimate - A Bit Disappointing.

- Noel Ong

- Aug 27, 2025

- 5 min read

Announcement

Rumble Resources Limited (ASX: RTR) has taken significant steps forward in positioning its Western Queen Project as a dual-commodity operation (Figure 1). In early August, the company reported high-grade tungsten assay results from historical diamond core samples, followed by the announcement of a maiden Tungsten Mineral Resource Estimate (MRE) just days later. Together, these developments underline the scale and strategic importance of Western Queen’s tungsten potential alongside its growing high-grade gold inventory.

Figure 1: The Western Queen Gold Project Location (source: RTR)

Key Highlights:

Multiple high-grade intersections from historical diamond core sampling, including:

3.45m @ 0.66% WO₃ from 299m (including 1.5m @ 0.96% WO₃)

0.57m @ 1.6% WO₃ & 17.3g/t Au from 371.86m

1m @ 2.24% WO₃ & 0.97g/t Au from 221m

3m @ 0.77% WO₃ & 61.4g/t Au from 96m

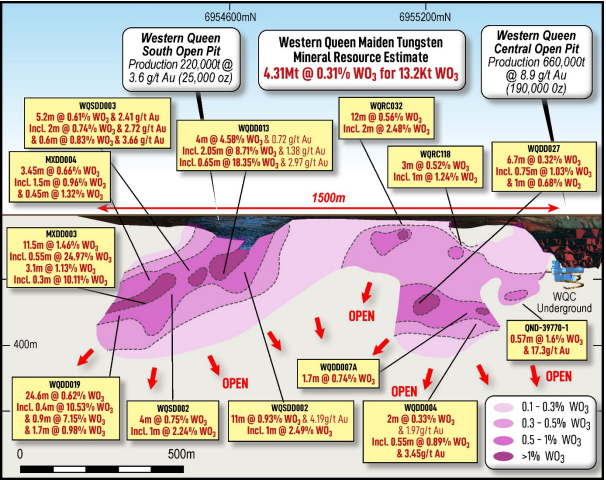

Eighteen tungsten lodes mapped over a 1.5km strike between the Western Queen South and Central open pits (Figure 2).

Tungsten mineralisation remains open along strike and at depth.

Geological and geochemical reviews have identified multiple high-priority targets over a 5km x 2.5km area, prospective for tungsten skarn-type mineralisation.

Preliminary metallurgical testwork indicates the potential for a meaningful tungsten revenue stream, pending further bulk sample analysis.

Figure 2: Current extent of mineralised tungsten lodes interpreted at the Western Queen Project (source: RTR)

Tungsten’s classification as a critical raw material — with applications in aerospace, defence, electronics, semiconductors, renewable energy, and military technology — provides strong strategic context for these results. The global market is facing constrained supply, with China controlling over 80% of production and experiencing a recent 12% output decline. Forecasts indicate ~7% CAGR growth to 2029, with prices for ammonium paratungstate up 43% since 2023.

Key Highlights:

Maiden tungsten MRE: 4.31Mt @ 0.31% WO₃ for 13,200 tonnes WO₃ at a 0.1% cut-off (Figure 3).

High-grade core: 1.44Mt @ 0.51% WO₃ for 7,400 tonnes WO₃ at a 0.3% cut-off.

Mineralisation defined entirely from prior gold-focused drilling — no dedicated tungsten drilling yet completed.

Lodes are sub-parallel to the updated gold resource of 3.72Mt @ 3.1g/t Au for 370,000oz.

Most of the MRE sits at the Western Queen South Deposit, where gold open-pit mining approvals have been submitted.

Reconnaissance work is underway to assess additional tungsten targets identified across the project.

Figure 3: Maiden Western Queen Tungsten MRE Highlights High-Grade Trends (source: RTR)

Metallurgical testwork will be critical in determining tungsten’s contribution to project economics. A bulk scheelite sample is being prepared for detailed analysis by Mineral Technologies to establish a grade-recovery curve. This will guide revenue modelling and potential inclusion of tungsten in mine scheduling.

Peter Harold, Managing Director and CEO, commented:

“To have reported a maiden tungsten resource of over 13,000 tonnes shows Western Queen is more than just a high-grade gold project — it has the potential to be a major tungsten project as well.”

Next Steps

Rumble will integrate the maiden tungsten MRE into its broader Western Queen development strategy, alongside advancing near-term high-grade gold production. Exploration programs are underway to test the newly identified tungsten targets, while metallurgical studies will define potential tungsten revenue contributions. Approvals have already been lodged for open-pit mining of the gold resource at Western Queen South, where much of the tungsten MRE is located.

Samso Concluding Comments

The recent results from Western Queen are good in terms of the grade, but when you start to hope for a larger interception that is measured in 100s or metres, of at least north of 50M to give scale, it is a bit disappointing not to see that happening. When I first started covering the Western Queen story, it had gone from a gold prospect to a tungsten hopeful, which was ok, but the numbers coming out look like it's not going to be in the scale of a standalone tungsten project.

Rumble is now going to have to decide if this is a gold project or not because I don't think the Tungsten story is going to cut mustard. I have seen several tungsten projects in my time, and this is not smelling the best. I was thinking that, coupled with a gold story, this could make grade, but the longer the Western Queen story is moving, the less confident I am of making a good story.

For the shareholders out there, a market capitalisation of AUD $28M is going to make it hard to change directions, as punters are always out for a bargain. I hope I am wrong in my comment, but this is one of those moments that I have had to reassess my optimism on a company.

There is time still to make amends, as the share price has been rising for the last 3 months, so maybe the market has got it right and I have not. The market is very buoyant at the moment on the small end of the sector, and there are still many alternatives for investments.

The Samso Way – Seek the Research

Announcements give us the facts, but research reveals the scale of the opportunity. Understanding tungsten’s market dynamics and Western Queen’s geological upside is where the real insight lies.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments