OD6 Metals Ltd (ASX: OD6) - Australia’s Standout Rare Earths & Copper Company — Scale, Metallurgy, and Strategic Leverage

- Noel Ong

- Dec 20, 2025

- 9 min read

East Coast Research - Australia’s Standout Rare Earths & Copper Opportunity (Dec 2025)

Introduction – Splinter Rock, Western Australia & Gulf Creek, New South Wales - A Rare Earths and Copper Story.

OD6 Metals Ltd (ASX: OD6) is shaping into one of Australia’s most strategically positioned critical minerals developers, underpinned by two assets at differing stages of maturity and differing exposure to global decarbonisation trends:

1. Splinter Rock Rare Earths Project – ~150 km northeast of Esperance, WA, hosting a large clay-hosted rare earth system with high NdPr content and exceptional metallurgy.

2. Gulf Creek Copper-Zinc Project – located near Barraba, NSW, within a fertile VMS corridor historically mined for high-grade copper.

Both projects benefit from Tier-1 jurisdictions, with Splinter Rock (Rare Earths) tied directly into the Esperance Port corridor and Gulf Creek (Copper) positioned within NSW’s Renewable Energy Zones (Figure 1).

Figure 1: Tenement Holding Area (source: OD6)

The Business of the Company: Focus – Projects

OD6 operates a dual-commodity strategy that aligns with global electrification megatrends.

Splinter Rock: A large-scale clay-hosted REE system totalling 682 Mt @ 1,338 ppm TREO, containing 209 kt of magnet rare earth oxides (MagREO).

Gulf Creek: A high-grade copper system with historical production and modern drilling confirming up to 4.6% Cu.

The company maintains disciplined project selection, having reviewed more than 30 copper assets before acquiring Gulf Creek.

Highlights – Metallurgical Strength, Strategic Relevance & Resource Scale

1. Rare Earth Demand & Application Tailwinds

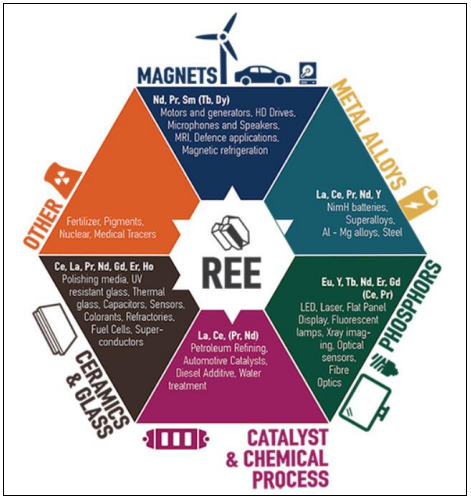

OD6’s focus on magnet rare earths sits firmly within the strongest pull of global demand. The growth in electric vehicles, offshore wind turbines, defence technologies, and everyday electronics continues to elevate the importance of elements such as NdPr, Dy, and Tb.

As shown in Figure 2, these minerals underpin a wide spectrum of modern applications — from high-strength permanent magnets to catalysts and specialised glass polishing — reinforcing why magnet rare earths remain the true value drivers in the sector.

Figure 2: Uses of Rare Earth Elements (source: Eurare)

2. Metallurgical Differentiation – A Clear Standout in the WA Clay REE Sector

Splinter Rock has emerged as one of Australia’s most advanced and clean metallurgical systems, supported by:

Up to 75% NdPr recoveries (heap leach)

MREC at ~56–59% TREO

Extremely low uranium and thorium (<0.01%)

Ambient-temperature heap leaching rather than high-cost tank leach

This metallurgical profile positions Splinter Rock for a lower-cost development pathway while naturally reducing environmental and processing risk. Figure 3 illustrates the staged impurity-removal process and the resulting high-purity MREC product, reinforcing the project’s strong leachability and favourable reagent behaviour.

Figure 3: Impurity Removal & Magnet REE Precipitation Profile (source: OD6)

The simplified process flowsheet (Figure 4) underscores the practicality of the Splinter Rock development pathway. It highlights an ambient-temperature heap-leach system supported by nanofiltration for efficient reagent recovery, culminating in the production of a clean magnet rare earth concentrate. The flowsheet reflects a straightforward, scalable approach that aligns well with the project’s metallurgical strengths.

Figure 4: Simplified Process Flowsheet (source: OD6)

3. World-Scale REE Market Context – Supply Chain Concentration

The global reserves chart in Figure 5 reinforces the concentration of rare earth supply within a handful of jurisdictions, led by China, Vietnam, Brazil, and Russia. This level of geographical dominance continues to shape global supply chains and amplifies the strategic value of new Western-aligned projects. Within this context, Splinter Rock stands out as a significant Australian opportunity capable of contributing to a more balanced and resilient rare earth supply landscape.

Figure 5: World’s Largest Rare Earth Reserves (source: East Coast Research & US Geological Survey)

4. Exceptional Resource Scale – Only 10% of Clays Drilled

The Inside Centre extraction profile (Figure 6) highlights the strength and coherence of the mineral system already defined from just a small segment of the broader basin. The distribution of key magnet rare earth elements across this area reinforces both the scale and the consistency of the mineralisation.

Inside Centre hosts 119 Mt @ 1,632 ppm TREO, providing a clear foundation for a potential starter operation.

Regional EM mapping outlines more than 30 km of clay-hosted signatures, pointing to basin-scale continuity and expansion potential.

Figure 6: Inside Centre Extraction by REE (source: OD6)

With OD6’s current MRE of 682 Mt (Figure 7) coming from drilling only ~10% of the identified clay-hosted targets, Inside Centre serves as an early indicator of what remains possible across Splinter Rock.

Figure 7: MRE by Prospect (source: OD6 & East Coast Research)

The cut-off grade sensitivity in Figure 8 shows that Splinter Rock maintains strong tonnage and grade even as thresholds rise, reflecting the robustness of the clay system. This resilience provides early confidence in the project’s scalability and economic flexibility.

Figure 8: Sensitivity of Resource to Cut Off Grade (source: OD6 & East Coast Research)

Figure 9 highlights Inside Centre as a clear high-grade standout within the broader clay system. The concentration of elevated TREO grades in this area strengthens its position as a natural starting point for future development and underscores the quality of mineralisation already defined at Splinter Rock.

Figure 9: Inside Centre High-Grade Standout (source: OD6)

Taken together, these factors underscore that the broader resource potential at Splinter Rock is still in its early stages of being unlocked.

5. Copper Market Tailwinds – Gulf Creek Positioned for Upswing

Copper remains one of the most supply-constrained metals heading into the 2030s, driven by electrification, grid expansion, and ongoing industrial demand. Copper futures on the LME continue to hold at historically elevated levels, reinforcing a supportive market backdrop for emerging discoveries such as Gulf Creek (Figure 10).

Figure 10: Copper Futures on LME (US$ Per Metric Ton) (source: East Coast Research & Capital IQ)

Long-term copper price trends point to a persistent, structural demand profile that continues to reinforce the metal’s strategic importance. Much of this demand is anchored by construction, electrification, electric vehicles, grid infrastructure, and broader industrial growth (Figure 11).

Figure 11: Copper Demand by Sector & Region (source: Cruxinvestor)

The forecasted deficit illustrated in Figure 12 underscores why new VMS systems like Gulf Creek are strategically significant. The widening gap between copper supply and demand points to a structural shortfall that is expected to deepen as global electrification accelerates.

Against this backdrop, Gulf Creek’s early drilling success is particularly noteworthy, having already returned:

1 m @ 4.33% Cu

8 m @ 1.41% Cu, 1.26% Zn

6 m @ 1.32% Cu, 2.82% Zn

Figure 12: Copper Supply & Demand Imbalance Likely to Grow (source: Bloomberg NEF Transition Metals Outlook 2024)

Figure 13 highlights the strong correlation between iron magnetism and copper mineralisation at Gulf Creek, providing a reliable geophysical vector for targeting additional high-grade zones.

Figure 13: Iron Magnetism vs Copper Mineralisation (source: OD6)

Figure 14 outlines a series of magnetic targets identified through 3D modelling, reinforcing the scale of the system and guiding the next phase of drilling at Gulf Creek.

Figure 14: Magnetic Targets from 3D Modelling (source: OD6)

Figure 15 presents the Sandfire share price analogy as a reminder of how transformative early VMS discoveries can be, showing the kind of value uplift that can occur as a project moves from initial hits to demonstrated scale.

Figure 15: Sandfire Share Price Analogy (source: East Coast Research & Capital IQ)

About the Project

🔹 Splinter Rock – Metallurgy First, Scale Second

Splinter Rock benefits from:

simple leach chemistry,

nanofiltration enabling >85% reagent recycling,

and a geological profile dominated by reactive minerals (rhabdophane, parisite–synchysite).

Figure 16 presents a weathering profile highlighting the clay-hosted zones and REE enrichment patterns that underpin OD6’s metallurgical success.

Figure 16: Geological Weathering Model (source: CSIRO, Ore Geology Reviews)

🔹 Gulf Creek – NSW Copper-Zinc VMS System

Historically mined for high-grade copper at the turn of the 20th century.

Very limited modern exploration before OD6.

Structural similarities to DeGrussa-style systems.

10 km of untested strike.

Near-term Milestones to Watch

Splinter Rock

✅ Bulk metallurgical sampling delivered to ANSTO

✅ A$1.5m testwork program underway

Next milestones

Bulk MREC samples for offtake (H1 2026)

First Scoping Study

Strategic partnerships

Expanded resource and optimisation studies

Gulf Creek

Phase 2 drilling underway

Down-hole EM to refine high-conductance targets

Step-out drilling planned for >3 km of magnetic anomalies

Continuous assays and modelling updates

How Samso Understands the Investment Memo for the Company

OD6 is moving toward becoming Australia’s most advanced clay-hosted REE developer capable of generating a clean, high-value MREC aligned with Western supply chains.

Splinter Rock’s investment case is strengthened by:

robust metallurgy,

scalable heap leach processing,

strong NdPr weighting,

and expanding clay-hosted footprints.

Gulf Creek adds asymmetric copper upside with a growing scale target and high-grade early hits.

Peer Positioning

Figure 17 shows OD6’s position relative to its peers, highlighting that despite a comparatively low market valuation, the company ranks strongly on both recovery-adjusted grade and recoverable TREO — effectively punching well above its weight.

Figure 17: Peer Analysis, Bubble Chart 2 (source: East Coast Research)

Splinter Rock Valuation

Figure 18 outlines the implied valuation for Splinter Rock, highlighting a meaningful uplift potential based on the adjusted TREO resource of 0.55 Mt and an implied EV ranging from A$59.8 million (Base Case) to A$73.7 million (Upside) using median peer-set multiples.

Figure 18: Splinter Rock Valuation (source: East Coast Research)

Gulf Creek Valuation

Gulf Creek is valued at 5% of Splinter Rock’s intrinsic value, generating an implied EV of A$2.99–A$3.69 million (Figure 19).

Figure 19: Gulf Creek Valuation (source: East Coast Research)

OD6 Total Valuation

Total implied EV of A$62.8m–A$77.4m, translating to a fair value of A$0.317/share with 256–336% upside from the current A$0.08/share (Figure 20).

Figure 20: OD6 Metals Valuation (source: East Coast Research)

Samso Concluding Comments

This research coverage is consistent with what Samso has been noting since our coverage going back to October 2022 ( OD6 Metals Limited (ASX: OD6) - The Rare Earth Elements Story | Coffee With Samso Ep. 158). The key to the confidence that I have is Brett Hazelden. When we first met, the confidence in his approach and the sincerity in the way he gave me in our many conversations on Coffee with Samso, has allowed me to feel comfortable in this story.

The Splinter Rock narrative is emerging as a globally significant clay-hosted rare earth system where only a fraction has been drilled. The geological footprint and metallurgical clarity reduce the risk inherent in early-stage REE development.

The integration of heap leaching, nanofiltration, and potential Chlor-Alkali capability points to lower operating costs and strong reagent efficiency, which are critical differentiators in the REE sector.

Global supply chain recalibration away from China continues to favour Western-aligned developers with clean product specifications. OD6’s low-impurity MREC squarely meets that requirement and is likely to attract downstream interest.

Gulf Creek adds an important copper exposure, with drilling already confirming mineralisation and geophysics suggesting scale. The copper market’s structural deficit amplifies the potential impact of any discovery. OD6 is therefore positioned with two commodities at the core of decarbonisation and electrification.

The Samso Way – Seek the Research

Every discovery begins with understanding — follow the geology, follow the metallurgy, follow the data.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation sees the benefit of what Samso is trying to achieve and has a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments