Miramar Updates on 8 Mile Drilling - Multiple Gold Zones - Search Continues - A Real Mineral Exploration Business.

- Noel Ong

- Aug 15, 2025

- 6 min read

Updated: Aug 17, 2025

Announcement

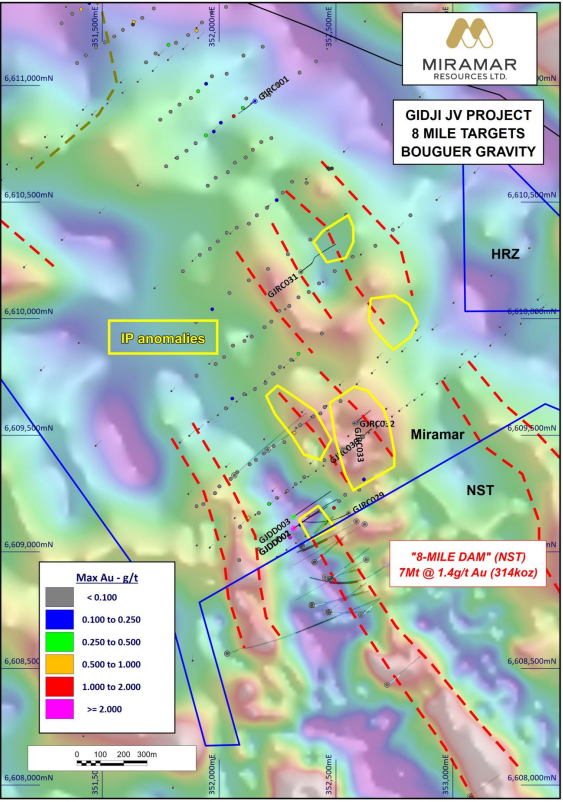

Miramar Resources Limited (ASX: M2R) has reported a promising start to its RC drilling program at the 8 Mile prospect, part of the Gidji JV Project north of Kalgoorlie. The first hole, GJRC029, intersected multiple gold zones and ended in mineralisation, confirming the potential extension of Northern Star’s nearby 8-Mile Dam deposit onto Miramar’s ground and reinforcing the project's prospectivity for a significant gold discovery (Figure 1).

Figure 1: The Gidji JV Project and 8-Mile Dam in relation to Kalgoorlie and surrounding deposits. (source: M2R)

Executive Chairman Allan Kelly commented:

“We are encouraged by the multiple gold intercepts in our first RC hole at 8 Mile,” said Executive Chairman Allan Kelly.

“The results support our view that gold mineralisation from 8-Mile Dam extends onto our ground, and we now have several follow-up targets from aircore and IP data to pursue.”

“We are planning additional geophysical surveys to refine our drilling strategy and believe 8 Mile could host significant gold potential given its location and geological setting.”

🔹 Key Highlights - A Mineral Exploration Business.

Multiple Gold Zones Intersected:

Miramar Resources’ (ASX: M2R) first reverse circulation (RC) drill hole at the 8 Mile prospect (hole GJRC029) intersected several zones of gold mineralisation and ended in gold mineralisation at 504m downhole (Figure 2).

Strategic Location Near Major Deposits:

The 8 Mile prospect lies within the Gidji JV Project, ~15km north of Kalgoorlie and adjacent to Northern Star’s 8-Mile Dam deposit (7Mt @ 1.4g/t Au for 313,977oz), confirming potential strike continuity of mineralisation.

Strong Geological Indicators:

Mineralisation is hosted within the 8 Mile mafic unit, with notable sulphide development (including arsenopyrite), elevated arsenic via portable XRF readings, and visible fuchsite, indicative of hydrothermal alteration typically associated with orogenic gold systems.

Initial Drilling Programme:

GJRC029 tested an IP anomaly thought to reflect sulphide-rich gold zones. Despite significant deviation from the planned azimuth, the hole intersected thick westerly-dipping altered mafic units and returned notable results such as:

⮞ 3m @ 2.67g/t Au from 243m (incl. 1m @ 6.51g/t)

⮞ 18m @ 0.94g/t Au from 480m (incl. 4m @ 2.83g/t and 1m @ 6.04g/t)

Next Steps and Additional Surveys:

Results are pending for four additional RC holes targeting offset IP anomalies. Infill gravity and sub-audio magnetic (SAM) surveys are being planned to refine future RC and/or diamond drilling programs.

Figure 2: Cross section showing GJRC029 about the 8 Mile mafic unit and the IP anomaly. (source: M2R)

🔹 Gidji JV Project Context

Miramar’s 80%-owned Gidji JV Project spans ~15km of the Boorara Shear Zone in WA’s Eastern Goldfields. Despite being surrounded by established gold operations (e.g., Kalgoorlie Super Pit, Kanowna Belle), Gidji has remained underexplored due to transported cover and the crosscutting Gidji Paleochannel.

Systematic aircore drilling since late 2020 has led to multiple supergene gold discoveries and several compelling bedrock targets. Miramar views Gidji as having genuine potential to evolve into a new gold camp with multiple deposits.

🔹 Exploration Update – Broader Portfolio at Gascoyne Regions Projects (Figure 3)

At the Bangemall Ni-Cu-PGE Project, Miramar is progressing with its EIS-co-funded airborne magnetic and VTEM surveys, with approximately 20% of the program completed. These surveys are designed to identify conductive anomalies associated with nickel, copper, and PGE mineralisation across the underexplored region.

At the Chain Pool SEDEX Project, the Company is preparing for a follow-up field trip focused on further soil and rock chip sampling. This work aims to advance the understanding of the high-grade sedimentary exhalative (SEDEX) system's prospective for copper, lead, zinc, and silver.

In line with its strategic focus, Miramar has also initiated the divestment of non-core assets, including the Glandore and Randalls Gold Projects in the Eastern Goldfields. These sales processes are part of the Company’s efforts to streamline its portfolio and allocate resources toward its highest priority targets.

Figure 3: Gascoyne Regions Projects (source: M2R)

📍 Drill Details – GJRC029 Summary

243–246m: 3m @ 2.67g/t Au

Including 1m @ 6.51g/t Au

252–254m: 2m @ 0.48g/t Au

374–375m: 1m @ 0.32g/t Au

378–379m: 1m @ 2.85g/t Au

480–497m: 18m @ 0.94g/t Au

Including 4m @ 2.83g/t Au

Including 1m @ 6.04g/t Au

501–504m: 3m @ 0.52g/t Au (end of hole mineralisation)

*Note: All intercepts use a 0.25g/t Au lower cutoff, with up to one sample of internal dilution.

Samso Concluding Comments

Miramar continues to present a tightly managed exploration story with a sharp geological focus. The Gidji JV Project, particularly the 8 Mile prospect, has matured from early-stage data collection into serious drill targeting, culminating in the intersection of multiple gold zones in its very first RC hole.

The 8 Mile target is compelling due to its proximity to known deposits, its geological signature, and early signs of system continuity. Ending a 504m RC hole in mineralisation is the kind of exploration result that commands follow-up.

Importantly, the Company’s layered targeting approach—combining aircore, IP, SAM, and gravity—reflects a methodical and technically sound strategy. The presence of sulphides, arsenopyrite, fuchsite, and anomalous arsenic detected by handheld XRF provides tangible indicators that this is not a one-off intercept, but part of a broader mineralised system.

This story is not about chasing hype—this is about doing the work. Some investors may say that management needs to create the hype, but as long as I have known the key management of the company, this is not in their DNA. They are all about getting into the business of mineral exploration in a cost-effective manner, and that is maximum funds into the ground and not about funding a lifestyle company.

Gidji has always had the ingredients of a significant gold system, and with each program, Miramar gets closer to unearthing its true scale. The first RC hole is just the start.

For investors seeking early-stage exposure to a potential emerging gold camp in Kalgoorlie’s backyard, Miramar is again demonstrating it has the geological smarts and the operational intent to deliver value. Miramar Resources is what I call a company that is a Mineral Exploration Business.

Check out the latest Coffee with Samso with Allan Kelly:

The Samso Way – Seek the Research

What sets stories like this apart is their grounded execution. While speculation abounds in early-stage gold exploration, Miramar’s work is grounded in structure, method, and data. The story isn’t about hype—it’s about following the rocks, reading the systems, and drilling with purpose.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and has a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments