🆕IPO Listing: Ariana Resources Plc (ASX: AA2) – Gold Mining Story at Scale from Zimbabwe to Türkiye.

- Noel Ong

- Sep 15, 2025

- 7 min read

Ariana Resources Plc (ASX: AA2 | AIM: AAU) is entering into the ASX spotlight with a dual listing that combines global operational success with a bold growth vision anchored in Zimbabwe’s emerging gold sector. With producing mines in Türkiye and a 100%-owned flagship gold project at Dokwe in Zimbabwe (Figure 1), Ariana offers a rare blend of cash-generating assets, a robust pipeline, and resource expansion upside. Following a consistent profit streak since 2016 and a proven development model, Ariana’s entry onto the ASX sets the stage for a fresh valuation re-rate.

Figure 1: Location of Dokwe Project in Zimbabwe (July 2025) (source: AA2)

This move comes at a pivotal time in the gold cycle, with Ariana looking to capitalise on its multi-million-ounce portfolio, a strategic alliance with Newmont, and a disciplined capital strategy. The upcoming IPO aims to raise up to A$15 million via CHESS Depositary Interests (CDIs) priced at A$0.28.

ASX Listing Details

ASX Code: AAU

Listing Date: Expected 15 September 2025

IPO Offer Price: A$0.28 per CDI

Current Share Price (as at August 2025): Not yet trading on ASX. Current AIM market capitalisation is ~£34.02M (≈A$70.42M)

Market Capitalisation (on Admission):

At Minimum Subscription (A$10M raise): ~A$92.8M

At Maximum Subscription (A$15M raise): ~A$105.5M

Industry Group: Materials – Mineral Exploration & Development

Investment Highlights – Ariana, a Gold Mining Story at a Glance.

Multi-Asset Gold Exposure:

Dokwe Gold Project (Zimbabwe) – 1.42Moz in JORC (2012) Resources; DFS underway targeting 100koz/year (Figure 2).

Figure 2: Dokwe Gold Project (source: AA2)

Zenit Partnership (Türkiye) – Producing mines at Kiziltepe (172koz Au at 1.63g/t Au grade MRE) and Tavşan (311koz Au at 1.26g/t Au grade MRE) with 2Moz in total Resources.

Proven Developer & Operator:

Two mines built in Türkiye – Kiziltepe (producing since 2017) and Tavşan (2024).

Over 81,900m drilled FY21–24; further drilling in 2025.

Financial Strength & Track Record:

Special dividends of £7.74 million paid across 2021–22.

£1.8 million raised in Q1 2025; US$2 million debt facility drawn.

Consistent profitability since 2016.

Undervalued Resource Base:

Ariana's EV/resource ounce of A$27/oz is low compared to peers – ASX listing designed to close this valuation gap.

Strategic Relationships:

Newmont holds ~4% of Ariana and is funding generative exploration in SE Europe.

JV structure in Zenit includes Proccea (23.5%) and Özaltin Holding (53%).

Core Asset: Dokwe Gold Project – Zimbabwe’s Largest Undeveloped Gold Resource.

The Dokwe Gold Project lies at the heart of Ariana’s strategy, boasting:

JORC Resource: 22.9Mt @ 1.52g/t for 1.1Moz Au (0.6g/t cut-off).

JORC Reserve: 18.25Mt @ 1.36g/t Au for 795.8koz Au.

Scalable Development:

2024 PFS outlines a 65koz p.a. operation.

DFS underway targeting 100koz p.a. with completion due mid-2026.

Estimated capex: US$82M (A$124.6M), payback in 1.8 years.

Use of IPO Funds:

Up to A$6M allocated to accelerating DFS and expanding Resources/Reserves.

Strong potential for strike and depth extensions.

Turkish Cash Engine: Zenit Operations

Kiziltepe Gold-Silver Mine (Figure 3)

126koz gold in JORC Resources.

Historic cash flow generator.

Figure 3: Kiziltepe Location Map, also showing Kepez, Karakavak and Kizilcukur Projects (September 2024) (source: AA2)

Tavşan Gold-Silver Mine (Figure 4)

Recently commissioned (2024).

311koz gold in Resources with 30koz p.a. production target.

New heap leach plant scheduled for Q3 2025.

Figure 4: Tavşan Location Map (June 2025) (source: AA2)

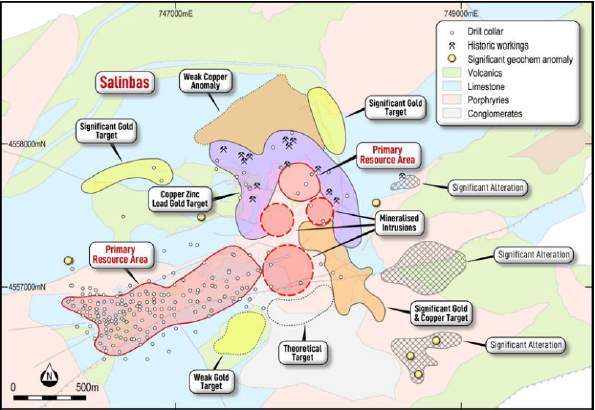

Salinbaş-Ardala Gold Project (Figure 5)

Large-scale 1.5Moz gold Resource across NE Türkiye.

High exploration upside.

Figure 5: Salinbas Gold Project (source: AA2)

Growth Beyond Core: Kosovo and Cyprus

Newmont Partnership – Backed by US$3.3M investment to fund Kosovo exploration, with follow-on funding tied to licences and drilling at Hertica Project confirming a Cu-Au porphyry system.

Slivova (Kosovo) (Figure 6)

76% indirect interest in Western Tethyan Resources Ltd, which owns 51% of the Slivova Gold Project.

Advancing through earn-in.

Figure 6: Slivova Gold Project (source: AA2)

Magellan (Cyprus)

61% indirect interest via Venus Minerals.

Resource: 96.7kt Cu and 26.8kt Zn.

Asgard Metals

100%-owned investment vehicle targeting early-stage discovery companies across the Eastern Hemisphere.

🔹 Offer Summary

Details | Minimum | Maximum |

Offer Price | A$0.28 | A$0.28 |

Funds Raised | A$10M | A$15M |

CDIs Issued | 35.7M | 53.6M |

Use of Funds | DFS, exploration, RiverFort debt repayment (A$3.4M), working capital | |

Market Cap on Listing | ~A$70M | ~A$75M (undiluted) |

The Road Ahead – Key Near-Term Catalysts

Completion of DFS at Dokwe by mid-2026.

Full-scale Tavşan ramp-up and heap leach plant commissioning in Q3 2025.

New drill programs across Zimbabwe, Türkiye, and Kosovo.

Potential monetisation of non-core holdings (Zenit, WTR, Venus, Asgard).

Newmont-supported exploration across SE Europe.

ASX re-rate opportunity based on resource growth and production scalability.

Board and Management – Proven Leadership Across Continents

A seasoned board leads Ariana Resources with deep experience in exploration, mine development, and capital markets. Chairman Michael de Villiers brings strong financial oversight, while Dr. Kerim Sener, Managing Director, drives strategy and discovery—having led the development of Ariana’s Turkish mines and now focused on unlocking value at Dokwe in Zimbabwe.

The team is rounded out by operational specialist Galip Sener, financial expert William Payne, and ESG-focused Dr. Lucy Morgan, combining technical capability with disciplined governance. Their global perspective and in-country expertise underpin Ariana’s success across Türkiye, Africa, and Europe.

Board of Directors – Ariana Resources Plc

Dr Ahmet Kerim Sener – Managing Director and CEO (founder, appointed April 2005). A long-serving executive, holding both leadership and board responsibilities.

Michael John de Villiers – Executive Chairman & Company Secretary (since approximately 2009–2010). Also chairs the Audit Committee.

William J. B. Payne – CFO and Non-Executive Director (appointed December 2010). Chairs Compensation Committee and sits on Audit Committee.

Michael William Atkins – Independent Non-Executive Deputy Chairman; serves on Audit Committee. (Appointed Aug 2018)

Christopher John Stuart Sangster – Independent Non-Executive Director; sits on Compensation Committee. Appointed August 2016.

Nicholas John Graham – Non-Executive Director (appointed June 2024); founder and substantial shareholder.

Andrew John du Toit – Operations Director & Director (appointed June 2024); part of the executive leadership.

Use of IPO Funds – Summary (Actual vs Budget)

Ariana Resources will use its IPO funds to progress the Dokwe Gold Project, allocating A$1.0M to feasibility studies, A$1.8–4.0M to drilling, and up to A$1.0M for environmental work, while also supporting the Slivova Project (A$0.4–0.9M), Western Tethyan Alliance (A$0.4–0.5M), and Venus Minerals (A$0.2M).

In addition, A$3.4M is earmarked for part repayment of the RiverFort Facility (pre- and post-Admission), alongside A$1.8–2.7M for working capital and A$1.4–1.7M for Offer costs. Under the maximum raise of A$15M, Ariana will significantly expand drilling and complete a full EIA, strengthening the Dokwe development pathway.

Investor Takeaway: The funding strategy prioritises fast-tracking Dokwe while maintaining a balance between growth, debt reduction, and portfolio development.

Samso Concluding Comments

Ariana Resources is anchored by a producing asset base in Türkiye, but it is the potential scale of the Dokwe Gold Project in Zimbabwe that could transform Ariana into a mid-tier gold producer. With an experienced board, a proven management team, and the support of strategic partners such as Newmont, Ariana is well-positioned to deliver on both near-term cash flow and long-term growth.

The strength of this story lies in balance. Ariana has demonstrated its ability to generate shareholder returns — through dividends, disciplined capital management, and smart partnerships — while still pushing forward aggressively on resource growth. This is not a one-dimensional exploration story; it is a growth strategy underpinned by production, feasibility, and discovery.

For investors, Ariana has multi-jurisdictional exposure, tangible development pathways, and exploration blue-sky potential. The next two years will be critical, as the DFS at Dokwe progresses and Ariana seeks to unlock the broader copper-gold opportunities in Kosovo under its Newmont alliance.

At Samso, we remind readers that #SamsoNews is where investors can look for valuable information. Always seek the research, and remember — the market rewards companies that not only tell a good story but can also deliver it.

The Samso Way – Seek the Research

At Samso, we believe in one principle — Seek the Research. The Samso Way is about cutting through noise, focusing on facts, and understanding the real stories that drive investment value.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments