Infini Resources October Round-Up: A$12m Raise, +10k ha, Uraninite Logged - A Canadian Uranium Story

- Noel Ong

- Nov 13, 2025

- 7 min read

Announcement

Infini Resources Limited (ASX: I88) delivered three key messages in its October sequence: the discovery of visible uranium in the core at Portland Creek (Figure 1), a 68% expansion of tenure around that system, and the raising of fresh capital at a premium to accelerate drilling in Newfoundland and the Athabasca region. This summary pulls the key facts and where they fit in the bigger picture.

Figure 1: Portland Creek Uranium Project, located in the pro-mining province of Newfoundland, Canada (source: I88)

About Infini Resources Limited

Focus: Energy-metals explorer targeting uranium (primary) and lithium in Canada and Western Australia; portfolio spans ~8 projects.

Key ground: Active uranium programs at Portland Creek (Newfoundland) and Reynolds Lake (Canada’s Athabasca region); recent drilling at Portland Creek reported “game-changing” uranium-hosting structures and visible uraninite, with the land package expanded ~68%.

Capital & runway: Completed an ~A$12m flow-through raise at a 34% premium (Oct 23, 2025) to fund expanded uranium work.

Firm commitments of ~A$11m via Canadian Flow-Through Shares at A$0.75, a 34% premium to last trade A$0.56; plus A$1m to sophisticated/professional investors at A$0.50.

Total raise framed as ~A$12m (Flow-Through + concurrent placement). Use of proceeds: expand drilling at Portland Creek and initiate programs at Reynolds Lake and Reitenbach Lake.

Loyalty Options: 1-for-4, $0.02 issue price, $0.27 exercise, expiry 30 Sep 2028; record date 7 Nov 2025; indicative timetable provided.

Infini’s Chief Executive Officer, Rohan Bone, commented:

"This heavily subscribed placement — completed at a 34% premium — is a powerful endorsement of Infini’s active exploration strategy and the outstanding potential of our uranium portfolio. The structure of this placement enables us to raise capital at a premium to market, reflecting the strength of our project portfolio and the tailwinds of a global resurgence in investment into clean energy-focused critical minerals.

With a strengthened balance sheet, we are now positioned to aggressively advance exploration programs aimed at unlocking potential new discovery opportunities at Portland Creek, Reynolds Lake and Reitenbach Lake projects located in the tier-1 mining jurisdictions of Newfoundland and the Athabasca region. The capital raised enables us to move decisively into our next phase of discovery growth, targeting high-impact results that can drive substantial value for shareholders.”

The Company raised ~A$11m via Canadian Flow-Through Shares at A$0.75 (≈34% premium to A$0.56 last trade), alongside A$1m at A$0.50 to sophisticated investors. Funds will expand Portland Creek drilling (up to 12 high-priority targets) and kick off drilling at Reynolds Lake and Reitenbach Lake.

+10,250 ha via 410 newly staked claims (all contiguous), lifting Newfoundland landholding to >25,000 ha — a 68% expansion of the Portland Creek footprint (Figure 2).

Figure 2: Infini’s footprint at the Portland Creek Uranium Project strategically increased by 10,250 hectares, covering potential extensions of known structures and prospective host lithologies. (source: I88)

Expansion secures possible extensions of E–W trending mineralised structures identified in recent drilling; positions the project for district-scale follow-up.

Phase-2 drilling context: visible uraninite in PCDD25-012 at 270.0 m (~1.2% U) and 289.0 m (~1.17% U) (pXRF); molybdenum up to 2.38% (pXRF) in PCDD25-009A; assays expected Q4 CY2025.

Infini’s Chief Executive Officer, Rohan Bone, commented:

" This is a strategic expansion for Infini at a pivotal time. Following the breakthrough of visible uraninite and high-grade molybdenum at Portland Creek, it was essential that we consolidate our position across this highly prospective district. These new tenements strengthen our geological footprint, secure potential extensions of known structures, and provide the foundation for long-term exploration and development. We’re building scale and optionality in one of the most supportive jurisdictions for uranium exploration globally."

Infini lodged 410 new claims (+10,250 ha) contiguous with existing tenure, consolidating the structural corridors now being drilled and lifting the Newfoundland holding to >25,000 ha. The move secures potential extensions of the E-W trending mineralised structures established in Phase 2.

PCDD25-012 (Target 2): visible uraninite at 270.0 m (12,000 ppm U) and 289.0 m (11,700 ppm U) by pXRF (~1.2% and 1.17% U), within intensely fractured/altered granites (Figure 3).

Figure 3: Drill core from PCDD25-012 (470459E, 5557965N, UTM Zone 21) (source: I88)

Fracture/joint-hosted mineralisation pervasive from 28–312 m: ~50 pXRF spots, >90% between 1,000–12,000 ppm U.

Example pXRF peaks across the hole include 3,200 ppm U (28 m), 6,600 ppm U (175 m), and numerous 1,000–3,600 ppm U readings at intermediate depths.

Polymetallic signatures nearby: 2.38% Mo (PCDD25-009A); 14.4% Ti (PCDD25-008); additional U hits in PCDD25-010 (all pXRF) (Figure 4).

Figure 4: Drill core samples with significant mineralisation detected using pXRF (source: I88)

Infini’s Chief Executive Officer, Rohan Bone, commented:

"These first drillholes are a game-changer for Portland Creek. We have intersected extensive zones of elevated uranium, confirming widespread hydrothermal alteration and validating our exploration model. With Phase 2 drilling still in the early stages, the scale of the opportunity at Portland Creek is becoming increasingly clear. With every hole, we are uncovering more indications of a potential district-level polymetallic uranium system in Newfoundland, at a time when uranium and critical minerals are central to the global energy transition.”

Phase 2 drilling at Target 2 (PCDD25-012) intersected pervasive fracturing and alteration with uraninite blebs at depth, alongside numerous fracture- and joint-hosted U readings from near-surface to >300 m (pXRF). These features align with near-vertical fracture sets and brecciation consistent with fluid pathways in a hydrothermal system.

Important Facts To Narrate a Uranium Story

The fracture-controlled U with visible uraninite provides a clear structural target to follow in Phase 2. Assays will determine thickness/continuity and economic context.

Mo and Ti responses strengthen the polymetallic narrative typical of robust hydrothermal systems.

Tenure scale now better matches the scale hypothesis emerging from drilling and historic geochem/radiometrics.

A premium raise reduces dilution and funds aggressive testing across Portland Creek and two Athabasca-region projects.

Samso Concluding Comments

The good news for any investor in the mineral exploration sector is that their Company has raised good cash. In this case, Infini has secured ~A$12m, comprising ~A$11m in Canadian flow-through shares at A$0.75 (≈34% premium to A$0.56) and A$1m at A$0.50, with the flow-through tranche to be block-traded at A$0.50; tax benefits remain with the initial Canadian investors.

Funds are allocated to expand drilling at Portland Creek and to commence programs at Reynolds Lake and Reitenbach Lake, including testing up to 12 high-priority targets at Portland Creek.

A loyalty offer is proposed on a 1-for-4 basis at A$0.02 per option, exercisable at A$0.27 and expiring 30 Sep 2028, with a record date of 7 Nov 2025 and an intention to seek quotation.

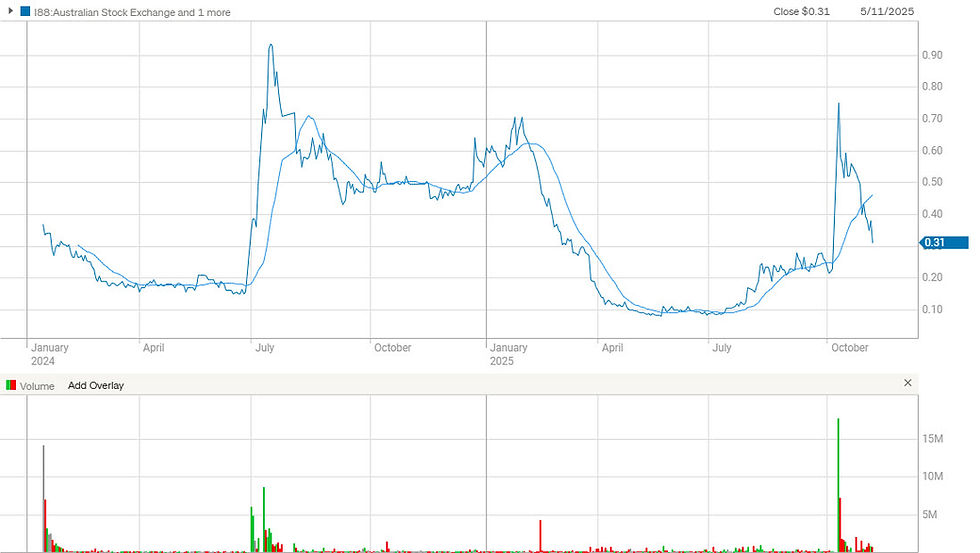

Figure 5: I88 share price chart as of 5th November 2025. (source: CommSec)

A current market capitalisation of AUD $26.5M is reasonable for retail to take a punt. Investors need to understand that working in Canada is going to cost a lot more so a raise this size is appropriate, and it does give people like Samso confidence that there are sufficient funds to undertake a good exploration program.

Near-term markers include assays from Phase 2 expected in Q4 2025 and the recently announced 10,250-hectare tenure expansion lifting Newfoundland holdings to >25,000 hectares; note the company’s caution that pXRF readings are qualitative spot.

The Samso Investment Memo

Thesis: Consistent positive drilling results across multiple targets will transition the company value from concept to discovery in a uranium market that is driven by supply tightness. Market capitalisation increases will be driven by drill results, scale of anomalies, and advancing to maiden resources.

What they own/sell: Early-stage exploration rights across uranium (flagship Canada) and lithium (Canada & WA).

Market: Uranium thematic (reactor restarts/new builds) supports funding for high-grade Canadian exploration; lithium optionality remains in the portfolio. If the lithium market stabilises with a return of lithium carbonate pricing in the USDS $20,000 + region, the lithium projects may come into play.

The Samso Way – Seek the Research

Read the original ASX releases and focus on the assay-confirmed results once available in Q4 2025.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments