DY6 Metals to Advance High-Grade Gallium and REE Exploration in Malawi.

- Noel Ong

- Sep 26, 2025

- 5 min read

Announcement

DY6 Metals Ltd (ASX: DY6) is advancing exploration at its gallium and rare earth projects in southern Malawi, a move that comes at a time when global demand for critical minerals is intensifying. The upcoming sampling programs at Tundulu and Machinga are designed to build on high-grade results already reported, positioning the Company to unlock further value in strategically important commodities (Figure 1).

Figure 1: Tundulu Project Location Map and Historical Drill Hole locations over Nathace Hill (source: DY6)

Key Highlights

Tundulu Project: 75 soil and rock chip samples planned to build on the discovery of high-grade gallium mineralisation (up to 310.46 g/t Ga₂O₃ and 5.68% TREO). Only 40% of the prospective area has been drill-tested, leaving significant upside potential.

Machinga Project: 116 soil and rock chip samples to be collected across a 400m x 200m grid, targeting strong radiometric anomalies. Maiden RC and diamond drilling (2023) confirmed high-grade continuity, including 15.1m @ 1.01% TREO and 0.36% Nb₂O₅.

Exploration Strategy: Both projects remain underexplored, with DY6 focused on expanding gallium, rare earth, phosphate, and niobium footprints in southern Malawi.

CEO Comment: DY6 sees significant potential to expand critical metal resources at a time of growing demand for gallium, REEs, and niobium.

Tundulu Rare Earth, Phosphate & Gallium Project

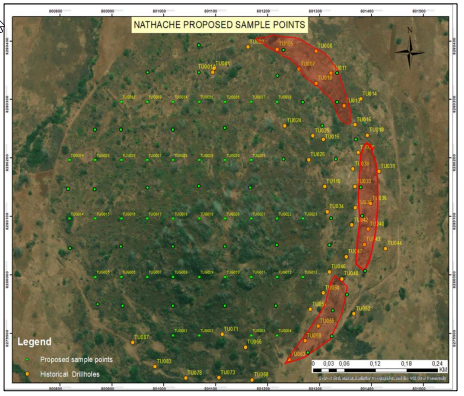

The Tundulu Project continues to show strong promise with historic drill results highlighting high-grade gallium mineralisation. Drill intercepts include 25m @ 64.63 g/t Ga₂O₃ and 1.03% TREO from 45m (TU008), and up to 310.46 g/t Ga₂O₃ with 5.68% TREO from 97–98m (TU043). The upcoming programme will target untested areas (~60%) while verifying historic surface results through carefully planned sampling lines (Figure 2).

Figure 2: Proposed Sampling Points and Gallium Zones at Nathace Hill (source: DY6)

Machinga HREE & Niobium Project

At Machinga, recent rock chip and soil sampling outlined a 2.7km-long geochemical anomaly, providing strong follow-up targets (Figure 3). Previous drilling confirmed mineralised zones correlate strongly with radiometric anomalies, underpinning confidence in targeting higher-grade areas. Upcoming work will collect 116 samples across a new southern licence area (EL0705) to refine targets for future drilling.

Figure 3: Planned Sampling Points over Machinga Anomaly (source: DY6)

DY6 Metals CEO, Cliff Fitzhenry, commented:

"Previous identification of high-grade gallium mineralisation at Tundulu presents a unique opportunity for DY6 to advance a critical metal alongside rare earths and phosphate. With only a portion of the licence area tested to date, we see significant potential to expand the footprint of gallium and rare earth mineralisation across both Tundulu and Machinga.

The upcoming sampling programs are designed to build on our recent successes and to further define high-value targets for follow-up drilling. Importantly, our initial work at Machinga has already confirmed excellent grade continuity, giving us confidence in the growth potential of these projects. We are excited to be advancing exploration in Malawi at a time when demand for critical metals is forecast to grow strongly”.

Samso Concluding Comments

For DY6 Metals, the significance of these results lies in the dual opportunity presented by gallium and rare earth elements. Gallium’s strategic role in semiconductors and defence technologies aligns with the global narrative of critical mineral supply chains, while the REE and niobium potential further enhances project value.

The upcoming sampling campaigns are not about proving a concept but expanding a foundation that already demonstrates grade, scale, and continuity. Malawi remains underexplored, and DY6’s methodical approach to verification and expansion could well position the Company within a broader critical minerals framework.

The market narrative for gallium and REEs continues to build, and it will be good for investors to watch if DY6 can transform early promise into resource definition. This is an example of exploration where the upside is measured not only in discovery but in timing, with global demand curves aligning strongly with DY6’s project pipeline.

The Malawi jurisdiction issue is going to hang over DY6 and its projects in the country, and this will weigh heavily on investors' thinking; however, a Gallium discovery of significance will put DY6 in a good position. The question of DY6 making a Gallium discovery of significance will be the hot topic. With the rutile story in Cameroon and the Malawi projects, one will have to hope that a focus will begin to develop sooner rather than later.

I can appreciate what management is trying to do, but we all know that the market is always right and it is a simpleton.. It likes simple stories.

As always, at #SamsoNews, we remind readers that opportunities in the exploration sector carry both risk and reward. DY6’s current work illustrates how exploration success is built — methodically, through data, geology, and persistence. The results of these upcoming campaigns will provide important signals as the story unfolds.

The Samso Way – Seek the Research

Facts first, context always. Map the geology to the strategy, verify the numbers, and decide only after your own research.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments