Cannindah Resources — Near-surface Cu-Mo Exploration Target at Monument, vectors to porphyry at depth

- Noel Ong

- Nov 13, 2025

- 7 min read

Announcement

Cannindah Resources Limited (ASX: CAE) has outlined a near-surface Exploration Target at the Monument prospect within the Southern Porphyry Target Zone at Mt Cannindah (Qld) (Figure 1), interpreting skarn mineralisation as the upper expression of a deeper, pencil-style porphyry. The work compiles historical drilling, recent mapping, rock chips, and trench/channel results into a coherent near-surface Cu-Mo model that opens new drill targets toward depth.

Figure 1: Mt Cannindah Cu/Au Project, Queensland (source: CAE)

About Cannindah Resources Limited

Focus: Queensland copper–gold explorer/developer. Flagship Mt Cannindah project (granted mining leases) with an updated JORC MRE: 14.5Mt @ 0.72% Cu, 0.42 g/t Au, 13.7 g/t Ag (1.09% CuEq); contains ~158kt CuEq. Secondary asset: Piccadilly gold project.

Current activity: Ongoing drilling across the Mt Cannindah breccia and larger porphyry targets (Southern & Eastern), aiming to expand resources and test deeper “pencil” porphyry centres.

Recent funding: Oversubscribed ~A$4.5m entitlement offer to advance drilling; program described as “potentially transformational.”

Highlights - A Porphyry Story Begins

(Figure 2)

Exploration Target (conceptual, JORC 2012): 25–30 Mt @ 0.2–0.3% Cu and 100–150 ppm Mo, equating to ~64–114 kt CuEq within an ~850 m × 700 m mineralised footprint at Monument. Note: insufficient drilling for a Mineral Resource at this stage.

System geometry: Outcropping skarn Cu-Mo is interpreted as the high-level signature of possible higher-grade porphyry centres at depth (vectoring particularly toward Appletree–Dunno and a NW target). Mineralisation remains open to the west, south, and east.

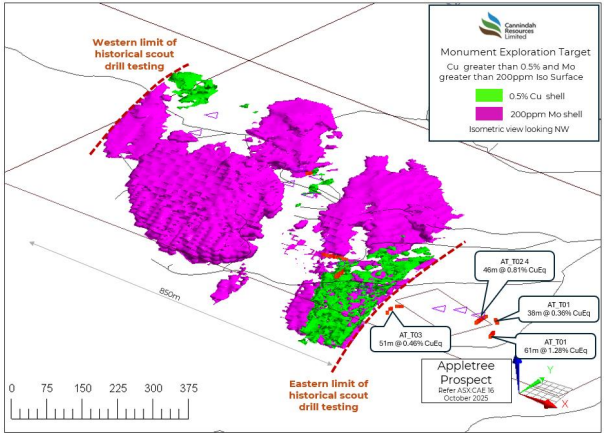

High-grade vectors: Modelled zones of +0.5% Cu and +200 ppm Mo occur on the eastern margin near Appletree–Dunno and in the NW (data-limited) area. These features support pencil-porphyry targeting beneath the skarn blanket.

Surface & trenching (Appletree): Previously reported channels include 61 m @ 1.28% CuEq (0.94% Cu, 0.22 g/t Au, 141 ppm Mo), 46 m @ 0.81% CuEq, 51 m @ 0.46% CuEq, plus other intervals; precious-metal credits are indicated but Au/Ag not yet fully incorporated due to incomplete assays.

Rock chips & textures: Mapping and sampling record peaks to 12.28% Cu, 9.94 g/t Au, 1.24% Mo, with porphyry-style veining preserved (Photo 1) and magnetite-garnet skarn textures consistent with fluid flow from a porphyry source.

Photo 1: LS25013 7269174N 325965E Cu 0.56%, Au 0.24gt, Ag 4gt, Mo 157ppm (source: CAE)

Program status: Scout drilling to ~320 m is planned to test combined geochem + IP chargeability + magnetics + geology criteria, following ongoing activity at the Mt Cannindah Breccia (5 holes completed; at the time of the release, first assays anticipated within weeks).

Figure 2: Mt Cannindah Project with near surface Exploration Target, MRE, and Target Areas. (source: CAE)

Chairman Mr. Michael Hansel commented:

“Our work programs continue to upgrade the mineral potential of Mt Cannindah. It is my understanding that the development of skarn mineralisation identified here is frequently typical of the upper or overlying level of many of these porphyry systems. The delivery of this exploration target is an exciting and significant result not only in consolidating the target but also verifying the transformational potential at depth of this significant project. Our exploration teams continue to rapidly advance the current drill program and we look forward the delivery of results.”

What’s been defined — the Monument Exploration Target

Cannindah delineates a near-surface skarn envelope within the Southern Porphyry Target, integrating 34 historical holes and recent surface datasets. The model shows continuous low-grade skarn (>0.1% Cu) with localized higher-grade cores and an eastern +0.5% Cu / +200 ppm Mo cluster contiguous with Appletree–Dunno (Figure 3).

Figure 3: Cross-sections (W→E) showing skarn continuity and higher-grade development toward Appletree–Dunno. (source: CAE)

The Company highlights this as vectoring toward internal porphyry centres, prioritising Appletree–Dunno for drilling while flagging a NW target for follow-up (Figure 4). Exploration Target statements are conceptual per JORC 2012 and not Mineral Resources.

Figure 4: Drill-hole plan over Monument wireframe and trench locations. (source: CAE)

Why it matters — vectoring to porphyry

The Cu and Mo distributions act as pathfinders. In Appletree–Dunno, coincident Cu–Mo highs suggest proximity to a centre; in the NW, Mo appears halo-like, possibly encircling a Cu-Au core yet to be tested. This pattern (plus IP chargeability highs and magnetite development) supports the “pencil porphyry beneath skarn” concept, a classic exploration trajectory for porphyry systems where skarn caps mark fluid outflow above intrusives.

Copper Distribution

(Figure 5)

Figure 5: Cu isosurfaces (>0.5% Cu cores) within the Monument model (isometric view). (source: CAE)

Molybdenum Distribution

(Figure 6)

Figure 6: Mo isosurfaces (>200 ppm Mo) highlighting large, significant zones. (source: CAE)

Interpretation of Cu Mo distribution

(Figure 7)

Figure 7: Cu–Mo coincidence at Appletree–Dunno and halo-like NW association (isometric view). (source: CAE)

Project context — existing CuEq and broader target pipeline

Mt Cannindah Breccia MRE: 14.5 Mt @ 1.09% CuEq for ~158 kt CuEq (Measured + Indicated + Inferred), with structurally controlled high-grade zones open along strike and multiple high-grade Au veins yet to be specifically targeted. This breccia body sits on the outer periphery of the porphyry system and remains a growth and extension drill focus.

Southern Target (regional footprint): A 1.4 km × 0.1–0.4 km geochemical anomaly with coherent Cu–Au–Mo anomalism, supported by IP/magnetics, mapping, and trenching—now anchored by the Monument Exploration Target and Appletree–Dunno vector.

Eastern Target: A largely undercover corridor with the largest IP response (coherent >100 mV/V), variable magnetics, and shallow anomalous skarn hits; further work is planned.

Put simply, the modelled metal footprint backs the call and speaks to system-scale.

Next Steps

Drill ~320 m scouts at Appletree–Dunno to test the Cu–Mo coincidence.

Probe the NW target along chargeability highs.

Finalise Au/Ag assays and update CuEq/zoning.

Integrate new holes with IP/mags + mapping and rank follow-ups.

Plan deeper tests beneath >0.5% Cu / >200 ppm Mo pods; publish assays + 90-day plan to the ASX.

Samso Concluding Comments

This ASX release is setting the path for a long journey for Cannindah Resources. Chasing porphyry is a bold move with a big prize if successful. The geological data is promising, and it does look like the mineralised porphyry does exist.

A target is one thing, but defining that into an economical porphyry is another matter. Management will need to keep abreast of the bank balance and looking at the share price chart for Cannindah Resources; shareholders are liking the news (Figure 8).

Figure 8: The share price chart for Cannindah Resources as of the 10th November 2025. (source: commsec)

CAE does have a market capitalisation of over AUD $57M and that would make this a risky punt for the average penny stock investor. However, if the project develops to being a monster, which commonly happens to well mineralised porphyry projects, the present market valuation will be very cheap.

Our Synopsis for the Investment milestones:

Thesis: If drilling extends mineralisation beyond the current breccia resource and vectors into porphyry centres, Mt Cannindah could scale meaningfully in a copper-tight market.

What they own/sell: Exploration rights at Mt Cannindah (Cu-Au-Ag; JORC resource in place) plus Piccadilly (Au). Value inflection is driven by drill results and resource growth.

Traction & signals: Resource upgrade (July 2024) now embedded in investor materials; active 2025 drilling; fresh capital secured to execute.

Catalysts (6–12 months): drill results at breccia and porphyry targets, MRE update, metallurgy (including Cu recovery options), and any scoping-level study signals.

Key risks: Exploration risk (geology/assays), permitting & logistics, need for ongoing funding if results/timelines extend, and copper price volatility. (Sector-standard risks summarised from company disclosures.)

The points above are very typical and are not anything that is mind-blowing in terms of what will trigger success. What I can say is that the capital raise in September is going to be well used, and there will be another raise coming soon if drilling keeps getting good results. Capital raises are good when it is coupled with good results, so investors should be patient in taking positions.

As usual, take your time, DYOR, and have fun.

The Samso Way – Seek the Research

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position, or particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation sees the benefit of what Samso is trying to achieve and has a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments