Boss Energy Limited (ASX: BOE) - Is This a Discount Worth Taking? - The Uranium Production Investment Opportunity.

- Noel Ong

- Aug 20, 2025

- 6 min read

Announcement

Boss Energy Ltd (ASX: BOE) has achieved a significant operational milestone with the successful restart and ramp-up of the Honeymoon Uranium Project in South Australia (Figure 1). As one of the few new uranium producers to emerge in a tightly held global market, Boss is positioning itself as a first mover in a sector benefiting from rising long-term uranium prices, policy momentum, and expanding nuclear power infrastructure.

Figure 1: Honeymoon Uranium Project in South Australia (source: BOE)

🔹 Honeymoon Uranium Project Restart – From Restart to Cashflow Positive

The April 2024 restart of the Honeymoon Uranium Project marked the return of commercial uranium production from this historic South Australian operation. Now, just over a year later, Boss Energy has exceeded its FY2025 production guidance with 872,607 lbs of U₃O₈ produced, beating its original target of 850,000 lbs.

Key achievements for Boss Energy at the Honeymoon Project include the declaration of commercial production in January 2025, followed by the project becoming free cash flow positive by April 2025. In the June 2025 quarter, production performance saw a marked improvement, with drummed U₃O₈ output rising by 18% and IX production increasing by 60% compared to the previous quarter. Notably, the C1 cash cost for the second half of FY2025 was reported at US$23/lb, placing Boss well below industry average and highlighting the operational efficiency of the ramp-up phase.

Figure 2: NIMCIX columns 1 to 3 at nameplate capacity (source: BOE)

Boss attributes this success to consistent wellfield performance and the operation of NIMCIX columns 1 to 3 at nameplate capacity, with columns 4 to 6 now practically complete and set for commissioning (Figure 2).

🔹 Wellfield Expansion and FY2026 Guidance

The Company’s ramp-up strategy is gaining momentum. With three wellfields already in operation, five more (B4–B8) are scheduled to come online progressively throughout FY2026. By the end of FY2026, Boss expects all nine wellfields to be operational, supporting its production guidance of 1.6 million lbs of U₃O₈ for the year.

For FY2026, Boss Energy is targeting uranium production of 1.6 million pounds of U₃O₈ from the Honeymoon Project. The Company has guided for a competitive C1 cash cost of US$27–29/lb, with an all-in sustaining cost (AISC) forecast between US$41–45/lb. To support this continued ramp-up, total capital expenditure is expected to range between A$56–62 million, including investment in new wellfields, infrastructure upgrades, and final commissioning of additional NIMCIX columns.

Figure 3: NIMCIX columns 1 to 3 at nameplate capacity (source: BOE)

Boss is also investing in long-term value creation through the finalisation of NIMCIX commissioning, construction of new wellfields, and enhancements to drying and packing infrastructure. Importantly, ramp-up efforts are matched by measured cost control and capital allocation.

🔹 Exploration to Sustain and Grow Production

Boss is simultaneously advancing its satellite deposit strategy to underpin mine life extension. During the quarter:

Infill drilling at Gould’s Dam and Jasons satellite deposits returned strong intersections, such as 3.25m @ 3,873 pU₃O₈ (WRM176) (Figure 4).

Mineral Resource Estimate (MRE) updates for both deposits are scheduled for this quarter.

Permitting processes for satellite deposits have commenced.

Exploration at greenfield targets, including Cummins Dam, continues with passive seismic surveys and aircore drilling.

Figure 4: Exploration Activities for Uranium (source: BOE)

These exploration efforts are designed to convert known mineralisation into future production and leverage Honeymoon’s existing infrastructure.

🔹 Strategic Platform: Tier 1 Focus and International Growth

Beyond Honeymoon, Boss Energy is building a diversified uranium production platform across tier-one jurisdictions:

Alta Mesa (Texas): 30% JV stake; ramping up, with 204,000 lbs U₃O₈ produced in the recent quarter.

Laramide Resources (Canada-listed): Strategic stake increased to 19.9%; includes the Westmoreland Project in Queensland (65.8M lbs U₃O₈ MRE).

Alligator Rivers (NT): Earn-in agreement with Eclipse Group.

Kazakhstan: 6,000 km² land position in the Chu-Sarysu Basin.

🔹 Positioned for Long-Term Uranium Price Upside

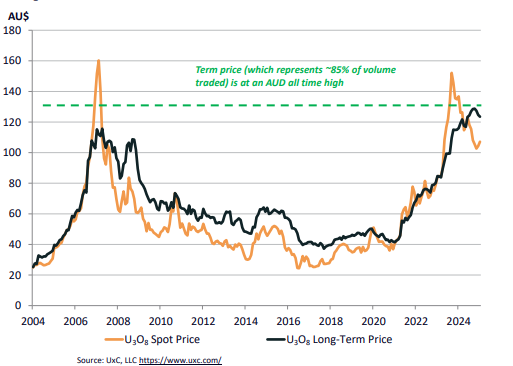

Boss Energy is well-positioned to benefit from the rising long-term uranium price, which is now at an all-time high in AUD terms. With approximately 85% of uranium traded under long-term contracts, the sustained strength of this pricing mechanism—currently around US$80/lb—supports Boss Energy’s commercial production strategy and underpins strong cash flow potential from its Honeymoon and Alta Mesa operations.

Figure 5: U₃O₈ Prices Since 2004 – Spot vs Long-Term (AUD) (source: BOE)

Samso Concluding Comments

Boss Energy’s successful restart of the Honeymoon Uranium Project in South Australia is a rare story of persistence, planning, and precision in execution. What began with a 2015 acquisition has now materialised into a cash-generating, fully operational uranium mine—one of the very few globally to reach commercial production status in recent years.

In the context of rising long-term uranium prices, global policy tailwinds, and energy security concerns, Boss is no longer a speculative uranium play. It’s a proven producer with a scalable foundation. The ramp-up strategy is clear, the wellfield development is sequenced, and cash costs are competitive—this is exactly what long-term investors look for in a resource story.

What also stands out is the company’s broader platform: Alta Mesa, the Laramide stake, and ongoing exploration across Australia and Kazakhstan offer Boss the kind of multi-asset, multi-jurisdictional exposure that is often spoken about, but rarely delivered at this scale from the ASX.

The takeaway is simple: Boss Energy has moved out of the explorer category. Honeymoon is not a case study—it’s a case closed. The production is real, the uranium is flowing, and the balance sheet is strong. From here, it’s about scaling, securing offtakes, and staying ahead of the demand curve.

For those watching the uranium sector evolve from promise to production, Boss Energy has quietly become one of the sector’s new benchmarks.

The Samso Way – Seek the Research

The uranium narrative is often driven by headlines, but value lies in the details. Boss Energy’s approach—grounded in disciplined ramp-up, tangible production metrics, and long-term infrastructure investment—exemplifies how real value is created in the resource sector. Honeymoon is no longer a future story—it’s a producing asset with momentum, and it warrants a close look from investors seeking exposure to the global nuclear revival.

Our mission is simple: cut through the noise and spotlight what matters—genuine stories, grounded insights, and real opportunity.

Our content is well-researched and is only created if the team sees a merit in discussing the company or concept. Investors can explore our three core platforms:

There may be numerous paths to success in investing, but the common thread among successful individuals is that they remain committed to making informed decisions. Equip yourself with the right knowledge and tools, and you will be well on your way to achieving your financial goals.

Most importantly, investors need to be absolutely diligent in understanding their own risk-reward tolerance and capabilities. Never bite off more than you can chew. As they say, Rome wasn’t built in a day, and the Great Wall stood because it took centuries to complete.

The Samso Philosophy:

Stay curious. Stay sharp. And remember—digging deeper always uncovers the real value.

In Life, there is no such thing as a Free Lunch.

Happy Investing, and the only four-letter word you need to know is DYOR.

To support our independent nature of our work, please head over to our Support Page and give us a helping hand in any of the ways listed. This is a new initiate for the Samso Platform, and it was always the concept of Samso when we started this journey in 2018.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and has a need to share your journey, please contact me at noel.ong@samso.com.au.

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments