Possibly the Best Copper Stock on the ASX - Castillo Copper (ASX: CCZ)

- Noel Ong

- Jul 27, 2023

- 7 min read

I've been following Castillo Copper Limited (ASX: CCZ) for the past year, and I believe it has the potential to be one of the best copper stocks on the ASX. Although it's a small-cap stock, I think it could have some upside. I've traded the stock and was a shareholder for a good 12 months. This company could be a dark horse in the sector with time and effort.

Jump to:

About Castillo Copper Limited

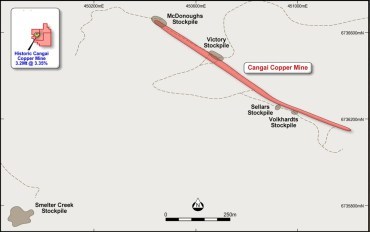

Castillo Copper Limited (ASX: CCZ) is an ASX-listed base metal explorer with its flagship project being the historic Cangai Copper Mine near Grafton in northeast NSW. The project consists of a volcanogenic massive sulphide ore deposit, and it has one of Australia's highest grade JORC compliant Inferred Resources for copper: 3.2Mt @ 3.35% (as of September 6, 2017).

In terms of contained metal, the Inferred Resource includes 107,600t Cu, 11,900t Zn, 2.1Moz Ag, and 82,900 Moz Au. One positive aspect is the presence of supergene ore with up to 35% copper and 10% zinc, which is ideal for direct shipping ore. Additionally, the project holds five historic stockpiles of high-grade ore located near Cangai Copper Mine.

Corporate Information

Information based on the September presentation:

Total Shares Issued: 580.1M

Options: 84.5M

Market Cap: AUD$24.9M

Cash At Bank: AUD$1.7M

The company has four projects in Australia, and one in Chile:

Jackaderry Project (100%, New South Wales): 3 prospects including the Cangai Copper Mine;

Broken Hill Project (100%, New South Wales): 2 prospects;

Mt Oxide Project (100%, Queensland): 4 prospects;

Marlborough Project (under application, Queensland): 3 prospects; and

Chilean Projects (100%).

My primary focus was on the Cangai Copper Mine. While the other projects may have potential, I believe that Cangai is more developed and has a stronger narrative to offer the market.

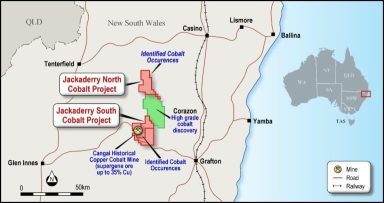

Project Location

The Cangai project in northern NSW has the perfect location as it has the infrastructure you would need to make the project work if it were to ever become a realistic proposition. If you have read any of my postings, you would know that my preference when it comes to projects is one with the least amount of things to do - things that do not relate to drilling for results.

Historical Facts

The mine operated from 1904 to 1917 and was evaluated by Western Mining from 1982 to 1984 and CRA Exploration from 1990 to 1992. Unfortunately, due to tough economic conditions during both periods, no progress was made. However, CCZ's geology team has confirmed a JORC Inferred Resource of 3.2Mt @ 3.35% Cu, which is a significant finding. The next step is to focus on proving this resource and increasing its size in the southern part of the project area. It's worth noting that within 5km of the Cangai Mine, there is the smaller historic Smelter Creek Copper Mine and several highly mineralised satellite deposits.

One of the key features of the Cangai Mine is the discovery of supergene ore, which contains up to 35 percent Cu and 10 percent Zn. This is a relatively rare geological occurrence. What makes supergene ore special is, if the grade is high enough, it can potentially be directly shipped to customers. This is advantageous because it avoids costly processing costs, resulting in high operating margins.

Why the interest?

Firstly, I don't believe this project falls under the category of "Don't drill a perfectly good project".

What intrigues me about this project is that it hasn't received much attention in decades. Unlike projects that have been recycled from the 80s or 90s, this one has remained relatively untouched. Although it was explored to some extent, no significant work has been done on it. As the grandchild of a gold miner from the 1940s and 1950s, I have a deep appreciation for the primitive mining methods used back then, which lacked precision in mine planning. It is precisely this lack of precision that gives me hope and optimism for the project.

In those days, miners would focus on extracting the higher grade materials and leave behind the "lower grades". Considering the size of the old mine and the recent drilling results that the management has found or reconfirmed, it's hard not to have high hopes for the project's success.

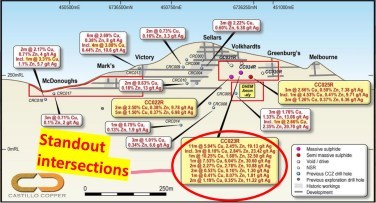

Figure 3

The two diagrams above really showcase the potential of this area. It's easy to see why one might think it could be suitable for an open pit approach, given how mineralised it appears. However, it's important to note that schematic diagrams can sometimes be a bit misleading. That being said, the intercepts are incredibly encouraging. The exciting part, as I may have mentioned before, is the unknown. We don't yet know just how big this mine could be if management handles it properly (refer to Figure 3 and Figure 4).

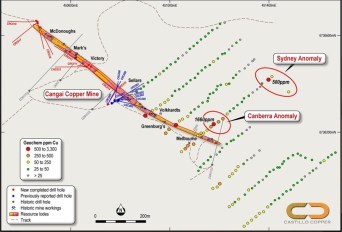

The type of mineralisation we're dealing with here has allowed management to explore the wider area for other forms of mineralisation. A recent announcement even suggests the possibility of parallel lodes based on some indicative surface sampling (refer to Figure 5). I should mention that surface sampling has led many companies down a path of disappointment in the past. However, it's still a positive sign, as I firmly believe that where there's smoke, there must be fire.

Figure 4 and Figure 5

The Stockpile

Within the area, the company possesses multiple stockpiles of copper ore (Figure 6). Through metallurgical studies, the company has demonstrated a copper concentrate recovery rate exceeding 80 percent, with a grade of up to 22 percent. If successful, this endeavour will serve as a lucrative means to finance future exploration efforts. The business model is straightforward: extract the ore from the stockpile, concentrate it, and sell it.

My Concerns

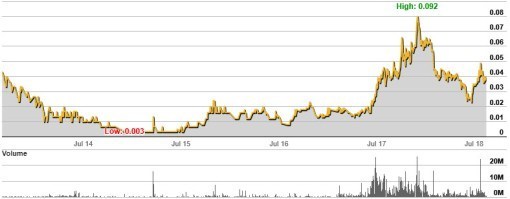

This company has been making promises about positive activity on the project for quite some time. I decided to sell my stock because I couldn't understand why it was taking so long to get things done. As the share price started to decline, I decided to take my profit and wait. With the share price hanging around the 2c area, I lost interest as I basically lost confidence on the whole story.

When the share price started to rise again, I hoped that it meant progress was finally being made. I've been watching from the sidelines, trying to understand the processes. It seems that a capital raising will happen soon. I'm curious to see if the rising share price is solely due to the need for funds. If it is, then I'll probably continue to wait on the sidelines for a bit longer.

Why am I so interested in the Base Metal Story?

I've been keeping an eye on the commodity prices over the past year, and I've noticed an interesting trend. Copper, Nickel, Zinc, Lead, and Aluminium all seem to be hovering around their 50 percent retracement value, which is quite intriguing. Now, I'm no expert, but I do enjoy observing trends. Currently, copper, nickel, and to a lesser extent zinc are showing signs of a bullish uptrend. It's like they went for a run, took a breather, and now they might be gearing up for another surge.

If you take a look at the charts below, you'll see that they all look pretty similar. Of course, you can interpret them however you like, but I believe the groundwork has been laid for these commodities to experience higher pricing. This aligns with my previous post where I mentioned the rising nickel price.

Copper Pricing Mystic

Copper pricing has long been regarded as a reliable indicator of the global economy's performance. Referred to as 'Dr. Copper' in certain circles, copper is an abundant and affordable metal with a wide range of valuable properties. It possesses excellent resistance to corrosion and serves as an efficient conductor of both electricity and heat.

When the price of copper rises, it signifies a thriving global economy, indicating increased demand for copper in various industries. This upward trend suggests that we are currently experiencing growth in the world economy after a period of decline, making it a positive indicator of this progress. Conversely, when the global economy experiences a downturn, the price of copper tends to decline as well.

Over the past century, just “industrial” demand alone for refined copper has increased from 500,000 metric tons to over 19 million metric tons. As our increasingly smaller world continues to experience population growth along with the progressive expansion, the demand for copper will exponentially increase. — oilprice.com

In Conclusion

I typically invest in small-cap stocks, and as an exploration geologist, I am particularly drawn to the excitement of discovery. That's why I see potential in CCZ. However, I do have some reservations. Firstly, I find it difficult to grasp the timeline of activities. Secondly, I am concerned about the upcoming capital raising and how it will affect the entry price of the stock. Apart from these concerns, I am intrigued by the story.

*Please note that I am not a shareholder and I am not providing any advice to buy or sell the stock. These are just my personal thoughts.

Source:

The information in regards to the company and the project has all been obtained from the announcements and presentations that are posted on the website of Castillo Copper LImited.

The project location plane was obtained from the article written by Proactive Investors on Castillo Copper.

The charts were taken from CommSec.

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints. Read full Disclaimer.

Share to Grow: Your Bonus

Samso has just released an eBook: How to Add Value to your Share Portfolio

A lesson on geological models sought by mining companies that gives insight and an understanding of which portfolios are better - and potentially more lucrative – investments. Click here to download this eBook.

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters. If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me on noel.ong@samso.com.au.

Comments