Best way to find a Gold Mine: A Mineral Exploration Success

- Veronica Lind

- Sep 10, 2018

- 9 min read

Updated: Apr 10, 2022

Bombora is a fantastic story to showcase why we do mineral exploration… The fact that the someone did the research, applied for the tenement, did the work and ultimately had success is the reason why I am sharing the story.

The company involved is Breaker Resources Limited (ASX:BRB).

I was reading the news with the headlines “Breaker back in favour with Bombora gold bounce” written by Stuart McKinnon. Upon reading the article, I thought, this is an exciting project. Hence, I continued spending more time reading it and I was right… it is a fascinating story.

The Bombora gold project is 100km east of Kalgoorlie. It is a large tenement holding, 550 km2, and completely 100% owned by Breaker Resources (ASX: BRB).

The cool part of this story is that it has been unexplored for the last 20 years and have had little historical exploration. The best part of that is that it has only about 5-10m of cover.

Over the last 10 years when I have been doing lots of project evaluation, I remember seeing so many projects with the same style. Those characteristics are not unique. All they needed was some drilling but with the equity market the way it was during those times, they never made it.

If you look at the state of the exploration market, there has not been any real exploration since probably the 1990s. What exploration that did attract money found some great things but in general, there has been very little money going into the market. However, I did see a lot of money starting to flow into the market in the last 12 months which is very encouraging.

Mineral Exploration – The Historical Story

On the 17th July 2015, the company announced that the drilling at Lak Roe would commence. The main target was a 4km-long zone of supergene gold mineralisation defined by historical drilling as see in Figure 1 and Figure 2. Eighty holes were to be drilled for a total of 3,200m. The historical data consisted of drilling from 1991 to 1998.

The maximum depth of mineralisation was within 30m. Everything else was untested. Drill chips from these drilling showed clear evidence of sulphide and carbonate alteration within the dolerite (— It is pretty amazing that this project lasted this long and has been ignored over all these years. There would have been geologists and prospectors walking over these things and nobody had pushed for more work to be done. And to top it all off, I believe that they picked this project up by applying for it, meaning it was basically free.—). The was no drilling within the salt lake and the lake cover appeared to be thin as they could see outcrops within the lake to the immediate west of the dolerite.

The aim of the drilling is to test any potential structural zones. In a layman’s explanation, the place where there is a weakness (lots of faulting/shearing) will lead to fluid movement and hence mineralisation. I should have listened more when I was in university in those structural classes…

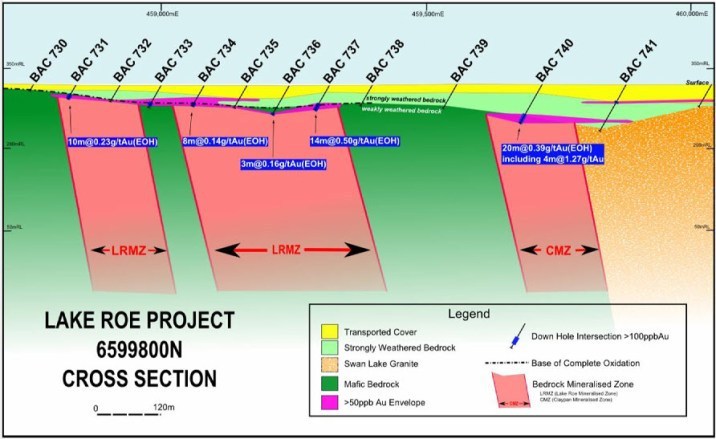

On the 26th August 2015, Breaker Resources announced that they had found a new Gold System at Lake Roe. The headline news was that they had found bedrock mineralisation (Figure 3). This means for those who are not clear is that they have found mineralisation in the basement, basically where you want to find it.

The comment by the Managing Director of Breaker Resources basically sums up the situation,

“the drilling has exceeded all of our expectations. The coherence, grade and extent of mineralisation encountered in a reconnaissance drill program of this nature is unusal and indicates a potentially significant new gold system”

Although at this stage I don’t think that anybody is talking about the future or possible future size (well, not formally anyway…) it could become in the future, no can deny that these are encouraging results. Remember, there is not a resource definition in sight, no JORC (my SEA associate/investors, please take note), but these are super encouraging results. Remember that it was this kind of persistent exploration that discovered many supersize deposits in the past.

The announcement continues to describe that bedrock mineralisation is best developed over a 2km-long zone in an area of structural complexity to the south where it is open along strike. it has an overall strike length of 5.5km (Figure 4; 8-m drill hole spacing). Mineralisation is up to 300m wide and hosted by a dolerite unit up to 800m wide (Figure 5).

Remember that the initial drilling program was just a look and test thought and the drilling was to “refusal” (basically meaning as far as the drill rig can go, which is usually on top of bedrock)

The photos below are from that Phase 1 drilling program.

Phase 1 means that there is a Phase 2. Phase 1 was a test of the new found gold system. Another 181 holes for just under 8,000m.

Results

3.3m @ 3.48 g/t Au

15m @ 1.46 g/t Au

9m @ 1.63 g/t Au

Alteration observed

30{e84228ce8c9f7001611629be1db85467cf541581cf1fd5424de0612b3249e3f5} of drill holes end in +50ppb Au in relatively fresh rock with grades up to 12.87g/t

At this stage, the Phase 2 results, I assume (and we all know what happens when you assume…) that the results would have been more than encouraging and there would probably be some sort of excitement that something big may be around… I think to put myself in their shoes, I would be thinking what could I do to stuff this all up….. I would be more nervous than excited… 🙂

At this point, the systematic drilling that followed, as we know now, resulted in what is a rather large gold resource. The key point I am trying to make here is that without the drilling program that the management persisted with, there would be no discovery. The initial work was in applying for the ground as vacant ground in 2014. Upon grant, the company had progressed in one year, a project with very little historical drilling to a project with a future 1M ounce resource.

Breaker Resources Limited listed on the ASX in 2012 and today in 2018, they are looking at a 1M+ ounce gold project within 60km of two mills and 100km from Kalgoorlie. Now that is what I call a good job. Looking at the presentation in July 2018, the market cap of the company was around AUD$38M, I think at the time of writing the market cap was USD$41M.

Figure 6 shows clearly the journey taken over the years and the highlights of each significant step taken. You would think that at this stage of the resource drilling, this share price must be pretty much ready for revaluation. I will point out that at this stage, I am not a shareholder of this company. I will say that as I write and as I do my own research, I am thinking hard about whether I should take a position or not. (Update: 10th September 2018, shares are up 5c as we publish)

The overall grade may be low but if they can make money getting it out, it is still AUD1600 an ounce. We are in Australia and in this part of the Goldfields, I don’t think we will see too many issues with things such as unpronounceable bats, or bees or yellow flowers…etc. However, I do worry about the fact that the resource is at a grade of 1.6g/ t. I do keep reminding me that Millennium Minerals Limited had very low grade too and they got that to work. Although, I do wonder if all the investors ended up making money over all those years … :-).

The super pit is also at the very low grade end but that is a very very big hole in the ground. In the back of my mind, I keep hearing this very important quote ” Grade is King…Grade is King…” This does worry me but at this point in time, I will say that there is still plenty of time to solve that “issue”. I don’t mean that it will get better but I think if they can pay themselves into the higher grades and chase those underground grades, it would be a good story. After all, its all about cost per vertical metre. Just like selling noodles…

I learned a lot when I was with Silverlake Resources. Listening to the miner’s talk was a good education and I will not say that I know enough to run a mining project. What I learned did give me a good appreciation of what needs to be done, what is required and what is most likely to work or not.

As you can see in Figure 7, the location of the project is in good company when it comes to the gold endowment. In fact, one of my favourite spots in the Kalgoorlie area is the Kurnalpi and the Mount Monger-Randalls district. Although I think the later is now pretty much taken up by the Silverlake people.

———————————————————————–

This reminds me of another place that had bedrock mineralisation and was given up because the directors of the company did not follow through (lack of funds). Now if given a second go with some money for drilling, I am sure they would give it a good go with some drilling. However, that seem unlikely so hopefully one day, someone will find their glory there and make history.

———————————————————————–

One of the interesting fact that I like cautiously, is the length of the strike. Like a rather smart person who used to work with WMC once said, think of an upside-down lightning. Mineralisation flow to point of least resistance. Although a large strike is good, I do sometimes think that if it was smaller, then the mineralisation may be more concentrated and not so spread out.

Of course, you could also say that if you had a big lightning, then you could have a very concentrated large strike. I agree with that statement also, however, 1M ounces in one spot is a lot easier and cheaper to mine than a large area… 🙂

Another potential issue could be with the fact that 58{e84228ce8c9f7001611629be1db85467cf541581cf1fd5424de0612b3249e3f5} of the resource in the Indicated range. This will mean more drilling and how long that takes will be interesting. There is definitely a bear in the gold price and how long that bear hangs around may affect the journey. Mind you with the strengthening of the USD, this could help the gold price.

However, if this bear takes the gold price near to that USD$1,000 mark like back in 2014, it would certainly make things interesting when they have to raise money. Market sentiment seems to follow the USD pricing. Silly as it may seem, but the market seems to do that historically.

I know I have mentioned this already but this low-grade thing is important in a bear market. I understand that these days anything above 1g/t is considered good. Some will point out that there is the large proportion that is of a higher grade, but I only see the global resource grade. However, I do want to make it clear that I am not negative on the resource. I am just trying to give a balanced point of view :-).

As for the Bell Porter report and all the broker reports that have come up. I treat them with the amount of salt as those that you may find in Lake Roe. It is a salt lake right ?… if not then the meaning is lost. Like those reports in 2000, I remember lots of reports telling us how much things such as One Tel would be worth….etc 🙂

That was just me doing a bitch session… 🙂 I am entitled to do that as I am the author….. 🙂

Basically, my experience is that if the margin works during mining, the rest is just administration purpose. The key is in the simple business of selling your product for a profit. If you can do that, you will be ok.

The exploration upside will be the icing on a very tasty cake when the time comes to converting exploration targets into resources and reserves. I have seen several companies do that and this is what drilling will do for the health of your project.

For me, this journey is all about the process of exploration and the excitement of finding it. Once that is done, the rest is pretty boring. Important but boring.

Well, I hope you have read this far and I have added some value to 5 minutes of your life. Thanks for reading and I hope you will be around for the next journey.

Unless stated, all information is taken from presentation and announcements from www.breakerresources.com.au

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints. Read full Disclaimer.

www.samso.com.au

If you find this article informative and useful, please help me share the information. I try and write about topics that are interesting and have the potential to be of investment value. It is not easy to find stories that fit those parameters.

If you or your organisation see the benefit of what Samso is trying to achieve and have a need to share your journey, please contact me on noel.ong@samso.com.au.

Comments